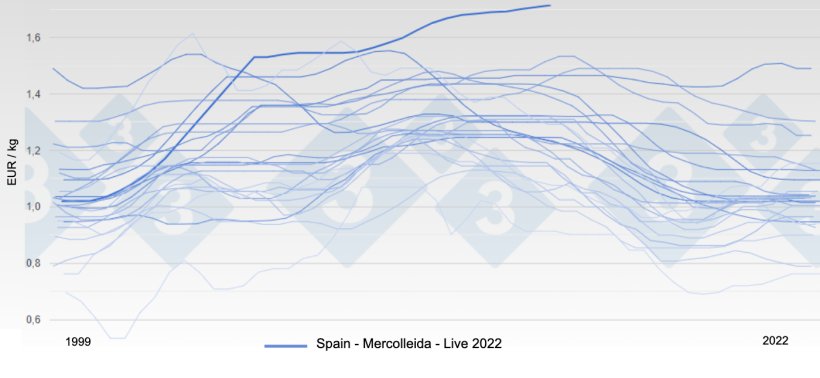

The series of agonizing price increases in July continued in August. It mattered little that our market price in Spain has been the highest in Europe for months. All the August increases have set new all-time price records. This is worth noting.

In the second half of the month it became known that South Korea agreed to negotiate the principle of regionalization for pork trade from countries with African swine fever. This principle of regionalization is EU doctrine. Until now, Asian countries have completely ignored this possibility. What has been achieved (agreeing to negotiate the principle) is a great achievement for EU diplomacy. For the time being, it is a first step, although they are mere words. If they go through with it, it is estimated that in January 2023 Germany (and other countries affected by the ASF) could start shipping pork to South Korea.

Since August 10, the market in Germany has "come back from summer break" stronger than usual in recent years; we will never know how much the modest slaughtering rate has influenced this buying interest. Germany has been slaughtering about 720,000 pigs per week for several months now; three years ago this figure exceeded one million head. This is certainly a very significant reduction which undoubtedly has consequences.

Since August 10, we have been experiencing a market that is dependent on the sudden jolts from Germany (in the last three market sessions the carcass price has gone up by +8, +7, and +5 cents respectively) and the sudden interest in buying (refrigerators had to be restocked after summer vacation; the cafeterias started up again, etc.). There has even been an interest in frozen pork; many transactions that were unthinkable a few weeks ago have been made.

In Spain, slaughter has remained very limited; the heat has not let up and the average carcass weight is currently the lowest it has been in recent years at this time of year. The extreme weakness of supply is the only factor that has allowed for the hard-fought and exceptional price increases in August (3 thousandths of a euro in the first market session, 8 thousandths in the second, 7 thousandths in the third, and another 7 thousandths in the last market session of the month). The price has not stayed the same, as we were suggesting in our previous commentary, but almost... Many pigs have been lacking and are still lacking.

As in the past and to get a proper perspective, let's compare the German price with the Spanish price at this time:

- Spanish price = 1.714 Euros / kg live, equivalent to 2.255 Euros / kg carcass.

- German price = 1.558 Euros / kg live, equivalent to 2.05 Euros / kg carcass

In September we will see the change of cycle approaching; the arrival of autumn and the decrease in sunlight hours will ease the thermal stress on the pigs. The delays will start to be made up and growth will return to normal.

The severity of the summer has left a deep impact on live supply; so much so that it remains to be seen if backlogs can be recovered before October. The price of pigs will undoubtedly fall in October; the rhythm and speed of the fall will depend more on export capacities (China has a lot to say here) than on the supply, which we already know will be significant and abundant. Let us not forget that Spain exports 58% of the total pork slaughtered.

The expected drops in the live hog price are necessary and essential for the slaughterhouse; which needs pig prices to go down more (and faster) than pork prices. Let us recall that this summer has been hellish in all aspects: skyrocketing energy costs, pig prices slowly but persistent rising, and pork "anchored" at immovable prices for weeks (until this week when the price finally went up). We know that the slaughterhouses' weekly losses have been more than 12 cents per kilo in carcass between the second half of July and the first half of August. It is clear that this situation cannot go on forever.

We believe that there is a general consensus that the incidence of PRRS (the Rosalia strain, which has a major impact in Catalonia and Aragon) has been compensated for in Spain by the fact that some important farms have recently reached maximum production. It is likely that by the end of 2022, the predicted reduction in slaughter will not take place. Time will tell. We are inclined to think that total slaughter at the end of 2022 will be very similar to that of 2021. Let's remember that in the first quarter of this year, Spanish slaughter was 3.80% higher than last year.

The supply of live animals for slaughter in autumn will be significant. Weights will recover (one way to optimize both on the farm and in the slaughterhouse) and slaughter will have to be at 100% capacity. We will all be attentive with one eye on the evolution of the Mercolleida price and the other on production costs. In July and August, the price has exceeded the cost; we will see where we stand come December...

2022 will be remembered as a year of many ups and downs and events. The war in Ukraine and its dire consequences reach all corners of our economy. It seems that we are still far from normalcy. Doubts and uncertainty are part of our daily life. Year-on-year inflation has exceeded 10% in the last three months, a dismal figure.

Let us end with a compound syllogism, enunciated by the Stoic master, Seneca: "He that possesses prudence is also self-restrained; he that possesses self-restraint is also unwavering; he that is unwavering is unperturbed; he that is unperturbed is free from sadness; he that is free from sadness is happy. Therefore, the prudent man is happy."