At the beginning of the year, in light of a significant decrease in the Chinese pig herd brought about by the serious problems caused by African swine fever, pork imports were expected to increase strongly to supply the China’s consumption. This would have caused an important increase in prices globally.

In the face of this situation, we decided to survey the users of 333 to produce an objective evaluation of the sector’s prospects. We asked the question: What do you think will be the maximum price of pork in 2019 in your country? 976 users were polled from 71 countries between the dates of May 21 and June 21.

333 users expect much higher pork prices than recent years

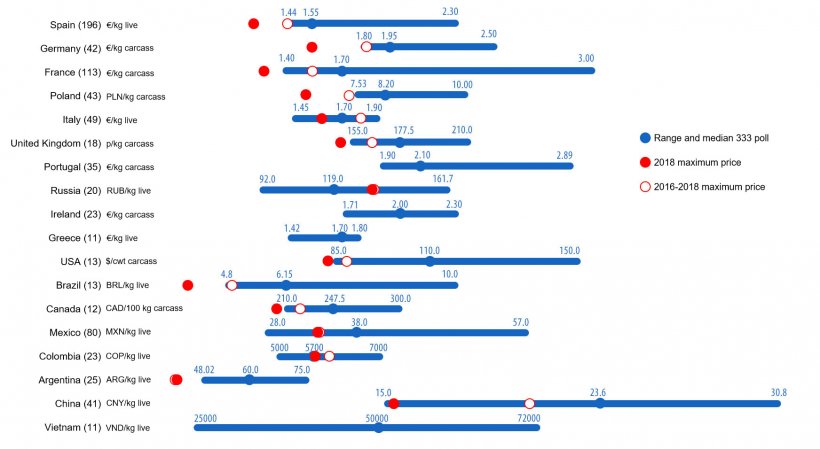

The expectations of 333’s users who participated in the poll are clearly optimistic, as seen in Graphic 1. For each country the range of the responses collected is shown for the expected maximum price with the minimum, maximum, median values, noted. The median being the middle value where half of the responses lie to the left and the other half lie to the right. The maximum price for the last year (2018) and for the last 3 years (2016 to 2018), according to 333's price system, are also shown for comparative purposes.

The idea behind representing 18 countries in the results was to have the broadest vision possible of the global panorama. In each case the number of responses is shown so the reader can assign the appropriate weight to each of the obtained results.

For the grand majority of countries the median of the responses is greater than the maximum price in 2018 and is even greater than the maximum price recorded in the last three years, except in Italy, Russia, and Colombia. These data indicate that the participants in the poll expect maximum prices much greater than those seen in recent years. To add to that, in a few cases the median is greater than the historic maximums, such is the case of Germany, with a median value of €1.95/kg of carcass weight exceeds the historical maximum of 1.93 €/kg seen in September of 2012 and August of 2013. Also, more than half of the analyzed countries distribution is skewed toward high values caused by the great contribution of more optimistic opinions. In fact, for some countries (Spain, Germany, Poland, Brazil and Argentina) almost the entire range of values given is greater than the maximum prices since 2016.

The level of dispersion is very variable. On one hand we find countries with an especially wide range that could reflect an higher variability between the opinions given while some, such as Asian countries the wide range may be come from a scarcity of data or certain country factors such as over-simplifying all of China with one price for the whole country when in reality it is much more complex.

Where are we at?

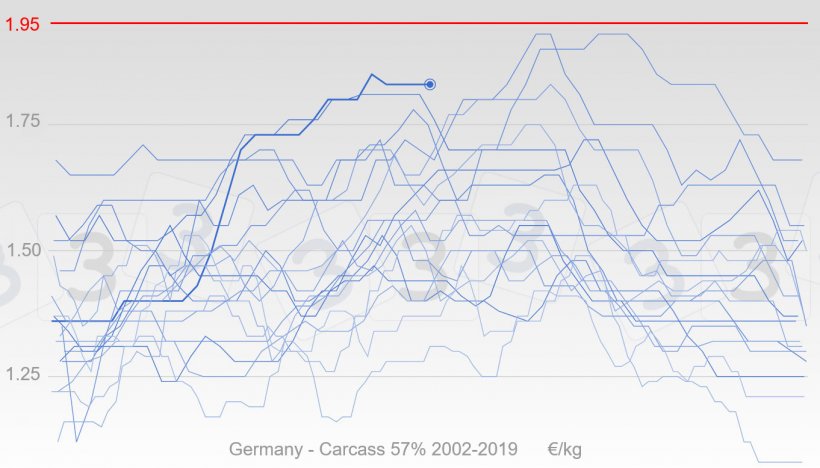

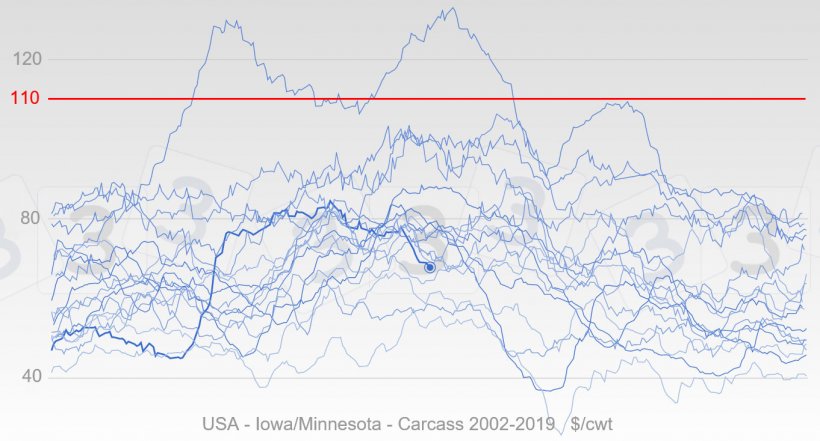

Now we are entering into July, a time where because of the season, the prices in the northern hemisphere should be near summer highs. In various countries a strong rise in prices was seen around March, emerged with some anticipation to the usual seasonal pattern, and followed by a stabilization in some cases, as in Germany (graphic 2) or a decrease in others, as in EEUU (graphic 3). Has the maximum for the year already been reached or is it still to come?

For information on other countries visit the 333's price system

There are many variables in play that influence prices; some of them have been revealed with time while others remain unknown. For example it has been confirmed that in China pork consumption has gone down as stated in a recent report from Rabobank and as already anticipated by DiPietre in April in his commentary "China Exuberance: The only sure thing is that China will be eating a lot less pork". According to the Chinese Customs Service report, pork imports have increased, however it seems perhaps in quantities lower than expected. On the other hand, the report from the USDA Statistics Service reports the greatest hog inventory in July in the United States, while the December 2018 livestock survey in the European Union showed a 3% reduction in the breeding herd. Unfortunately, African swine fever has spread to more countries in Asia and, in Europe, it remains active in almost all the affected countries. We have also yet to see how things will play out with some of the comercial conflicts that have been dragged out from months ago, such as the extension of the Russian embargo, the situation between China and the United States, or sudden happenings such as the recent Chinese suspension on imports from Canada.

See you in December

Now its time to ride out the second half of the year and we will see how high the maximum prices will be.

In December, with data in hand will be able to compare our expectations to the reality of the maximum prices.

Thank you to all the poll participants for your contribution!

333 editorial staff