The big news in the US is the ease at which extra supply is being taken up by the Asian markets particularly but also in the increased domestic demand. Now, even the forward marketing signals are bouncing around breakeven for the winter quarter, the time when losses reliably occur. This has preserved and elevated prices and profits far more than most industry players would have guessed back in February when the supply situation was creating big concerns. There has been some alarm for more than a few years that the structural changes in the industry are removing the opportunity to establish a market price since so few pigs are sold on a negotiated basis day by day. In the next decade or so, if current trends continue, that could be a moot point anyway. More on this in the future.

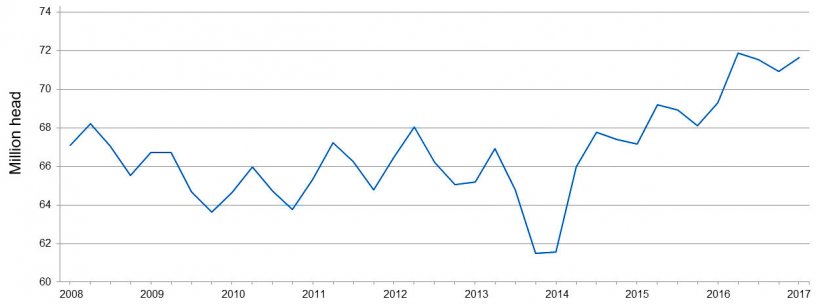

To get an idea what landed us in the current situation, one needs to look back to the period 2008-2014, when the US inventory of all hogs and pigs was very stable, moving reliably within the mid 60 million head range with ups and downs related to normal seasonal production patterns. However, the advent of PEDV in 2014, which resulted in a quick disappearance of roughly 10% of the US production and sent hog prices and profits shooting up to all-time records, created a fever in more than the hogs. Since 2014, the US hogs and pigs inventory has taken on an ever-upward trajectory blowing past the replacement of the lost 10 percent and moving into the low 70 million head. That shows no sign of being deterred yet.

Very stable and low feed ingredient prices combined with record prices in 2014 and resulted in the near complete retirement of all previous capital debt within the US production industry. This set the stage for huge investments in both modernizing, expanding and investing up-chain in producer owned processing facilities.

The disappearance of the debt ball-and-chain unleashed plans for big increases in systems of specialty pork production, most notably antibiotic free production. In addition, it created the possibility for the largest private pork production systems, of either first ventures (for some) or expansions by others of their own processing plants. This has resulted in new kill and processing plants springing up across the corn belt from west to east and some of the better mid-sized packing plants also either expanding or in some cases brought out of mothballs and restarted.

Since there was more than enough time to see the handwriting on the wall, existing independent packers encouraged their largest pork producers to expand so that they would not face the sudden loss of hogs when they were diverted to the new plants. Low debt allowed this to go ahead at the production level and allowed for the orderly marketing of expanding pork supplies since the growth in the industry has occurred over the last three years.

We have discussed the importance of this structural change in previous articles but essentially, the industry in the United States is rapidly becoming driven by sophisticated production systems which have moved the locus of industry profits away from the processing function, which his being reworked as a cost center, to the production setting where by far, the greatest full chain investments are made and therefore where the greatest cost efficiencies and product value-added are possible. Value-added at the processor level is substantial but is limited to processing, packaging, smoking/flavoring etc. as processors cannot fundamentally change the underlying product. Production systems however can do this by organizing a whole host of valuable new attribute production which resides directly within the raw product (antibiotic free, increased internal or intramuscular fat from genetic choices). In addition, only production systems can create and enforce certain non-meat attributes (humane production, fair labor assurances, technology attributes and organic production to name a few) and they are off and running to do just that.