The one thing that pork producers often don’t understand well is that the profit margin for commodity production (like live hogs) is very stable over the long run unless there is a fundamental change requiring more or less “return to risk” to induce the same level of production. When producers experience tremendous profits like in 2014 or substantial losses like the late 2008-09 period, these are transient moments of disequilibrium in the long term trend that can be caused by a variety of factors. While transient downturns can still spell disaster for poor performing firms or firms caught in a liquidity problem due to poorly structured debt or unlucky decisions regarding when to trigger that expansion, most can feel assured that by pulling in the belt and hanging on, good times will return.

The year 2008 found the US coming off of extremely high commodity input costs (energy and feed ingredients) at the end of the frenzy just before the housing market bubble burst. Coupled with that, the U.S. export market uptrend line was broken going from 2008-2009 for the first time since 1990 when China cooled down its buying binge just after it hosted the Olympic games. Red ink was everywhere. In the case of 2014, excess profits emerged as very low feed ingredient prices, compared to the previous five years, was coupled with a more or less 10% kill off of the US herd due to PEDv.

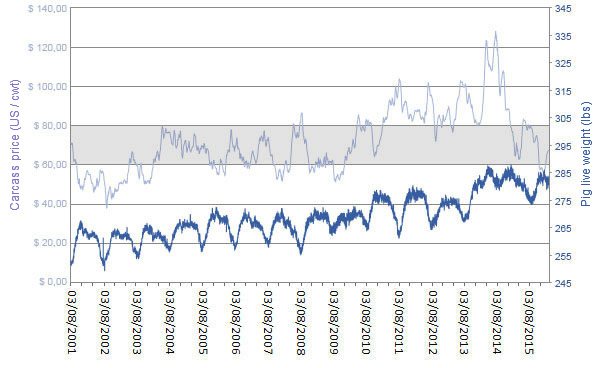

Figure 1 is a great example of this long run trend principle. Note that US hog prices appear to be stabilizing in the old $60-$80/carcass cwt range again as feed ingredient prices have returned to pre- 2010 levels, and the collapse of the oil/energy markets results in low demand for ethanol etc. US NET exports of pork are flat and the per capita US pork consumption is stable as a rock in a multi-decade sideways pattern.

Figure 1. Average net carcass price and live weight for US pigs from 2001 to 2015. Source: USDA.

We are cycling into seasonal losses now in this old pattern we have returned to, (both last year and this year) because weights have increased a full 10 lbs on average over the last few years. Weights began rising in a noticeable way starting when the big hog price breakout of the 2003-2010 price band (shown in grey on Figure 1) happened in early 2011. High prices do not necessarily mean high profits as even high feed costs can drain the impact, however, this breakout was associated with an extended run of profits which began in 2010 and ended with the rather spectacular corn price spikes in the spring of 2012 when dry weather gave way to the realization that a true drought was underway in the corn belt. The big jump in these increasing market weights occurred in the PEDv year of 2014 when producers with pigs to sell found out they could fill some of the national gap in head produced with 10-20 lbs more on each hog sent to market. Most producers experienced periods of well over $100/head profit in 2014.

Production snapped back to normal as fast as it plummeted during the epidemic once PEDv came under control. Sluggish worldwide growth (read sluggish demand for oil) coupled with the Saudi attempt to bankrupt the US shale oil industry unleashing a worldwide oil glut more or less ruined any chance that ethanol demand would soak up huge stockpiles of corn and threaten feed costs. So we are left with the big question: Will we see the predicted 2% increase in production this year that USDA is forecasting? Right now we are seeing the component parts of that setting up in such a way that more than 2% increases could occur, especially in the fourth quarter of this year. Along with the usual creeping upswing in sow productivity which adds a little every year, we have begun the year selling more than the previous year on a week by week basis and the University of Missouri gilt slaughter data suggests that at least a small amount of gilt retention remains underway. It is hard to see the competitive firms backing down weights since feed costs and feed ingredient availability are very favorable at the present time and some have locked in profits at heavier weights for a substantial part of the year.

The futures markets remain hopeful that a normal summer seasonal will occur with some pretty reasonable profits forecast for June. It seems likely that the summer seasonal is fragile though and if we do not get a bad start to the planting season, producers will see long term low cost feed, expanded packer kill capacity coming on line, and the general optimism that infects the resilient US pork producer as a big green light.

Keep in mind Chinese debt has just been downgraded by a major rating agency in the US and the stability of the European Union remains in jeopardy with the flood of migrants and the coming vote this summer in the UK on EU membership and we have the conditions for a strong US dollar with its resulting negative effects on US net exports. US hog prices may rise into the summer months but there are a lot more than the usual number of exit ramps that head downhill along that path. I’m watching for the turn signal to click on.