A shockwave hit the US pork industry in mid-April when packing capacity began to shrink due to COVID-19 disease closures. A similar shockwave is working its way through Germany and will likely affect most pork packing plants throughout Canada, Mexico and the EU. Very few anticipated that a month after the first US beef plant closure (at the end of March), thousands upon thousands of perfectly healthy, market ready pigs would be euthanized and made into compost, landfill garbage or rendered for grease and other byproducts due to follow-on closures in US pork harvest plants. The race is on now to flatten the euthanasia curve in precise parallel to the actions taken to reduce the potential of hospitals being flooded with surges of human cases, outstripping bed and critical care equipment availability such as ventilators.

Every major harvest plant for hogs in the United States has faced some level of closure, slowdown or operating procedure changes. As of today, all have returned to operating, but only a tiny number are harvesting again at or near their as-built capacity. In addition, many further processing plants have also closed temporarily and are seeking to reopen with changes ensuring worker health.

The US pig harvest was already challenging nationwide harvest capacity from time to time when this disaster struck, compounding the tragedy and blunting any possibility of a quick fix. The prospect of improved profits for producers due to fewer head coming to market as summer approached, coming lighter weights and dramatic increases in export sales, especially to China, was suddenly and dramatically reversed in the last few weeks.

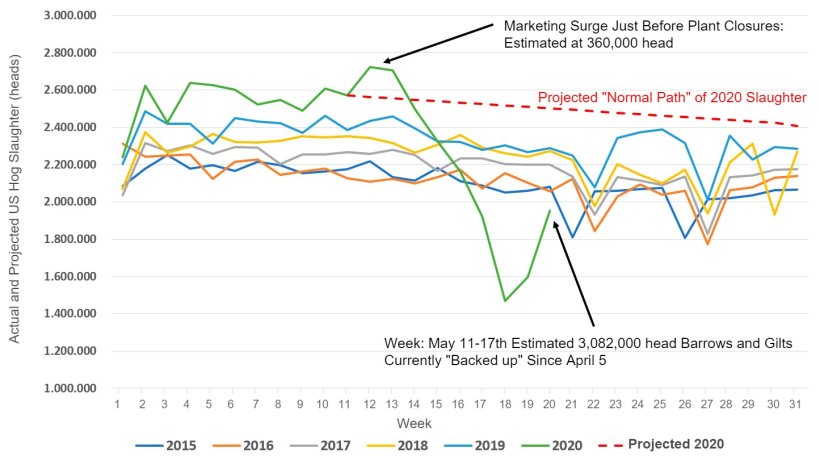

Figure 1 shows an estimate of just over three million head of finished pigs are currently slaughter-ready and/or “backed up” in the US as of May 17, 2020. This has continued to increase but at a slower rate as plants begin to find their footing. Many multiple thousands of market ready hogs are already destroyed or waiting for a window for slaughter as their weights creep higher. We can project the full magnitude of this unprecedented calamity through the summer months with some adjustments for the success of major mitigating factors.

Those factors include first, how effective producers are at slowing the growth of market hogs and having space to “store” them in maintenance mode and how fast and at what level of efficiency, the harvest plants can return to production. Storing involves either keeping animals in aisles or other unused buildings, euthanizing weaned pigs and using their wean-to-finish space for market-ready pigs and in some small farm cases, letting pigs go outside in fenced paddocks. The estimates in Figure 1. include all commercial barrows and gilts under federally inspected slaughter. Small local plants under state inspection have been pressed into service as consumers are buying hogs from smaller farmers and taking them directly to these local abbatoirs.

We project the trajectory of the 2020 demand for slaughter (red dashed line) by applying the typical seasonal decline for the last five years beginning from the time of the first hog plant affected in April through July of this year. There was a surge in slaughter for two weeks prior to the first plant closure harvesting an extra 360,000 head. These have been subtracted from the forecast immediately after the first plant closure as they appear to have been pulled forward.

