Historical background of pig introduction in Africa

The history of pig production in Africa is a tale that spans millennia, deeply intertwined with the continent’s cultural, economic, and agricultural evolution. Domestic pigs are not native to the African continent and were introduced into the continent through conscious and unconscious means.

The introduction of pigs in Africa captures five main historical occurrences and events:

- Early introduction to Northern Africa coast through trade routes by Phoenicians around 1100BCE.

- European Exploration and Colonization Age: which started from 15th century by bringing livestock including pigs, to provide a familiar food source and to sustain themselves during long sea voyages and in new colonies.

- The Transatlantic Slave Trade: a period of forced movement of millions of Africans to the Americas, which also caused traders to bring pigs along on slave ships as a source of food for themselves and the enslaved Africans.

- Activities of Christian Missionaries and settlers who arrived in Africa also brought pigs with them as part of their efforts to introduce western Agricultural practices in Africa.

- Recent Pig importations, modernization and commercial farming: the importation of pig breeds from other continents, particularly Europe and North America, has contributed to the spread of pigs in Africa.

Present status of Africa’s pig industry

1. Current statistics of pig production in Africa

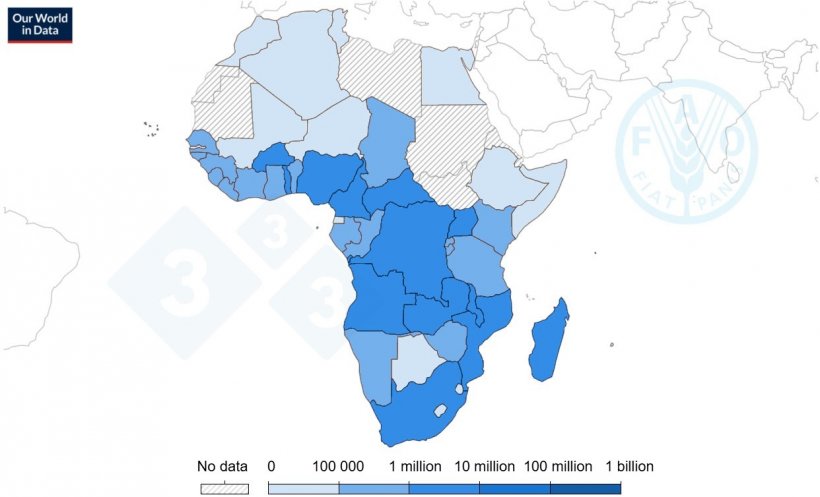

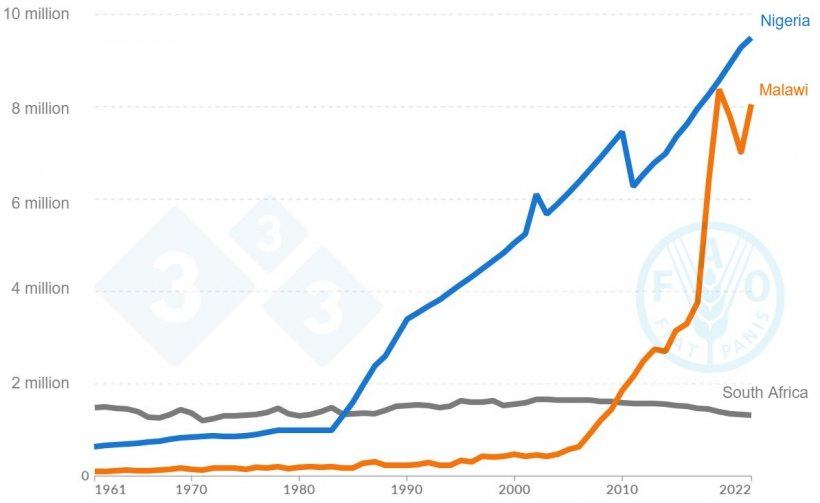

Pig population in Africa

The total population of pigs in Africa is approximately 4.6% of total world population and in the table below we can see an account of the current distribution between countries with 1 million to 10 million pigs (FAOSTAT 2023)

