After Easter, the hog price in Spain has remained the same for five consecutive market sessions. The delays from the holidays have been absorbed with relative ease and slaughter flows continue normally.

This month the average carcass weight has reached close to 95 kg, which is a record weight for this time of the year. This heavy weight can be explained by swine farmers' interest in making the most of favorable feed prices.

Just five years ago the average carcass weight in April was very close to 86 kg (Mercolleida data); that is, the carcass weight has increased by 10% in barely five years. This is where we are, although these exaggerated weights cause commercial problems for slaughterhouses due to the excessive size of some pieces.

Spring consumption is slow: the weather has not encouraged many barbecues (this April temperatures have dropped sharply in Spain and ice has formed in low altitudes!). After a few weeks of waiting for the starting signal -which has not sounded due to bad weather in Central Europe- the market appears tired and demand is rather weak.

We have no doubt that in the short term, the hog price in Spain will be linked to how pork prices evolve. For now, the return of the Japanese market purchasing pork bellies (the star product there) is very noticeable; we perceive a certain stagnation for other cuts that we hope will be temporary.

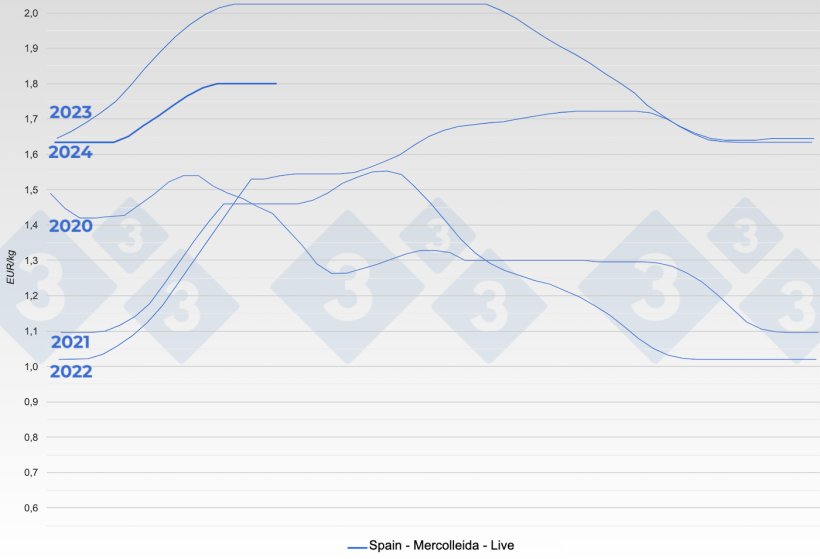

The month of May will likely define the height to which our price can reach. Stakeholders wait expectantly for the market to revitalize with the arrival of warm weather. We will see what happens. In any case, it seems unlikely the Spanish price will reach 1.90 €/kg live this year, although... far off in the distance, a powerful buyer market can be seen in China in the second half of the year, as a result of the massive sow slaughter due to disastrous finishing results that have gone on for months. It remains to be seen if, before the end of the year, we'll get a surprise...

Things continue to happen in the EU: we recently learned of the closure of a major slaughter plant (1,200 workers, 45,000 pigs processed per week) in Ringsted (Denmark) resulting from the herd reduction there. In general, all EU countries have suffered significant pig herd reductions in recent years, although it seems that in 2024 this decline has stopped according to published slaughter figures. Forecasts suggest that total slaughter within the EU will be around 2% higher in 2024 than last year.

As far as our competitors on the international scene are concerned, we should mention that hog prices in the United States have risen very strongly, going from a derisory price of 0.93 €/kg carcass on January 23 to 1.89 at the end of April (doubling in just three months!). As you can see, this price stands nowhere near the European ones, despite their recovery. Brazil is still anchored at a price of around 1.20 €/kg carcass, which is not at all in line with the EU. The Brazilian price is half the current Spanish price. It seems incredible, but that is how it is. Let us recapitulate: The United States is about 50 cents cheaper than Spain per kg carcass and Brazil at half our price... This is the situation.

It is easy to conclude that we have enormous competition difficulties for exports to third countries. The unbeatable prices in the Americas make it very hard for us and our European colleagues.

Let's keep our fingers crossed and hope May proves true to form, temperatures rise steadily, and barbecues become widespread in Germany. Europe needs pork consumption to remain at its usual levels so as not to suffer too much surplus.

In Italy, ASF is rampant and the affected areas are spreading. Cases have been found near the Parma ham nucleus and part of Italian cured hams exports to third countries is in question. It is very likely that, without being able to export, the large Italian dryers will not buy hams they won't be able to sell outside the EU and this will negatively affect the price of hams within the EU. This week the price of ham in Italy has already begun to falter.

A few weeks ago in Spain, a medium-sized sausage manufacturer in Barcelona has entered into an arrangement with creditors. The bad news continues.

The first link in the production chain (read pig farming) has seen many months of good results; the persistent challenges for the following links will inevitably have undesirable consequences. Time, in its inexorability, will bear witness to the events to come.

We close with a very illustrative phrase from famous Uruguayan writer, Mario Benedetti, which fits with the current times of changes and unknowns, in which we must be prepared for any scenario: When we thought we had all the answers, suddenly... all the questions changed!

Guillem Burset