In view of the special circumstances of the last few days, we are advancing the publication of our usual monthly commentary by one week.

Indeed, the pig markets within the EU are in explosive mode, breaking record after record in a bull run at an unbridled pace. Everything we thought might happen is happening: sooner than expected, much faster than expected, and with far more virulence than expected. Pork prices have risen finally (there is no other way) as if the compressed spring we mentioned in the previous commentary has sprung with titanic force.

Our reference market in Spain has seen three maximum rises (Mercolleida's operating rules do not allow rises or falls of more than 6 cents in a single session). But it so happens that we are still far from the upper limit. In Spain from the end of January (1.02) until today (1.35) the pig price has risen by 32%, which is not insignificant.

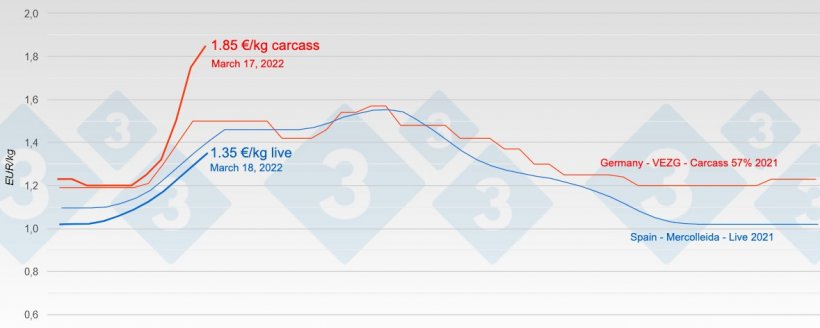

Germany, once a powerful leading European market, has spurred prices "ad infinitum" by rising from €1.20/kilo carcass on February 9 to an inconceivable €1.85 just five weeks later. This movement represents an increase of 54%. Nothing more and nothing less. Looking at the following graph of the price evolution of pork carcasses in Germany, it can be seen that a real wall is being erected - with unusual speed.

Graph 1. The price of pork in Germany is rising - unusually fast - like a wall.

The French reference market MPB (Breton Pig Market) yesterday moved its price by + 10 cents per kilo carcass, although its rule prevents movements of more than 5 cents in a single session: yet another sign of complete exceptionality.

We are in the midst of a bullish tsunami that is far from over.

In our opinion, there are several, diverse concomitant causes affecting the market at the moment:

- Russia's invasion of Ukraine is causing runaway increases in the world markets for raw materials for animal feed. In a short time, the production cost price of a live pig has gone from 1.30 to more than 1.55 euros / kilo live. It remains to be seen whether there will be enough feed to feed livestock.

- The same is true for energy. Gas has skyrocketed and energy costs are absolutely out of control.

- Inflation is at levels not seen in the last 30 years; we will soon find that this is only the beginning.

- Sick and tired of being sick and tired, central European farmers have had enough of finishing out pigs. More than 16 months of below-cost selling prices have decapitalized and demoralized the industry. There are no pigs as a consequence of the massive slaughtering of sows and piglets (for fear of losses if pigs were finished out).

- The persistence of health problems (particularly respiratory syndrome) that continues to decimate piglets on affected farms.

- The historic, unusual and unexpected decision of the large German slaughterhouses (without exception) to unilaterally annul or cancel firm contracts for frozen meat orders without prior notice, has triggered the understandable panic of shortages, exacerbating the nervousness of many important operators.

- The concentration of businesses: there are fewer and fewer operators (both in the livestock and slaughterhouse sectors) and they are becoming larger and larger. This fact amplifies and accentuates the pendular movements of the market, exaggerating them.

- The lack of pigs due to supply restrictions is the first factor responsible for what is happening. It is a fact: there are not enough pigs, not only in Spain but in the EU as a whole.

At this time it is very difficult to foresee or intuit how far the pig price can rise. Necessity obliges and it seems evident that we will surpass all historical records. Farmers need to be able to sell their pigs above cost price. It is an axiom: if this does not happen, then there is no future.

The European processing industry (sausage manufacturers) will have to face purchase prices for their raw material (meat) that are 50 to 70% higher this spring than in the second half of 2021. The industry is facing an unclimbable wall. It will not be easy to convince large supermarkets and retailers that the prices of processed products must rise. And that they must rise accordingly, not simple upward adjustments.

The industry must face this difficult and very complicated task. We believe it essential to be able to renegotiate contracts for the sale of processed pork products. Even if it is necessary to allege force majeure; or is not a 50% increase, or more, of the raw material undoubtedly a force majeure?

The European authorities and the various state governments should understand that big problems require big solutions (and they should act accordingly). And do their part (offer interlocution? offer mediation? offer arbitration?). We believe that the survival of a large part of the processing industry is at stake. And this is very serious. The authorities cannot and should not remain impassive in the face of the uncontrolled demolition of such an important productive sector.

It is not possible to absorb, just like that, pork price increases of 50 or 70%. This is obvious. It is a very high and smooth wall, unapproachable without help. What cannot be, cannot be, and moreover, is impossible.

Let us hope that manufacturers and supermarkets (with the help of the authorities?) can reach a consensus on minimums in order to find a viable way forward. The situation is unprecedentedly hairy, dangerous, and delicate. These are truly historic times. Perhaps unrepeatable.

With the conflict in Ukraine unresolved, we will see and experience very complicated situations. All of Europe will have to fasten its seatbelt. We will all suffer, no one is safe. We are living through anguish to get grain for feed.

We will end with a Spanish saying: "Misfortune watches at the door, and at the first opportunity, it sneaks in."

Guillem Burset