The health crisis caused by COVID-19 is affecting the pig sector, both in the French and international markets. Companies in the sector are experiencing major changes in their operations. Pig prices are falling due to lower demand from slaughterhouses, affected by labor shortages and problems accessing foreign markets. Despite the strong demand for exports to third countries, these new elements are limiting the price of pork for the time being.

Animal feed: highly volatile commodity prices

Following the outbreak of the virus in China, there has been great volatility in grains, oilseeds and oilseeds meal prices. The spread of the epidemic to areas of major commodity production and export (United States, South America, Black Sea) has exacerbated the price volatility.

Containment measures have led to strong consumer demand for wheat-based products (flour, pasta, bread). Major importers (Algeria) placed new orders to secure their strategic stocks. As a result, prices recovered sharply: +12% on the Euronext market between mid to late March.

In addition, the situation is changing day by day and many countries are gradually taking measures to limit inflation of basic necessities. For example, Russia, the world's largest wheat exporter, has announced a grain export quota until the next harvest. The accumulation of these policy decisions will lead to increased market volatility in the coming weeks and months.

By contrast, corn prices have not followed the same trend as wheat. In the United States, the ethanol sector accounts for more than a third of the corn market. The fall of oil prices, together with lower domestic demand for fuel, has led to a drop in activity of US factories, so that more volume is available for export and animal feed.

In addition to cereals, the coronavirus has impacted global logistics for soybeans and soybean meal. Brazilian and Argentinean exports are disrupted by the logistical restrictions implemented to limit the spread of the virus. Faced with these supply difficulties, soybean meal prices on the French market have soared (+11.3% in two weeks on the Montoir market).

At the same time, the drop in demand for vegetable oil for the biodiesel sector could lead to a reduction in the activity of French and European crushers, and consequently to a drop in the supply of rapeseed and sunflower meal. For the time being, there is no effect on the prices of these raw materials.

Just as how households have stockpiled basic necessities, the animal feed industry has also noted a phenomenon of overstocking by French farmers. Despite logistical challenges, there have been no shortages in supply for the French feed industry. However, the availability of soybean meal depends on the decisions that South American countries make, which is an important point to consider.

Pig market: price recovery interrupted, companies facing restrictions

At a time when European supply is stabilizing and Asian demand is strong, the key variables of the pork market favor high prices. However, logistical difficulties in accessing foreign markets and labor shortages in slaughterhouses are hampering demand.

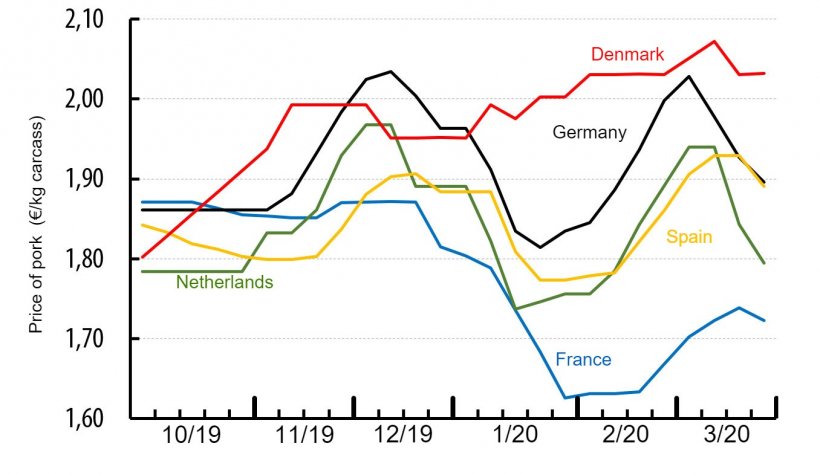

After significant increases between January and February, European prices fell sharply in March, particularly in Germany and the Netherlands. German and Dutch prices lost 19 and 15 cents/kg respectively between the first and last week of March.

Price of pork in different European countries (€/kg carcass weight). Source: IFIP from national data.

European slaughterhouses and processors are trying to stay active. However, organizing work crews is becoming increasingly difficult. Faced with threats of staff shortages and restrictions on movement, companies are running short on manpower. Germany and the Netherlands are particularly affected by this labor shortage as some employees from the East were not able to reach their workplaces before the lockdown orders were given. The significant drop in pork price is directly linked to these limitations.

On the other side of the Atlantic, the crisis caused by COVID-19 is also having a serious impact on the pig market. US slaughterhouses are starting to face the same staffing problems as in Europe, but their better conditions for accessing the Chinese market along with abundant supply is encouraging the US to increase operations further. However, companies are still dependent on labor from Mexico, which may be compromised by a lack of visas.

The COVID-19 epidemic is also affecting meat and live animal trade in Europe. The lack of truck drivers is increasing logistics costs. In addition, wait times at the borders are long, with additional paperwork.

On the export market, port activity is gradually picking up again in both Europe and Asia, after major disruptions at the beginning of the year. Lack of container availability remains a major problem, and freight costs have risen considerably. In addition, the world's major exporters, the United States and Brazil,are speeding up flows to China in anticipation of a potential halt in activity caused by the coronavirus.

Temporary interruptions with lasting effects?

In the coming months, the pig market will be influenced on the one hand by global supply and demand driving high prices, and on the other hand by COVID-19 still rather unpredictably disturbing consumer behavior, access to foreign markets, and international competition.

In the first half of 2020, the European supply of pork will remain stable, or even slightly higher due to an increase in carcass weight. At the same time, the habits adopted by Europeans in confinement may prove advantageous for supporting pork consumption; as pork products find their place in economical dishes prepared at home.

As far as exports go, interruptions linked to COVID-19 are still expected in the coming weeks, but when China resumes normal activity demand will continue to be strong. Therefore, China will continue to import, but by increasing competition between the EU, the United States and Brazil, to contain prices.

However, European exports to Asia could be hampered by the spread of African swine fever (ASF) in western Poland. The number of affected animals in this region continues to grow with 209 cases identified between March 1 to 27, or +46% compared to February. On 23 March, the first outbreak on a domestic pig farm was confirmed, involving 23,700 animals. Never before has an infected wild boar been as close to the German border (10 km) as the one identified on 27 March.

In the long term, the crisis could also lead to seemingly contradictory effects on consumer habits.

On the one hand, the new habits gradually adopted by consumers during the crisis could become permanent (online purchases, prepared meals delivered to the home). These would impact distribution methods at the expense of physical outlets and the supply of prepared meals and processed products as opposed to fresh meat.

On the other hand, the strong economic impact of the health crisis affects the purchasing power of consumers and price could play an important role as a key factor in purchasing products and, with it, price decreases, private labels, and discount store chains.