Most commentators became confused about the timing of price changes due to ASF in China because of a misunderstanding regarding the impacts of liquidation. Many people expected the prices in China to go up dramatically soon after the August 2018 first outbreak of ASF but it wasn’t until early May of 2019 that prices truly began to rise sharply (Understanding liquidation is key to forecasting Chinese ASF price outlook globally). The reason for this “late arrival” of escalating prices was that the market in China was being burdened throughout the fall and early spring by the regular slaughter pigs and very gradually, added to this production, the culling of both breeding stock and market hogs as ASF spread around the country.

Some producers were reported to have sold their entire herd before there was any evidence of ASF if it had been reported in the area as they anticipated that there might be a condemnation of their animals and their removal from the food chain. This would have left them with a regional compensation scheme payment that was uncertain to even occur and was far below the market value. Many other farms were reported to have depopulated when the first deaths occurred before the disease had spread to the rest of their production. These animals sometimes remained in the food chain and kept prices from rising. However, by June of this year, the disease was widespread and the culling of healthy animals was essentially complete, however, failed repopulations were still providing animals to the market place but not enough to relieve the shortage that began to roll through the entire country.

You could track this spread through the country by the wise interpretation of reported prices. If you examined the daily prices reported for the various regions of China, it was the precipitous drops in price that indicated new outbreaks of ASF. This was due to the sudden depopulation and sale of herds to recover value before a condemnation decree became effective for the area.

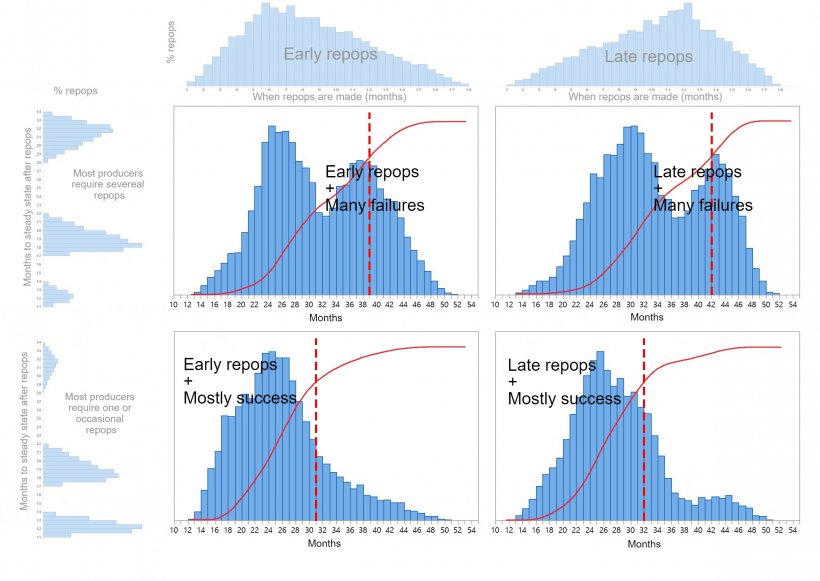

Similarly, we can observe the progress of the repopulation in China, its success or failure, by watching both prices and total output. I show the two typical issues which determine a hog price and production cycle, which the ASF epidemic is emulating. The first issue for producers and companies is when to increase production (or repopulate), which is a risky decision, so everyone will not make it at the same time. This set of decisions over time forms a distribution and those decisions are broadly either optimistic (because of the lure of very high price/profit rewards) or skeptical and “wait and see” which delays the bulk of repopulation until evidence of others success is first observed. In the graphic below, you will see these two potential distributions along the top of the “MBA square” which is a tool to illustrate the combination of two choices.

The second thing that matters, after the decision about when to repopulate, is whether or not it is successful early or requires several attempts and repopulations before full production is restored. These two outcomes are shown in the distributions on the left side of the MBA square. Within the four squares are the mathematical combination of the decision under risk regarding when to repopulate and the risky outcome of those collective decisions.

In the upper left hand box we show a “bi-modal” distribution of repopulation which illustrates the pattern of the return of hogs if the predominance of producers choose early re-entry but are not immediately successful. The two humps represent two waves of production increase, the second one being the set of repopulations after first failures. Similarly, the box on the upper right shows later or cautious decisions to repopulate but also with widespread failure leading to multiple repops for many producers before production country-wide is reestablished.

On the bottom row we illustrate first (lower left box) the best possible outcome, with early decisions to repopulate with much fewer failures and then in the lower right box, the late start consensus coupled with mostly successful outcomes.

Note that these graphs were constructed using hypothetical but reasonable timeframes so they are only meant to illustrate patterns to look for rather than actual forecasts of what will happen in China. We sincerely hope that China’s recovery is both rapid and successful. Lots of investment in new breeding stock but also in farm, regional and countrywide bio-security structures, layers and the like are underway. Watch prices because they will produce a mirror opposite pattern to the return of production possibilities in the MBA square. In other words, as production rises, prices will fall and vice versa. Now you are equipped to beat the “pros” in understanding the economic signs coming out of China and what they really mean for normalization of production.