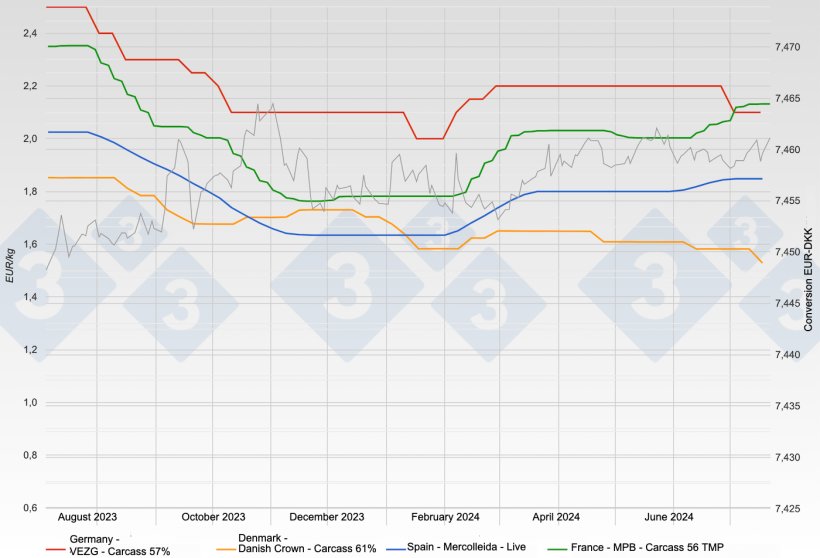

July began with a 10-cent drop per kilogram carcass in Germany. After 17 weeks of the price remaining the same and some opportunities for increase lost, pork's reluctance together with the diaspora of the German population due to summer vacations prevailed. Since that first market session of the month, calm and repetition have been the constants.

As our readers know, up until a few years ago Germany was the leader in European pig production. Nowadays, although it has lost its lead on the continent to Spain, it is still a very powerful market with several satellite countries (Netherlands, Belgium, Poland, Austria, ...) due to the numerous exchanges that take place between them.

We frequently mention what is happening in Germany because of its persistently major role as the leader of the Central European markets. What happens there is not unimportant to us and will serve as a reference. This has been the case to date and continues to be.

Quite a few things have happened, are happening, and will happen in the EU swine industry. Some of them are striking. Large companies or organizations seem to be in trouble. Let's look at the evolution of slaughter in the most representative countries over the last ten years (Table 1).

Table 1. Evolution of pig slaughter in ten of the main producing countries in the EU and Russia. We include Russia due to its geographical proximity and relevance; as we know, Russia is not part of the EU. The selection is completely random: we have chosen only the ten countries with the highest production. The total sum only includes the countries mentioned. *Denotes countries currently with African swine fever. Data from Pig333.

| Annual slaughter (x1000) | Weekly slaughter (x1000) | |||

|---|---|---|---|---|

| 2013 | 2023 | 2023 | ||

| Spain | 41,400 | 53,000 | +28.02% | 1,040 |

| Germany* | 58,600 | 43,800 | -25.26% | 858 |

| France | 23,700 | 21,840 | -7.85% | 428 |

| Poland* | 19,120 | 18,900 | -1.15% | 371 |

| The Netherlands | 14,014 | 14,700 | +4.90% | 288 |

| Denmark | 19,100 | 14,500 | -24.09% | 284 |

| Italy* | 13,100 | 9,900 | -24.43% | 194 |

| Belgium | 11,910 | 9,360 | -21.41% | 184 |

| Portugal | 5,180 | 5,230 | +0.97% | 103 |

| Austria | 5,400 | 4,700 | -12.96% | 92 |

| Total | 211,524 | 195,930 | -7.37% | 3,824 |

| Russia* | 29,100 | 44,300 | +52.23% | 869 |

The figures speak for themselves: total production is decreasing with great differences between countries. Spain is increasing its market share (currently one in four pigs in the EU is Spanish); Germany, Denmark, and Italy are leading the decline. Decreases up to 25% in just 10 years must necessarily mean reconversions or restructuring. The rate of self-sufficiency in the EU as a whole is decreasing, because although domestic consumption is falling, production is falling faster. A lower self-sufficiency rate implies fewer surpluses and, consequently, overall EU exports to third countries decrease. Spanish growth clearly makes up for the decreases in Central Europe.

