An analysis of the economic situation of pork production in recent years was carried out, considering Brazil, Mexico, Argentina, Chile, Colombia, Peru, Ecuador, Costa Rica, Paraguay, and Panama as the main pork producing countries in Latin America.

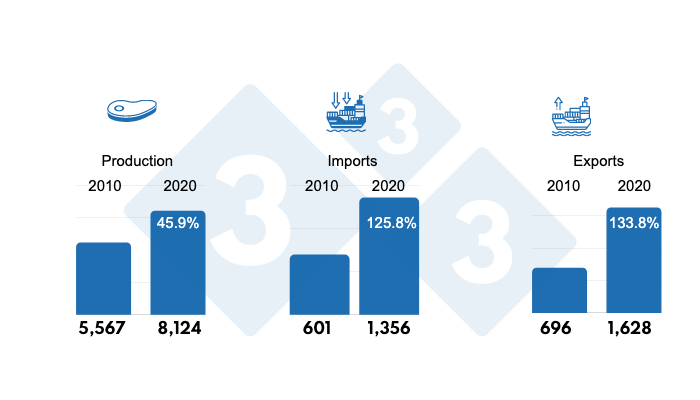

Figure 1. Total pork production, imports, and exports in thousands of tons for the main Latin American producers in the period 2010 and 2020, and % increase.

Production

Table 1. Pork production in the main pork producing countries in Latin America between 2010 and 2020.

| Production (1000 t) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | 3,078 | 3,370 | 3,150 | 3,117 | 3,193 | 3,431 | 3,711 | 3,825 | 3,951 | 4,124 | 4,130 |

| Mexico | 1,175 | 1,202 | 1,239 | 1,284 | 1,290 | 1,323 | 1,376 | 1,440 | 1,501 | 1,447 | 1,649 |

| Argentina | 279 | 301 | 331 | 416 | 442 | 484 | 522 | 567 | 621 | 610 | 655 |

| Chile | 498 | 528 | 584 | 550 | 520 | 524 | 508 | 496 | 534 | 530 | 574 |

| Colombia | 195 | 226 | 243 | 265 | 289 | 320 | 357 | 371 | 410 | 447 | 469 |

| Peru | 155 | 157 | 163 | 170 | 181 | 191 | 199 | 210 | 220 | 231 | 270 |

| Ecuador | 95 | 105 | 115 | 120 | 126 | 138 | 150 | 161 | 150 | 187 | 190 |

| Costa Rica | 44 | 46 | 48 | 48 | 51 | 53 | 62 | 63 | 67 | 68 | 74 |

| Paraguay | 18 | 21 | 23 | 27 | 29 | 36 | 43 | 45 | 55 | 58 | 64 |

| Panama | 30 | 32 | 37 | 37 | 37 | 39 | 42 | 48 | 53 | 48 | 49 |

| Total | 5,567 | 5,988 | 5,933 | 6,033 | 6,157 | 6,538 | 6,971 | 7,227 | 7,561 | 7,750 | 8,124 |

It is surprising that Paraguay was the country with the highest growth during the last decade, growing 262%, followed by Colombia, with 141%, and Argentina, with 135%. In contrast, Chile grew by only 15.2% during the same period.

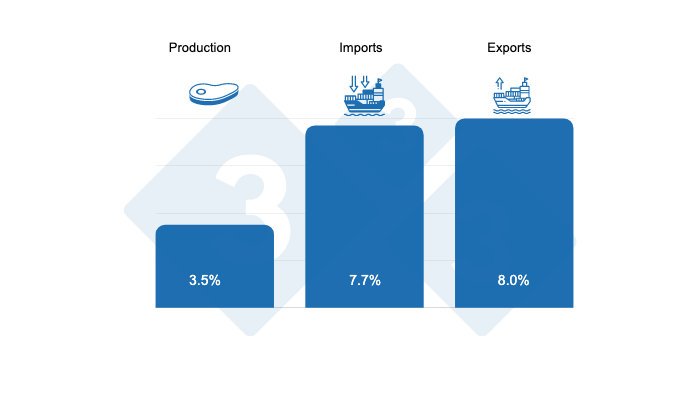

Similarly, according to calculations obtained from the compound annual growth rate (CAGR), which show smoothed results, reducing the effect of market volatility, the growth figures show a similar order (Figure 2).

Figure 2. Compound annual growth rate (CAGR) of production in the main pork producing countries in Latin America for the period 2010 to 2020.

Now, considering that the countries analyzed represent approximately 90% of Latin America's production, it can be said that the region has seen a positive evolution, from 5,566,748 t in 2010 to 8,124,453 t in 2020, with a consolidated growth rate of 44.9% and a total CAGR of 3.5% (Figures 1 and 3).

Imports

Table 2. Imports of pork from the main pork producing countries in Latin America between 2010 and 2020.

| Imports (1000 t) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | - | - | - | - | - | - | - | - | 16 | 18 | 15 |

| Mexico | 498 | 416 | 516 | 574 | 601 | 723 | 755 | 803 | 875 | 1,140 | 1,095 |

| Argentina | 48 | 55 | 31 | 17 | 9 | 12 | 28 | 39 | 45 | 33 | 22 |

| Chile | 12 | 14 | 19 | 38 | 34 | 34 | 54 | 90 | 74 | 99 | 104 |

| Colombia | 23 | 28 | 37 | 57 | 64 | 56 | 58 | 81 | 106 | 115 | 76 |

| Peru | - | - | 4 | 5 | 6 | 8 | 8 | 9 | 9 | 8 | 8 |

| Ecuador | 14 | 15 | 15 | 13 | 10 | 7 | 3 | 4 | 4 | - | - |

| Costa Rica | 5 | 3 | 4 | 5 | 5 | 7 | 9 | 13 | 11 | 12 | 9 |

| Paraguay | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 4 | 5 |

| Panama | - | - | - | - | 7 | 9 | 19 | 16 | 20 | 25 | 23 |

| Total | 601 | 533 | 627 | 710 | 737 | 859 | 935 | 1,058 | 1,163 | 1,453 | 1,356 |