| Country | Estimated pig population (million heads) |

|---|---|

| Nigeria | 9.51 |

| Malawi | 8.07 |

| Angola | 3.55 |

| Uganda | 2.63 |

| Mozambique | 2.32 |

| Cameroon | 2.18 |

| Burkina Faso | 1.78 |

| Madagascar | 1.75 |

| South Africa | 1.32 |

| Zambia | 1.16 |

| Central African Republic | 1.07 |

| DR Congo | 1.01 |

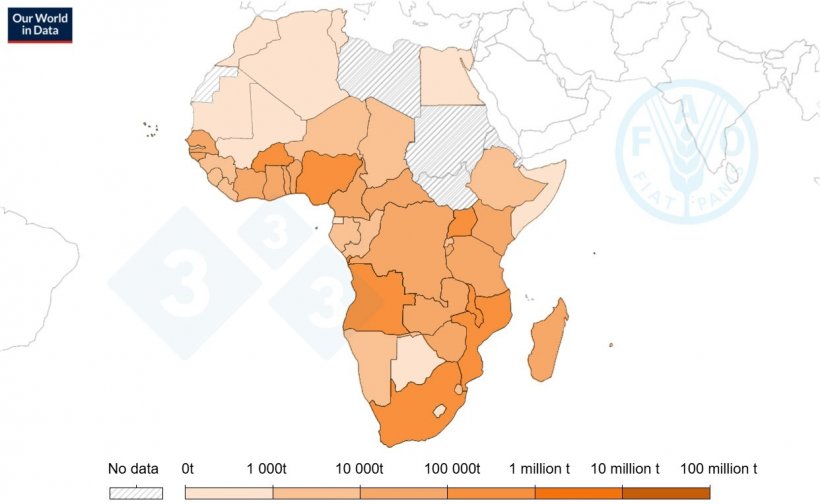

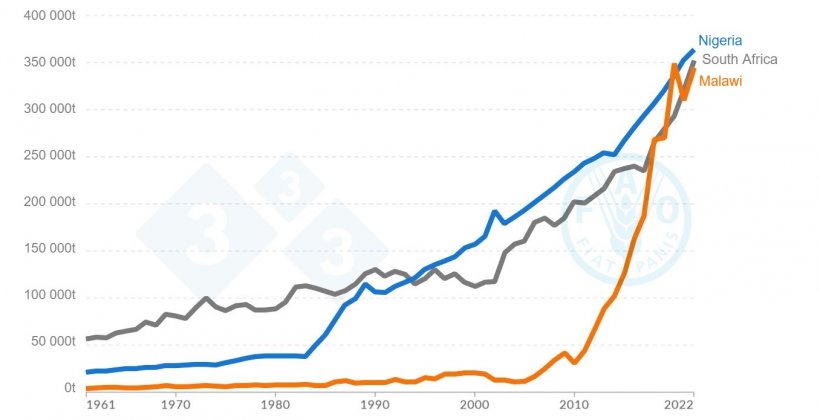

Pigmeat production in Africa

The pigmeat production record of Africa when compared to the pig population reflects the impacts of production systems in diverse regions.

Pigmeat production in Africa: Leading countries in pork production (FAOSTAT 2023)

| Countries | Estimated pigmeat production (tons) |

|---|---|

| Nigeria | 363,123 |

| South Africa | 351,560 |

| Malawi | 344,550 |

| Burkina Faso | 224,127 |

| Angola | 169,196 |

| Mozambique | 136,637 |

| Uganda | 128,310 |

| Cameroon | 48,560 |

| Tanzania | 44,420 |

| Ghana | 28,820 |

| DR Congo | 27,416 |

| Madagascar | 26,500 |

| Zambia | 24,249 |

| Kenya | 20,460 |

| Senegal | 19,798 |

| Central African Republic | 19,471 |

| Togo | 17,154 |

The emergence of South Africa as the second highest pork producer in Africa (despite the low population of pigs in the region) is because of the high level of intensive pig production system and the use of quality genetics in the region.