We could ask ourselves - and rightfully so - what is the reason for Spain increasing its pig production while the other Member States (with a few exceptions) are reducing it. The answer is simple: Spanish farmers have earned and are earning money (the best stimulus for growth) and farmers in other countries have suffered losses (a good reason to decrease). In a future commentary, we will explain our point of view on the matter, and at the same time we will try to explain the whys of all this and we will try to detail the market's inner mechanisms that explain these opposite tendencies.

Our price managed to rise in the first market session of the month by an inconsequential four-thousandths of a euro. Since then, apparent calm and repetition have been the norm. The supply shortage continues, but in view of the weakness of pork, the price remains the same market session after market session. From a distance, the market may appear as an encephalogram flatlining, but this is not the case: underneath the superficial calmness there are underground struggles that are ending in a draw for now. Some slaughterhouses have been slaughtering only four days a week all month.

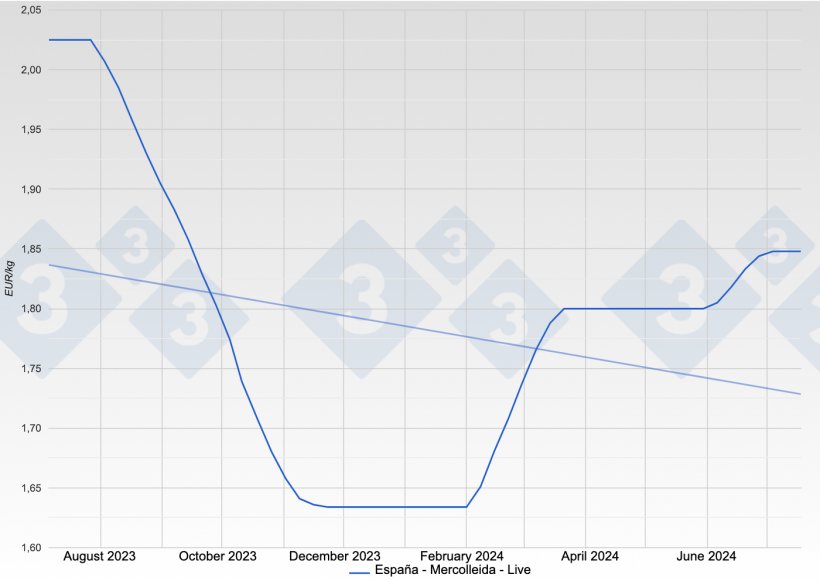

Pig price in Spain - Mercolleida - Live

We are still on edge regarding the future of our exports to China. We know that industry associations have made and are making considerable efforts to minimize the damage and impact. Let us hope that the Chinese authorities do not mix cars with pigs. The Chinese authorities are currently reviewing the sales in recent years from some large European slaughterhouses to China (Vion, Litera Meat, and Danish Crown) to determine whether they have practiced dumping. We will keep a close eye on developments and report on them.

As we announced in our previous commentary, we think the Spanish pig price is at its highest for the year. It is possible for the price to fall in August, dragged down by some poor pork sales and the evolution of our neighboring markets. The Spanish price is still at the top of the European podium, while the French price is almost on a par with it; Germany and its allied countries are much lower (about 18 cents per kilogram live) and Denmark has the dubious honor of being at the bottom of the EU price list, much further back. This differential between Spanish and German prices cannot last long: either Germany goes up or Spain goes down. We are leaning towards the latter.

There is a shortage of pigs and a surplus of pork: this is the current situation. With these high prices, no one wants to freeze and all operators strive to sell fresh. This situation is not expected to change in the short term.

At the moment, the pig price in Spain allows the farmer a good margin; it seems impossible for the price to go up and the normal thing would be to hold where we are until pork prices force it to come down. As mentioned, we will see if we can get through August without giving in.

In 2023, Spain slaughtered approximately 53,100,000 pigs; Brazil slaughtered 58,800,000. Brazil is therefore the third largest pork-producing country in the world. It will probably remain in third place for many years to come, behind China and the United States. Spain has dropped to fourth place, overtaken by Brazil.

Under the current circumstances, which are very favorable for Spanish swine production, it is easy for optimism to overflow and for things to look rosy. However, we know that everything that goes up must come down, which means keeping our feet firmly on the ground is advised. Let us remember a saying from Epictetus of Phrygia, a Greco-Latin philosopher: “Prudence is the highest of all goods”.

Guillem Burset