If you live in the United States and are not a vegetarian it’s time to celebrate! With the entire meat complex bulging with supply trying to get into packing plants, plus the supply coming in the pipeline later this fall, it’s time to fill the freezer. Focusing just on hogs, a fire in a mid-size Illinois slaughter plant closed it down for a few days in early September and sent the jitters through the industry. The June 2016 USDA Quarterly Hogs and Pigs Report (next update to be released September 30) revealed that US producers had more hogs and pigs in inventory than at any time in the last 50 years. It seems likely too that this year will see the US exceed records in total red meat production. The trend line is right back on track continuing the gentle upward drift that began anew when commodity prices collapsed after the beginning of global woes in mid-to-late 2008. The only interruption for hogs was the big divot taken out of the trend by PEDv a couple years ago but that was very brief (though severe) and is only a dim memory now.

The push to produce more hogs is related to gearing up for the sequential opening of the new producer-owned packing plants which will begin in the next year or so. Assuming they are successful, they will lower the cost of production and increase the sales revenue to their producer/owners as they capture the economies of integration and share profits back down the chain.

Much of the activity in new packing capacity being created in the US is driven by large production companies and partnerships. In a twist, they are not going to be relegating their pig production to cost center status with all the profits pushed up the chain to the final sale point, as is often the case in a pure integration move. A cost center is a stage in a production chain which does not have the motive of accruing profits. Rather, it performs its functions at least cost for reimbursement, allowing another part of the chain to realize the profits.

The largest production companies in the US invaded the packing/processing space to increase profitability of their hog production by removing information barriers and optimizing across that full-chain knowledge. It is more likely that long-term, the packing and processing functions will be the cost centers, distributing profits back to the production phase over the next decade. This will be required for much needed reinvestment in coming precision-based innovation (especially in genetics and production technologies as they become available at the right price points) plus expansion. Since domestic demand is saturated, these companies must export substantively to be successful.

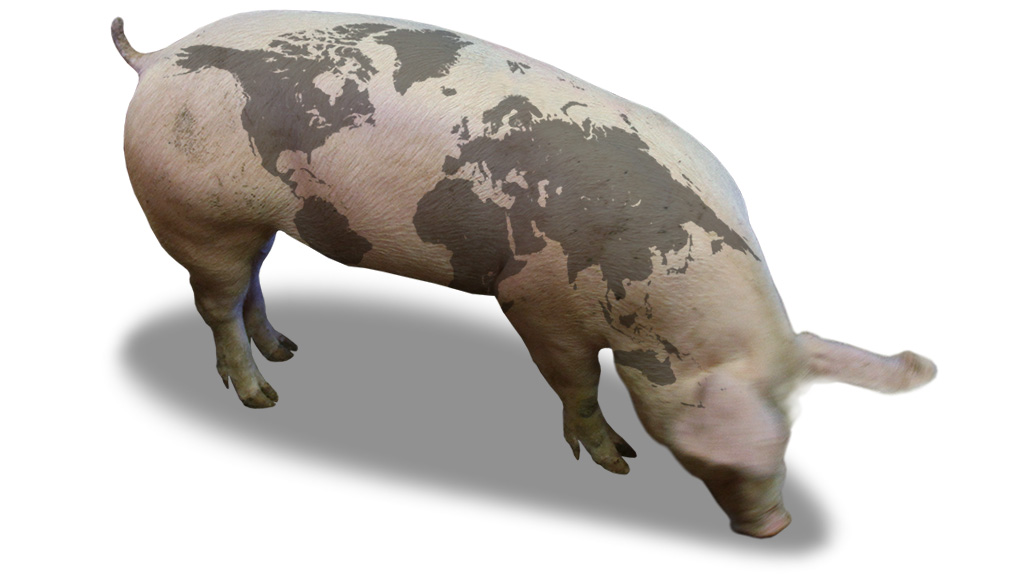

With the future growth of the world economy coming under serious doubt, even in the longer term, and global tensions rising, the pressure to reorganize how products are produced and sold throughout the world is increasing. One of the models we see emerging is not necessarily new but the future scale may be shocking. It is being orchestrated by countries that are expecting sizeable increased future demand but cannot produce the needed products domestically. This is usually caused by lack of needed resources and/or lack of competitive production systems for key resources (as well as other limitations).

Rather than simply engage in trade for the needed final products with countries which can produce them at a comparative advantage, nations are purchasing or investing heavily in the production chains in the countries where the production is less expensive. So don’t be surprised over the next decade if another one or two of the large US pork production/processing chains changes hands or gains significant new partners from another country. Global tensions seem likely to dampen the prospect of simply depending on trade for critical food needs. Ownership brings some strategic control and certainty but it’s not foolproof!