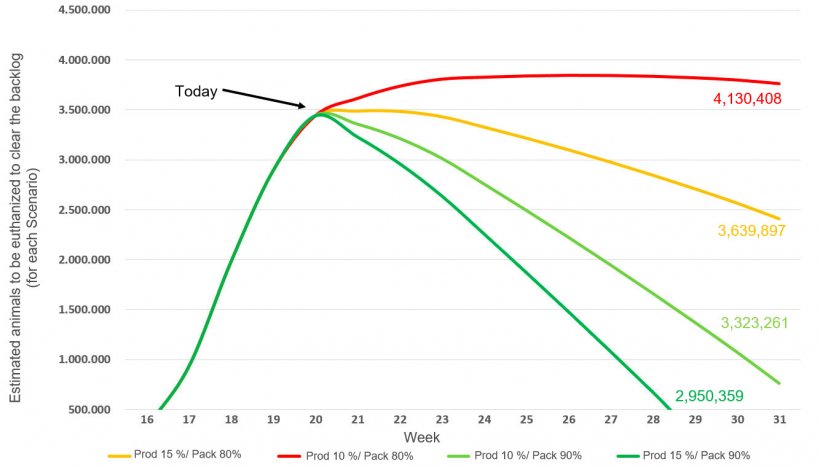

Figure 2 is a forecast of the total expected demand for euthanasia, the curve that producers and packers are desperately trying to flatten. There is good hope producers will achieve the lower bounds of the forecast as they are getting very timely information from both private consultants and university sources on how to slow the growth of healthy animals in the finishing phase. This can flatten the curve to some extent and slow the jam at the packing plant dock if they can be “stored”.

There are a variety of slowing strategies including dietary changes which limit growth but allow healthy maintenance of current weight. These include dietary additives (removal of certain ingredients which support or produce growth) as well as things which limit intake due to the production of satiety. Some feed additives, while humane, can cause a reduction in weight due to inappetance. Other strategies for smaller herds include moving animals outdoors if feasible, and with indoor production, increasing heat and moisture simulating full summer conditions.

Others involve increasing stocking density within the bounds of animal welfare which is a well-studied condition decreasing average daily gain after a threshold density. While slowing growth is not a perfect solution, as pigs are constantly moving forward from the farrowing house, some producers are also euthanizing all piglets at birth for a couple of weeks to create a gap and building availability, while also slowing the growth of pigs in finishing. We estimate that animals slowed in finishing might be stored for up to 3 weeks by double and triple stocking wean-to-finish barns temporarily until space is gone and weights creep beyond safe stocking densities and acceptable slaughter levels. We note the national average live marketing weight is now 291 lbs (132kg). These standard deviation around this mean will prohibit any further advance of the mean. We show two levels of effectiveness at this slowing and storing, 10% and 15% of normal growth rate as a national average, but euthanasia must begin after three weeks of “storage”. Unfortunately, many producers routinely already double stock wean-to-finish barns so extra space is not available to all.

Second, we do not have a firm idea how the measures within plants, which are being prescribed to protect human health, will eventually stabilize to a “new normal” level of efficiency. I would be very surprised if US packers cannot creatively achieve the health goals for workers while returning to near normal operating conditions in the long run. The short and intermediate run is the key. The stakes are too high as the heavy fixed costs of plants dramatically raise cost of production when throughput is reduced. In Figure 2., we show a return to either 80% or 90% of full packer harvest capacity which is currently estimated at or near 2,750,000 head per week including a short half-day on Saturday.

While a very few plants have made these changes and returned to full or nearly full capacity, most are hovering right now at the rate of 70-85% of pre-COVID-19 line speeds. Many believe that testing all employees, taking temperatures daily and carefully protecting workers in-plant with additional personal protective gear may allow close to full recovery but it will likely take many weeks. Availability of workers, who often live in multi-family settings, where passing the disease to family members, especially older ones, is a very high risk, will also need to be solved. It is interesting to note that up to 90% of plant workers tested recently within plants are asymptomatic, but the danger to others in their living environment is delaying their return to work until they test negative. Those closest to this situation are concluding that the spread of the disease among plant workers is most likely happening outside the plant, rather than in it, due to socializing patterns and typical multi-person/multi-family residences of plant workers.

US supermarkets now ration meat purchases typically to 1-3 packages across all types of fresh meat per visit and costs have risen 20-40% at retail. All of this is new ground for the current generation of US citizens as similar rationing was last enforced by law during world war II. Since everything is on the table, a new higher normal price at retail may be the outcome if the implemented changes permanently slow meat plant output.

There really are not words to describe the sense of dread that lays heavy among the production systems, the people who produce the food animals in United States, who now must voluntarily destroy them in large numbers. Heroic acts abound during this despair. There are cases of substantial purchases of live hogs by private entities, locally provisioned at small butchers, and then given to food banks. But overall, the numbers don’t move the needle. Producers are themselves giving away large amounts of pork to their local food banks and charitable distribution channels both individually and through their national association.

National hog prices (used in the bulk of prices formulas) appear to be being maintained at or above the cost of production (the negotiated series are low volume and unreliable measures of price) for those who can get shackle space, even though true market prices would be much, much lower. Just like these unprecedented times, I must conclude on an unusual note by hoping against hope that my forecast is just as wrong on the high side as the human epidemiological models used to forecast COVID-19 outcomes have been, at least in the US.