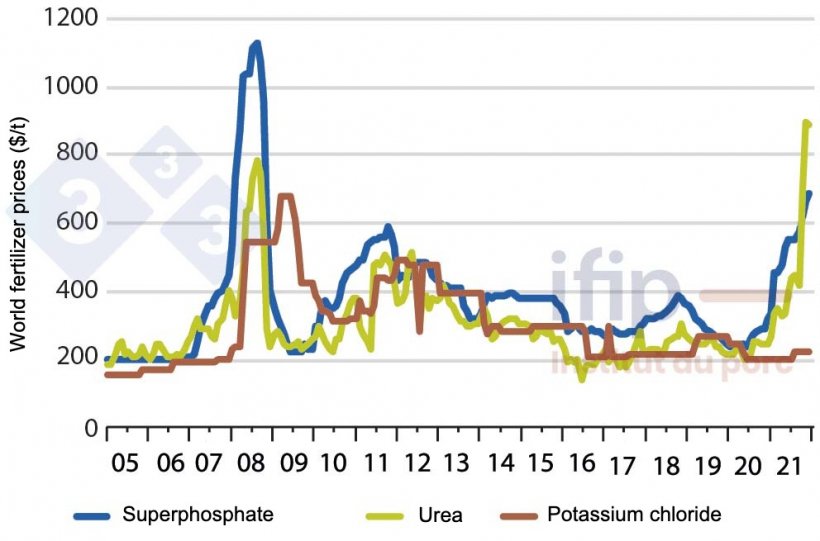

Dependence on Russia for fertilizer supplies

The dependence on Russia for fertilizer supplies is strong: Russia supplies more than 10% of the volume of nitrogen and phosphate fertilizers used in France, or more if we include the Belarusian and Ukrainian origins. The prices of these fertilizers have skyrocketed since the summer of 2020 because they are linked to gas prices, which represents 80% of the cost of urea production. Difficulties in the supply of nitrogen fertilizers already existed before the war in Ukraine. The European Union depends on Russia for gas and fertilizers.

World fertilizer prices ($/t) (Source: Ifip based on World Bank data)

Origins of EU imports of the main fertilizers (Source: Ifip based on Eurostat data)

Access to the Black Sea: a geopolitical and export competitiveness issue

Located at the center of geopolitical tensions is the Black Sea, the key area of economic exchanges in Eastern Europe. The Ukrainian ports of Odessa, Mariupol, Mykolaev and Kherson shipped 95% of Ukrainian wheat exports in 2020. These trade hubs are heavily affected by the ongoing armed conflict and the ports of Mariupol and Odessa have been inoperative since the Russian attacks. Exports from the Black Sea are stagnant, while 6.3 million t of soft wheat still remained to be exported from Ukraine at the beginning of February.

Geopolitical situation (Source: Ifip)

The geographical areas that have become targets for Russia would allow it direct access to the Black Sea. It should be noted that last summer Russia doubled the capacity of the Russian port of Novorossiysk in the east of the Black Sea, creating new infrastructures for storage and reception of Panamax-type vessels.

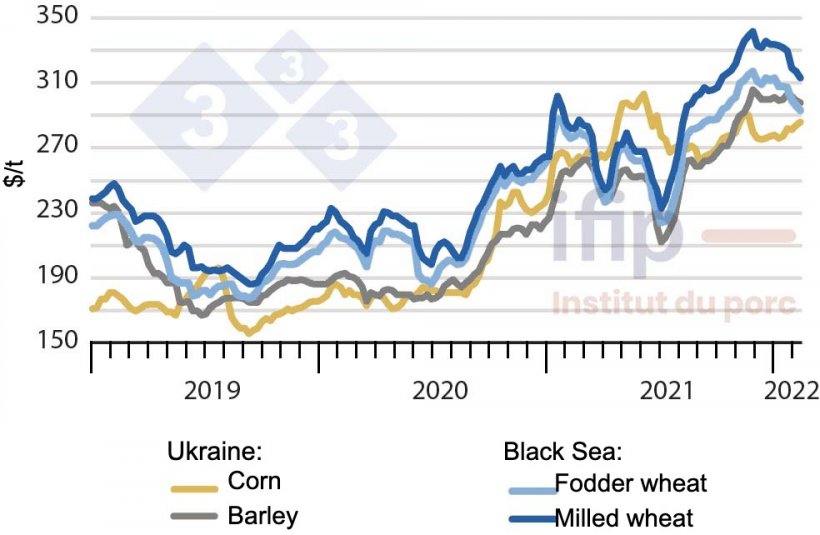

Insecurity in the grain trade

With problems accessing export areas, Ukrainian products cannot be exported. Restrictive measures towards Russia are tightening markets and reducing grain availability. In this tight market situation, prices are rising. At the beginning of 2022, wheat prices were already at high levels. Ukrainian export prices had taken advantage of the weak currency and availability to become very competitive. However, the political climate is reversing this trend and driving prices back up.

While the outlets to the Mediterranean are closed, a new passage to the East is opened with the Chinese trading partner. The future Zabaikalsk grain railway terminal should open in the second quarter of 2022 and will connect Siberia with Chinese Manchuria as Chinese demand for wheat is on the rise. However, logistics costs are rising compared to sea transport in bulk carriers.

Grain prices in the Black Sea (Source: Ifip based on APK data)