In the past, the most seasoned of market price forecasters in the swine area always used to say that no disease outbreak in modern times, no matter how seemingly severe at the local level, has ever been observed to be definitively reflected in the market price for hogs. This was especially the case prior to PRRS but even after the advent of PRRS, it was not until the full bloom of porcine circovirus associated diseases (combined with PRRSV and probably SIV too) that measurable increases in slaughter hog prices, not associated with the normal seasonal and cyclical movements were noted. That was tempered by the eventual development and widespread adoption of the vaccine for PCV2. Now we have the advent of Porcine Epidemic Diarrhea Virus (PEDV) and by the end of 2013, there were reported to be hundreds (a few thousand) of cases reported in 20 of the states with the hog dense states leading the way, as expected.

At the beginning of the outbreak of PEDV (May 2013) there was near, if not complete mortality of all newborn piglets infected though by the end of the year, there were some reports that piglets were surviving. One estimate is that the U.S. has lost over three million pigs in just a few months and this could be part of the explanation for the surprising reduction in on-farm inventory reported in the December 2013 USDA Hogs and Pigs Report. Inventory was reported to be down one percent from a year ago and two percent from last quarter.

Time will tell if PEDV is the cause but weaned pig and feeder pig prices began to turn up in June, a couple of months ahead of their traditional seasonal bottoming with the turn toward seasonal highs which peak usually in February or March. Weaner pig and feeder pig prices are currently heading for outer space with the full weighted average weaner pig prices in the mid-$60s/head (constrained by formula prices) while some individual cash sales are in the mid $80/head and feeder pigs are closing in on $100 per head at the national average (many individual sales have been above $100/head).

With pig prices running so high, a question that comes to mind is, “Just how good are weaner and feeder pig prices at predicting the profitability of their end-product, the finished hog at market weight?” You would think that weaner and feeder pig prices would be a very good reflection of what purchasers believe the profitability of their production will eventually be, that bidders would go after weaned and feeder pigs in times of anticipated profits, driving up their prices and shun them when losses were expected to run deep sending their prices plummeting. A big question that arises is how often are weaner and feeder pig buyers right in the price they agree to pay by the time the production process ends and the pigs are sold for pork. Will $100+/head weaner and feeder pigs still create profitable finished pigs?

Some things to consider are, while there are still some opportunity finishers out there who only buy these pigs when they believe they will be profitable, many sales today are under contracted arrangements which continue year round hoping the losses in one period at finishing will be evened out by profits in some other period, so they are buying all the time regardless of price. Is the run up we are currently observing in weaner/feeder pig prices due to the expectation of high profits related to the collapse of feed costs or has PEDV struck some of the weaner and feeder pig producers, reducing supply for the coming year? That would leave purchasers who have given up farrowing and depend on these sources left looking hard for a source of good quality, high health piglets, driving up demand and prices. Farms which do not normally buy pigs but have had a run of PEDV and have created a four or five week hole in production may also be pressuring the market.

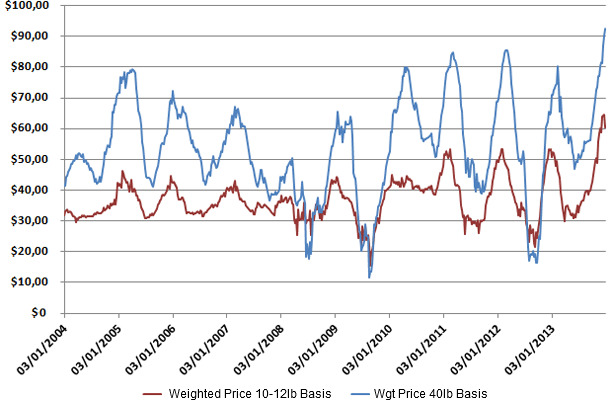

Figure 1. Weekly average weaned pig and feeder pig prices

Source: USDA Agricultural Marketing Service

Figure 1 illustrates the seasonal character of weaner and feeder pig prices. They spike in early spring when their anticipated finished period will hit the seasonal highs of the finished hog market. This is especially the case for feeder pigs which are more subject to opportunity arrangements. Feeder pigs prices are highly volatile and frequently double from seasonal high to seasonal low. Weaner pig prices are remarkably stable and tend to hover near or a few dollars above the full cost of production for an average farrowing farm. This is because the production of weaner pigs is as close as this industry gets to a full cost-center concept with little or no value added to the pig. Weaner pig prices are differentiated by size of group, average weight, genetics and health status. Profits are very slim for the average producer and not guaranteed even for the best of producers year in and year out.

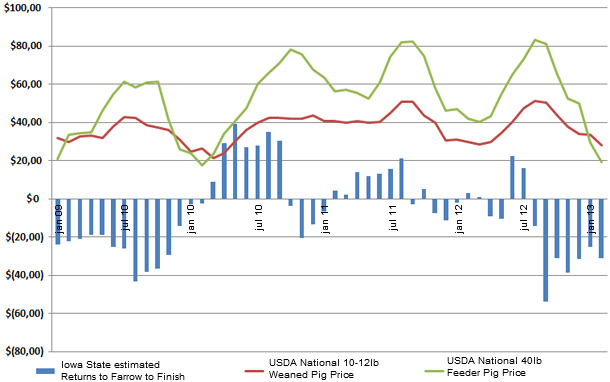

Figure 2. Estimated returns from finished hog production

matched to USDA national average weaner and feeder pig prices

Source: Ag Decision Maker B1-30, Iowa State University

USDA Market News Service Livestock Prices

In Figure 2, we add the estimated profitability of finished hogs to the picture to get an idea of how good buyers are at turning weaned pig prices into finishing profits. In Figure 2. I have matched the weaner and feeder pig prices paid to the month the profits were created by the sale of the finished animal. In other words and as an example, in Figure 2., the January 2009 estimated profits figure is aligned with the June 2008 weaned pig price and the July 2008 feeder pig price. How well do you think buyers anticipate eventual profits or losses in their willingness to pay for weaner and feeder pigs? Would you pay $100+/head today for a 10-12lb pig or a 40lb pig to be sold this summer?