I have been in the Argentine pig industry for 37 years and have had the chance to experience every link of the chain- production, industry, promotion, trade, export, and union. I have been here since the years when there was talk of the potential of the swine industry, up to the present day with many goals having been met.

Between the year 2002 and today, the Argentine swine industry has experienced strong growth, with a constant increase every year, going from being a pork importer to an exporter and developing the domestic fresh pork market.

The key was to generate a plan with few points: eradicating CSF, promoting consumption, and developing exportation.

Production

In 2002, production with 150,000 sows reached 136,000 tonnes, and projections for the present year with 395,000 sows are 775,000 tonnes. The increase in production was 5.7 times in these 19 years with an average of 10.3% per year and peaks in 2004 with 18.3% and in 2013 with 18.1%. (Graph 1)

Graph 1. Evolution of production 2002/20. Source: Ministry of Agriculture, Livestock and Fisheries of Argentina (MAGyP) and own data - Year 2020 projected data.

Gross margin

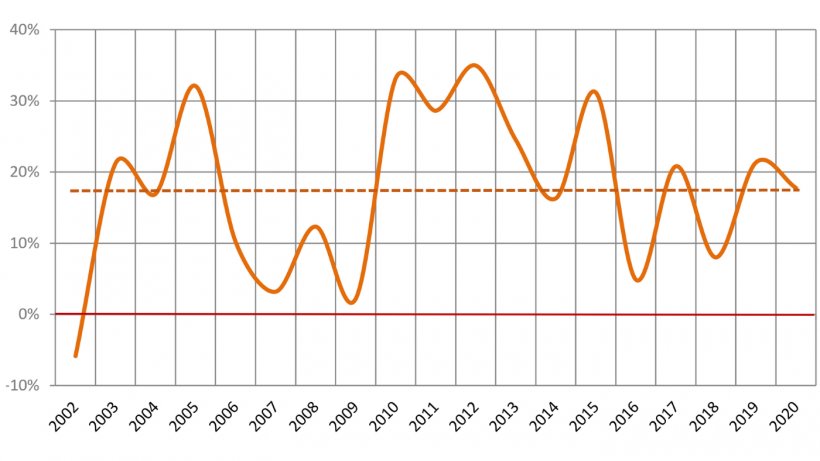

Not only was there growth in production, there was also a positive economic outcome. The gross margin expressed in dollars per kilo live weight before taxes for the 19 years analyzed gives an average of 17.6% with only one negative year, 2002. There are four years with below-average profitability, which are 2007 due to the strong price rise in corn, 2009 due to influenza A H1N1, improperly called "swine" flu, 2016 due to a strong devaluation and removal of the export taxes on corn, and 2018 due to severe drought. The results are shown in Graph 2.

Graph 2. Gross margin 2002/20. Source: Data from the Ministry of Agriculture, Livestock and Fisheries of Argentina (MAGyP), Banco de la Nación Argentina, and own data – Year 2020 with data to September.

Imports

It is interesting to note that Argentina did not import pork until 1992 and was a low volume exporter. Despite being a pork producing country, in 1999 it imported 50% of what was consumed. The year 2003 saw the highest percentage for the period of the amount imported with respect to what was produced, with 30%. Currently, in the projections for 2020, imports amount to 2% of what is produced. Graph 3.

Graph 3. Imports and relationship with domestic production. Source: customs and own data - Year 2020 projected.

Exports

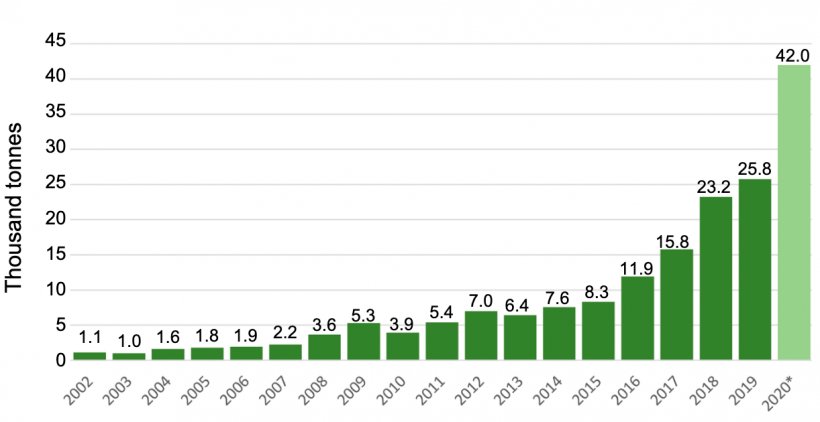

The period analyzed (2002-2020), began with exporting small quantities and mainly offal. There was an initial pork export trial in 2009 that was not very successful and was started up again in 2015 in an attempt to solve the problems that had gone wrong. This second opportunity generated the strong growth of recent years, with 13 destinations and China being the main export market currently, with 67%. The current percentage of exports related to total production is 5.4%. It is worth mentioning that 2020 is the first year with a favorable export/import trade balance, both in quantity and foreign currency. Graph 4.

Graph 4. Exports. Source: Data from customs – Year 2020 projected.

Projections

In a possible growth projection based on historical data, with an increase in the local fresh pork market and greater participation in exports, it is estimated that in 2030 it would exceed 1,400 tonnes. Exports, by that time, could exceed 10% of total production. Graph 5.

Graph 5. Production projection. Source: Own preparation.

Argentina's pig industry has shown highly satisfactory performance in recent years, placing it among the best sectors of greatest growth in the country's agro-industrial area.

International opportunities presented by ASF, reinforce the justification of significant growth. But in a country where beef is king, pork has found a place on the Argentinean plate and has an important growth margin.

In this new stage, health controls must be further strengthened to continue maintaining the good health status achieved, improving communication with the society on increasingly important issues such as environmental and social impact, animal welfare, and responsible use of antimicrobials. It is also necessary to continue promoting consumption and developing new marketing channels, which COVID-19 has encouraged.

Rapid adaptation to new changes will ensure the pathway to growth.