We have expanded the pig price information system by adding the Ukrainian market information to the "Pig prices and markets" section.

The Ukrainian pig price is calculated through an average of the prices at a farm level in the three main pig producing regions in the country. The current price is UAH30.74/kg liveweight, this is €1.20 or USD1.33.

The Ukrainian price is updated weekly, and the price series since 2012 are also available.

Graph 1. Ukrainian weekly pig price (UAH/kg LW) since 2012.

As we can se in graph 1, the pig price in Ukraine began a considerable increase since April 2014.

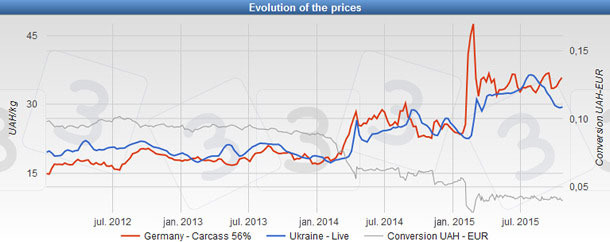

At that time a strong devaluation of the Ukrainian currency began and elicited a significant drop of pork imports. The exchange rate evolution can be seen in graph 2, along with a comparison with the pig prices in Germany, which is a significant exporter to Ukraine (the leading one in 2015).

Graph 2. Pig price in Ukraine (UAH/kg LW), in Germany (UAH/kg carcass) and conversion rate UAH/€ since 2012.

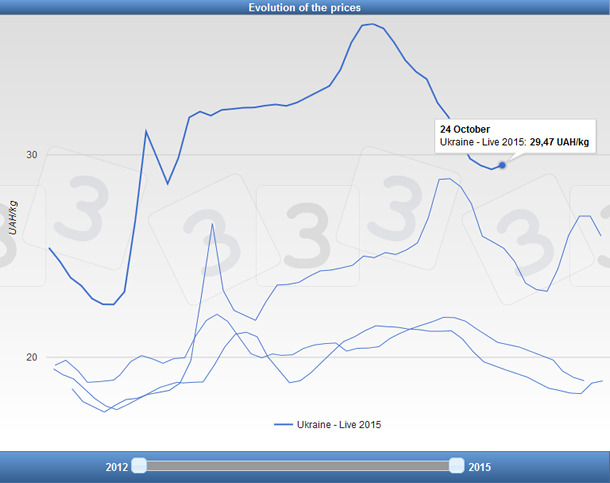

The Ukrainian pig market is seeing very important changes in 2015. Pig production is increasing as well as pork exports, whilst imports are decreasing at the same time. Pig prices have continued to rise in 2015, at much higher levels than in previous years (graph 3), until a sharp drop happened in August, a month earlier than expected, according to the seasonal pattern.

Graph 3. Ukrainian weekly pig price (UAH/kg LW) from January 2012 to October 2015.

According to the Association of Pig Producers of Ukraine there is a current oversupply that is explained by several reasons:

* During the first nine months of the 2015 the commercial farming sector has supplied slaughterhouses with 395.6 thousand tonnes of pigs (LW), which is 2% more than during the same period of 2014.

* Although the number of pigs has decreased by 6% on backyard farms, commercial pig production has increased its census, reaching 3,85 million heads (+40.2 thousand heads compared to 2014).

* A weak domestic demand limited by a low purchasing power. In summer the surplus was purchased by Russian Federation and Crimea. However, the trade with these territories has been less active since August.