The leading importer of pork in Latin America is Mexico with 120% growth from 2010 to 2020. This is due to the fact that this country has been dedicated to exports, and its per capita consumption of pork is the highest in the region, reaching 19 kg, so it must resort to imported pork to supply its domestic demand. Chile follows, with an increase of 756%, and Colombia, with 237%.

It is important to note that, despite the numbers, countries with much lower import volumes, such as Paraguay and Panama, have shown significant growth in this area in recent years, importing 414% and 224% higher volumes compared to the first year of available data. On the other hand, Ecuador has been seeing a significant decrease in imports, so it can be inferred that a large part of the domestic consumption of pork in this country is supplied thanks to the behavior of domestic production. A similar case is seen in Argentina which, despite having significant year-on-year variations during the period, has reduced its imports by 53% since 2010.

All the countries included in the study, with the exception of Chile and Panama, showed a decrease in the amount of pork imported in 2020, which has regularly been associated with the sanitary crisis caused by COVID-19.

Brazil is a unique case in terms of imports. As a large producer, it is able to not only be self-sufficient but also to export a large amount of its production, so it has been reducing its import levels over the last 3 years.

It is worth noting that for Latin America, the increase in imports at a rate much higher even than production (125%), from 600,739 to 1,356,453 t between 2010 and 2020, with a consolidated CAGR of 7.7% for the region (Figures 1 and 3), indicates that a large part of domestic consumption is being supplied by other countries, especially in countries such as Mexico and Colombia, Costa Rica and Panama.

Exports

Table 3. Pork exports from the main pork producing countries in Latin America between 2010 and 2020.

|

Exports t |

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Brazil | 540,000 | 516,000 | 581,477 | 517,000 | 505,000 | 555,000 | 672,762 | 656,145 | 634,000 | 734,000 | 1,021,000 |

| Mexico | 58,082 | 63,298 | 71,288 | 84,163 | 89,374 | 97,059 | 104,978 | 124,464 | 131,264 | 185,085 | 276,050 |

| Argentina | 3,903 | 5,377 | 6,968 | 6,430 | 7,568 | 8,316 | 11,904 | 14,635 | 23,228 | 25,575 | 41,271 |

| Chile | 93,671 | 100,888 | 132,466 | 120,310 | 121,783 | 133,727 | 130,022 | 127,470 | 193,342 | 220,284 | 283,454 |

| Colombia | 18 | 7 | 10 | 15 | 28 | 1 | 6 | 4 | 1,674 | 24 | 100 |

| Costa Rica | 483 | 231 | 509 | 133 | 329 | 501 | 298 | 107 | 63 | 360 | 226 |

| Paraguay | 26 | 56 | 1,065 | 2,325 | 2,351 | 2,969 | 3,149 | 3,399 | 5,204 | 4,739 | 5,462 |

| Total | 696,184 | 685,857 | 793,783 | 730,377 | 726,433 | 797,573 | 923,119 | 926,224 | 988,775 | 1,170,067 | 1,627,563 |

Not all Latin American countries are pork exporters. However, 2020 was an atypical year, which boosted the growth and development of exports in several countries in the region. The best example of this is Brazil, which reached 1,021,000 t exported in 2020 due to the high demand for pork from Asia after the ASF outbreak in China and other Asian countries. Brazil's main export destinations include Asia (China, Hong Kong, and Singapore), Latin America (Chile, Uruguay, and Argentina), and Russia, thus achieving an 89% increase in exports over the decade.

In the case of Chile, exports reached 283,454 t, achieving a growth of 203% over the analyzed period. The main destinations are Asian countries such as China, Japan, and South Korea, along with the Russian market.

Mexico was the third largest exporter in Latin America in 2020, with 276,050 tons and an increase of 375%, marking a historical increase of 49% over the previous two years (2019 to 2020), thus becoming one of the main exporters to Asian countries such as Japan and, to a lesser extent, China and South Korea.

Another country that exhibits an interesting evolution in this regard is Argentina, with an increase of 957% over the last decade, reaching 41,271 t in 2020, positioning itself as an important player within the pork exporting group at the regional level. Like Mexico, Argentina has managed to significantly increase its exports in 2019 and 2020 (61%).

Exports are expected to increase thanks to free trade agreements with Asian countries, which have led them to increase their exports in recent months.

Finally, Costa Rica and Colombia still export low volumes but are taking steps to increase their share in the coming years.

Just as with the production and import indicators, pork exports from Latin America increased substantially between 2010 and 2020, going from 696,184 t to 1,627,563 t with a growth of almost 134% and a CAGR of 8% (Figures 1 and 3). Consequently, the amount of exports exceeded that of imports in this region.

Figure 3. CAGR of production, imports, and exports of the main pork producing countries in Latin America for the period 2010-2020.

In conclusion, the increase in demand from Asian countries such as China, Japan, South Korea, and Hong Kong, added to the spread of African swine fever in 13 Asian countries and part of Europe, generates a greater demand for protein, a large part of which is being supplied by Latin American countries.