Up until a few years ago, Spanish integrators shied away from growing through farm ownership, for two main reasons:

- They had to make large investments in facilities, which significantly reduced the profitability of their investment in pig production.

- There were many complications involved in the daily management of the farms, especially:

- Environmental issues (slurry management, carcass removal, etc.)

- Personnel management

With the consolidation of the pig production model in multi site type of production, opting for new site 1 farms with a significant number of animals (around 3,000 sows according to the maximum allowed by law in Spain), and the implementation of hyperprolific genetic lines allowing production to reach around 30 or more piglets per sow per year, several years ago some spanish integrators chose production models based on having their own sow farms, where production costs could be even lower than those obtained in classic integrations, although the profitability of the invested capital could be considerably lower.

In the last two years, coinciding with the high profitability on the production side in Spain and the serious health challenges that cause severe economic problems on the affected farms, and given the difficulty of contracting new farms in integration models, many integrators are changing their course of action and are embarking on purchasing facilities, some of them many years old.

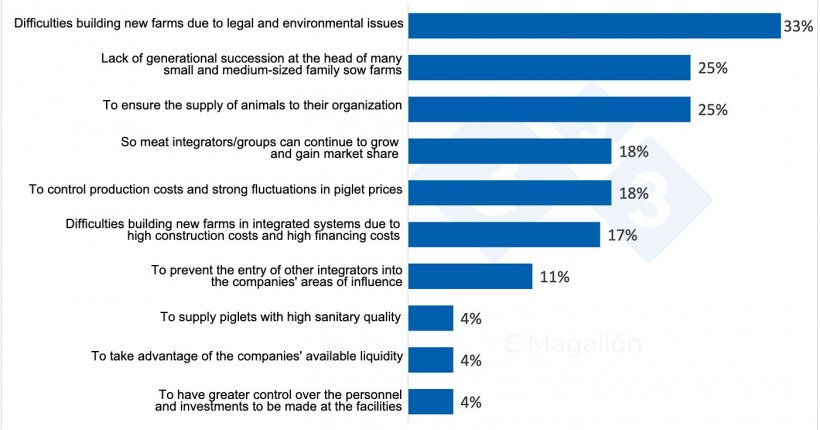

Aware of this reality, Pig333 used a survey to ask our spanish readers why they believe these changes are taking place and why integrator companies and meat groups are buying farms. The survey was very well received with 401 user responses and 645 opinions, since respondents could choose several options.

The following are the survey results:

Why are integrator companies and meat groups buying farms? Results of 333 user survey. % of total participants. Multiple response survey.

We would first like to highlight the variability in the responses since the most popular option was selected by only 34% of participants and the two next most popular responses by just 25%. Therefore we think there are several reasons for this phenomenon and that some of the reasons are complementary.

Let us analyze the different options.

1. Difficulties building new farms due to legal and environmental issues (33.41% of participants)

There is no doubt that it is becoming increasingly more difficult to obtain licenses to build new pig farms in Spain. In addition to the regulations requesting minimun distances between farms, there are complications regarding slurry management and, above all, the license to obtain water. Authorizations from the Hydrographic Confederations are increasingly restricted. In areas classified as vulnerable zones new authorizations are impossible.

On top of these difficulties, there are the pressures and appeals filed by neighborhood groups opposed to the installation of farms, which complicate and delay municipal farm licence approvals. We must also take into account the regional moratoriums for the construction of new farms in large areas of Spain. With fewer farms expected than planned in the past, ensuring they capture the production of each farm becomes more important. for the different companies.

2. Lack of generational succession at the head of many small and medium-sized family sow farms (25.93% of participants)

In Spain, as in other countries in Europe and the rest of the world, profound changes are happening in pig production models. They are moving from small or medium-sized family farms to larger, company-managed farms, with hired personnel that most of the time is unrelated to the ownership of the farms.

We do not have statistics on the average age of family farm owners in Spain but, undoubtedly, many are close to retirement age.

The new generations do not want production systems that involve working 365 days a year, including holidays, without being able to enjoy vacations or weekends off. When they have to take charge of family farms they look for alternatives that are compatible with the new social realities.

Many small sow farms are being converted to finishing farms or isoweans, and medium-sized farms are trying to expand to accommodate the new production models.

The larger ones, or those with the possibility of expansion, are sold to integrators or meat groups that want large farms with sizes adequate enough to fill isoweans and finishing barns from one or very few origins to improve their economic and health efficiency.

3. To ensure the supply of animals to their organization (25.18% of participants)

It is well known that Spanish slaughterhouses have a high working capacity that exceeds the production capacity of the spanish farms. This fact, together with the difficulty of importing pigs for slaughter due to economic, sanitary, and logistical reasons, has led many of the meat groups to become involved in production to ensure the supply of animals for their slaughter and manufacturing chain and to be able to meet their commercial commitments.

4. To control production costs and strong fluctuations in piglet prices (18.45% of participants)

High piglet prices in recent years have meant low profitability from pig production based on purchasing piglets, whether imported or from domestic clients. This has favored purchasing farms that produce piglets to have more control over piglet price, origin, and health traceability.

5. So meat integrators/groups can continue to grow and gain market share (18.20% of participants)

The large Spanish meat groups, which largely come from production, want to continue growing and gaining market share both nationally and internationally. To this end, they invest directly in production, given the difficulty of continuing to grow, based exclusively on the classic integration model.

6. Difficulties building new farms in integrated systems due to high construction costs and high financing costs (16.71% of participants)

The cost per sow place in a new farm in Spain has skyrocketed in recent years, often exceeding 3,000 euros per place on the sow farm. Financing costs have risen significantly. This prevents integrated farmers from accessing bank financing and, above all, from making their investments profitable. In addition, financial institutions require that investors have or personally guarantee a significant part of the total investment, which often makes it difficult or impossible for the integrated farmers to invest.

Other less popular answers may also have been the reason for the sale in specific cases, but less than 11% of the responses were the following:

- To prevent the entry of other integrators into the companies' areas of influence

- To supply piglets with high health quality

- To take advantage of the integrator companies' available liquidity

- To have greater control over the personnel and investments to be made at the facilities

In conclusion

The Spanish swine production model is changing in terms of sow farm ownership. Until now, these farms have been mostly managed by family labor. The major concentration of Spanish swine production revolves around integrators and meat groups, which due to their volume and economic capacity, are absorbing other production companies and small family businesses.

There are more projects for new farms and existing farms for sale by owners affected by serious health problems, their high average age, legal, environmental, and economic difficulties, and the large investments required to build new farms. All this "forces" pig production companies that want to maintain their market share or continue growing to get involved in direct investments in facilities, through the purchase of sow farms, which means that they must directly assume the management of personnel, environmental aspects, and cost control on the farms, in addition to provoking a significant drop in economic profitability, measured on the total capital invested.