Thirty-five days and five market sessions later, we return to the topic of the economic developments in Spanish swine production. The current scenario is radically different from the one at the time of writing the previous commentary.

We announced that the pig price in Spain could do nothing but go down, and it has. The question of when was cleared up just a week after last month's article.

In Spain, we have seen five consecutive downward movements; from the memorable and historic 2.025 we have fallen to 1.905. A drop of 0.12 €/kg live. After four months of being at the limit, the price is gliding down - seemingly without panic - in search of a bottom.

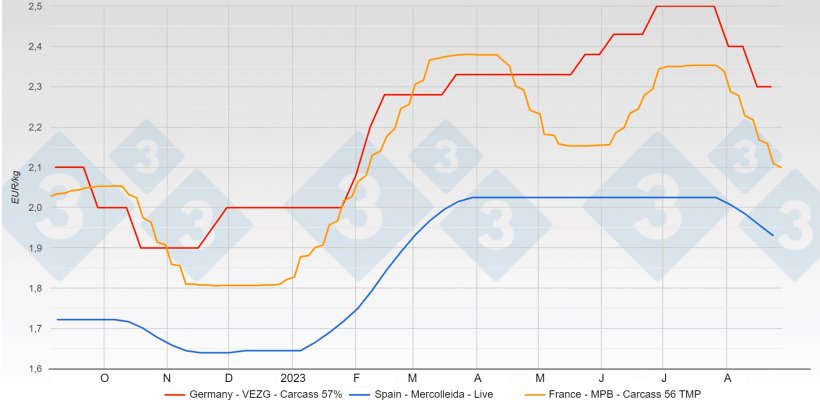

It is interesting to look at what has happened during this same period of time in other markets (all of which have seen decreases except China):

- In Germany, hogs are down from 2.50 to 2.30, a drop of 0.20 carcass, equivalent to 0.152 €/kg live.

- In France (traditionally Spain's main customer) pigs have dropped from 2.35 €/kg carcass to 2.05; a whopping 0.30 €/kg carcass equivalent to 0.23 €/kg live.

- In Canada (Ontario) pigs have gone from 1.74 €/kg carcass to 1.62; a decrease of 12 cents carcass equivalent to about 0.09 €/kg live.

- In the United States, hogs have dropped from 2.09 €/kg carcass to 1.76: 0.33 €/kg carcass equivalent to 0.25 €/kg live.

- In Brazil, they have gone from 1.27 €/kg live to 1.19. A drop of 8 cents/kg live and still at the bottom of the prices among the world's leading producers.

- In China, the pig price has risen; from 2.09 €/kg live at the end of July to 2.19 in mid-August. They are rising strongly and resolutely.

In Spain, pig prices are going down, but more moderately than in Germany and especially in France. In Canada and the United States, pig prices are also coming down after a clearly high month of July.

In China (at last!), pig prices seem to be rising steadily. The main trigger for this rise is none other than the significant slaughter of sows that has occurred there. Let us remember that, from the end of March to the end of July, the price in China has been lower than in Spain. The huge losses (production costs in China are far higher than those in Spain) have forced the major pig holders to cull sows while waiting for better times. Losses of hundreds of millions of euros have been reported in some large Chinese integrating companies; their reaction to slaughter sows obeys the logic of the market.

In the United States, there are reports of well above-normal slaughtering of sows. Some large producers have reported multi-million dollar losses and herd reductions. We expect better prices in the near future.

The Spanish scenario -and therefore the European one- appears to be very complex. Supply is still at a minimum, but consumption has disappeared and exports to third countries are neither there nor expected. Consequently, there is a surplus of pork.

Let's hope that the Rentrée (the return of citizens to their homes after summer vacation) will help to mitigate the slump by boosting consumption. We fear that it will not be enough, although we need all the help we can get.

We can see a glimmer of hope in the distance; at the moment it is shaky and uncertain, but it looks like it will grow. We are referring to the aforementioned decrease in the Chinese herd. It could very well happen that in a few months, China's pork deficit will be significant. We will have to wait and see. Perhaps the foreseeable decrease in the United States could also help improve our exports in Spain.

In Spain, pig prices are decreasing due to extreme market fatigue. The slaughter capacity far exceeds the live supply. This circumstance interferes and greatly influences the evolution of the price. We can say that pig prices are going down even though there is not a single pig left over.

The loss of virulence of the predominant PRRS strains in Spain today is a fact. Piglets that become sick right now suffer, but survive. Battered, but they survive. This fact could lead to a significant increase in supply before the end of the year. We know that the limiting factor of the Spanish supply has been the presence of PRRS, since all the breeding sows are still active. We think that in November we could see record slaughters again.

The initial drops in pig prices in August have not been passed on to the pork; although slaughterhouses are still in the red, losses are no longer as severe as they were at the end of July.

It is quite possible that pig prices will go down until the weekly results of the slaughterhouses are balanced (to 1.85? - to 1.80?). A more or less firm bottom could then appear that would hold until late autumn, when what we can consider as "normal supply" comes in. Although, as is evident, everything remains to be seen.

We remain vigilant as to what happens in order to report on it.

In these extraordinary times, full of turbulence, we would like to recall a phrase from the great German philosopher Immanuel Kant: "The intelligence of an individual is measured by the amount of uncertainty he is able to bear".

Guillem Burset