Counter seasonal hog prices in the summer, where hog prices fall into May, June and July is relatively rare. In the last two decades, it has only happened three times until this year. Frequently, the hog “cycle” effects are the explanation, where cyclically (nominally every three-five years) burgeoning supplies weigh down normally rising summer prices within the seasonal pattern (which rides along the longer hog cycle) repeating at 12-month intervals.

However, in the normal cycle downturn, prices will trend downward from, for instance January to December, but the summer quarter prices will still stick up like a bump in the down trend due to its origin in nothing more reliable than the movement of the planets. Increased heat and the beginning of the decrease in daylength (photoperiod) co-create resistance to pregnancy in sows and gilts and their decreased production finally arrives at market some 10-12 months later. Regardless of the perpetual clock that is our little part of the universe, a sizeable number of producers do not have enough gilts ready to over-breed at this period to maintain full farrowing rooms. I digress, this is another topic for another day.

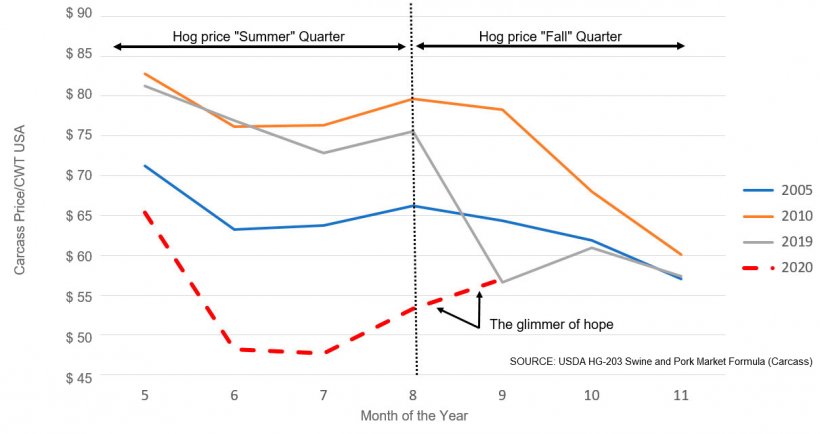

We are so immersed in the unusual this year that we are left to reading tea leaves as random shocks land about us. However, if we look at the years which experienced counter-seasonal summer quarter prices, we can see what happened immediately afterward, in the fall (See Figure). You might expect the fall to rebound in an unusual way due to the actions taken in response to the unusual summer slumps. It doesn’t happen—until this year. Defying all previous trends in the last 20 or so years, US hog prices are climbing right into mid-September after cratering in the summer quarter.

How long this will last is anyone’s guess but here are a few things which combine to provide the briefest pause, for a moment of hope. Despite an horrific derecho gust front that sailed across Iowa (largest corn producing state by far) and knocked down 10 million acres (4,046,856 hectares) of corn and soybean plants (along with a sizeable number of large storage bins), the sheer abundance of carryover corn and the ability of modern harvesting technology to save a surprising percentage of what was knocked flat, prices are remaining low. The big issue, which is unknown at this time is whether the corn was simply pushed down or was in fact snapped at the base.

With storage diminished, a lot of corn will have to flow to market at harvest even if the producer wanted to store it. Currently, central Iowa corn prices are very close to a 10-year low price and soybeans are also hanging toward the very bottom of a 10-year price range. A glut of low-cost oil has kept gasoline prices low and the demand for ethanol sluggish damaging corn demand. Feed costs will be very low making even modest improvements in hog prices generate the potential of slim to modest profitability.

Sow slaughter remains consistently above the trend line. Plus, the typical strategy during such times of selling off and abandoning the bottom five percent of sow farms within large firm holdings has taken place. With the euthanizing of large numbers of market ready animals and the newly acquired knowledge in slowing growth with feeding strategies, a kind of double punch down has been made to the tremendous planned increase in 2020 production. The hole card in this poker game, however, may be the little discussed euthanizing of newly farrowed pigs a few months ago when their price essentially went to nothing. This has created a space of unknown size in the US production flow which could arrive just in time to slow the punishing fall quarter price collapse. Empty finishing buildings from euthanized finishing hogs are just now filling up again, so market-ready hogs have had to be bid for by packers in the last several days.

Packers are up and running at full speed and are as mentioned, currently bidding hog prices up. An extra kick up is likely occurring due to increases in export demand that will show up with certainty when the final government export sales statistics arrive in a couple of months. While export sales from the US have been outstanding in both quantity and in value, there is a disproportionate buyer in the total volume and that of course is China. No one will complain of course, but it is always best to have breadth as well as depth in the purchasing countries.

After 2020, black swans will have to be a little darker to be labeled as such. I suspect that for German producers, the recent news of ASF near Brandenburg makes all the Black Swans this year like COVID-19, merely gray geese.