The swine market has been affected by an increase in raw material prices and a decrease in pig prices between mid-2021 and the first months of 2022. Pig farmers are in a situation of financial crisis compounded by energy, health, political, and climate crises. European supply decreased by 4% in 2022 compared to 2021, and this decline will be accentuated until mid-2023.

In the EU, production is expected to fall by 3.6% in the first half of 2023 compared to 2022 and by 2.6% for the full year.

In Spain, the increase in the pig inventory is limited by the stabilization of exports to third countries, worse economic performance in 2022, the deterioration of the health status of livestock, and the heat. In the first half of 2023, Spanish pig production is expected to decrease by about 3% compared to the same period in 2022, despite a large supply. This halt in growth should be temporary as Spanish producers are expected to consolidate their position in the European market in the medium term.

In Germany, the drop in the number of sows continues at a worrisome rate, and the market, already struggling after the ASF and Covid-19 crises, is facing an economic crisis and exploding input prices. German production is expected to fall by 2.3% in the first quarter of 2023.

This situation is expected to extend to Denmark (-13% in the same period). The Danish industry lacks outlets for its piglets in the EU and for pork and pork products in third-country markets.

In France, the market is maintained thanks to the protective strategy of Le Porc Français. The government's financial support to the sector limits the impacts. The drop in French production is expected to be 1.2% in the first half of 2023.

Sales remain sluggish, but in the face of inflation and declining European production, producer prices will remain high until the first half of the year: +50% compared to the last quarter of 2022, then +32% in the first quarter and +4% in the second quarter. The prices seen are unusually high. In France, pig prices are higher than they were in 2021 (+13% in Q2 and +37% in Q3).

Slaughterings and forecasts for the EU 28 in million head (% evolution). Source: Ifip.

Commodity prices have been rising since late 2020. For the 22/23 season, the USDA estimates that corn and wheat usage will be higher than production. For soybeans, the situation is reversed. On top of this is the geopolitical situation and tensions in the Black Sea grain export corridor. Oilseed production estimates are good. The price of cakes is affected by the price of energy, as co-products of oil production, their production cost is linked to the price of energy. Milling plants could be forced to stop. Prices would remain stable at high levels. The northern hemisphere wheat harvest has been good and, despite the insecurity of the Black Sea corridor, prices are expected to stabilize at a high level. The situation is identical for corn, where Latin American production is catching up with European production, stabilizing prices at a high level. With a stable cost of materials, the price of feed (Ifip calculation) should remain stable over the coming months. Energy prices will play an important role in feed production. High feed and raw material prices seem to be the new normal.

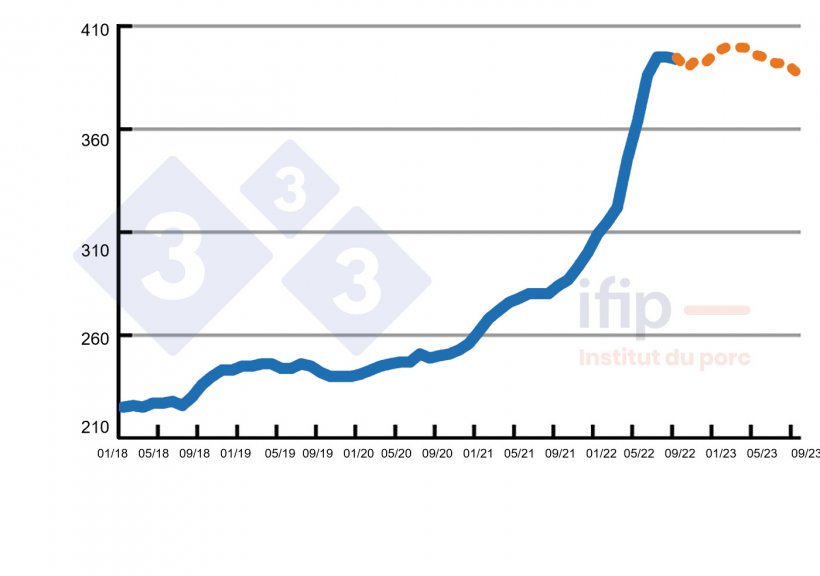

Feed price (as calculated by Ifip) in €/ton.

These forecasts depend on the war in Ukraine, energy costs, and their impact on global production and use, and no further spread of ASF in European markets. This situation will exacerbate tensions between the different players in pork production, as meat processors face the impact of production costs...