2. Swine production systems in Africa

The current systems of swine production in the continent of Africa can be classified into the following:

- Traditional scavenging system: Where pigs are allowed to roam around to fend for themselves with little or no supplementary feeding. The scavenging system is mostly common in rural communities and in some peri-urban regions of Africa. While this traditional method may seem cost-effective for rural farmers, poses serious challenges that undermine both the profitability and sustainability of pig farming in Africa causing negative impacts which poses threats to biosecurity that can include disease transmission, public health risk and as well low productivity.

- The smallholder system: This is usually a small-scale subsistence production where a few pigs are raised by individual families.

- The intensive system: A commercial operation where large number of pigs are confined in controlled environment on either concrete floors or deep litter system. Inputs is high in the intensive system thus; growth rate and productivity is always better.

- Free range system: In some regions in South Africa, this system is dominant and unique where pigs are kept in large camps where they can roam freely on pasture or grasslands. Free range pigs forage for part of their food and supplemented with additional feed from natural sources.

- The cluster system: Is an organized approach where pig farmers within a specific geographical area are given access to a cluster of compartmentalized housings/pens that is mostly owned by the government or corporative. The system grants smallholder farmers easy access to some facilities that large scale farmers have but creating the challenge of maintain good biosecurity and control disease transmission.

3. Challenges of Africa’s pig industry

The pig industry in Africa holds great potential as a key driver for food security, income generation, and rural development. However, it faces several challenges that hinder its growth and sustainability. These challenges include:

- Genetic limitations: Traditional African breeds are mostly characterized by low productivity in terms of growth rate, feed conversion efficiency, and reproductive performance and the access to commercial breed is still limited and has to increase gradually.

- Lack of regulations and policies: Weak or poorly enforced policies and regulations have caused several detrimental effects, impacting various facets such as disease Control, quality and safety standards, breeding practices, and market prices and market standard among others.

- Inadequate infrastructure: In Africa, Pig production is still being affected by lack of modern facilities, limited access to quality feed and water, poor transportation network, insufficient slaughterhouses and processing facilities of low quality.

- Disease challenges (Africa swine fever and other diseases): African swine fever is the most significant disease affecting Africa’s pig industry. The quick spread of the disease is mostly caused by the absence of proper regulations and policies that control farms, sales and transfer of infected pigs to slaughterhouses, contaminated food waste, and movements of scavenging pigs.

- Religious and dietary preferences and cultural bias: In many African countries with significant Muslim populations, pork consumption is prohibited by Islamic dietary laws which reduces the market size for pork. In addition, in some African cultures, pork is not traditionally included in the diet, which have lead to lower consumption rates even in areas without religious restrictions.

- Lack of technical knowledge and expertise: Limited access to training and technical knowledge about modern pig farming techniques and its adoption have continued to be a challenge for small-scale pig farmers, who form the majority in most countries. The lack of expertise, in areas such as breeding, nutrition, artificial insemination, housing, and biosecurity practices has hampered productivity and limited the ability to adopt improved farming techniques, hence, decreased productivity and efficiency.

- Market-related issues: like high cost of Feedstuffs, poor unregulated pig prices (mostly chased by middle offtakers) and limited access of farmers to formal markets.

The pig industry in Africa holds substantial prospects and potential for growth and development. By addressing existing challenges and leveraging opportunities in domestic and export markets, technological advancements, investment, sustainable practices, and supportive policies, the industry can achieve significant improvements in productivity, profitability, and sustainability.

With over 1.4 billion people and projected growth to nearly 2.5 billion by 2050, the demand for animal protein, including pork is steadily rising in Africa. All these improvements will provide great opportunities for the swine industry in Africa.