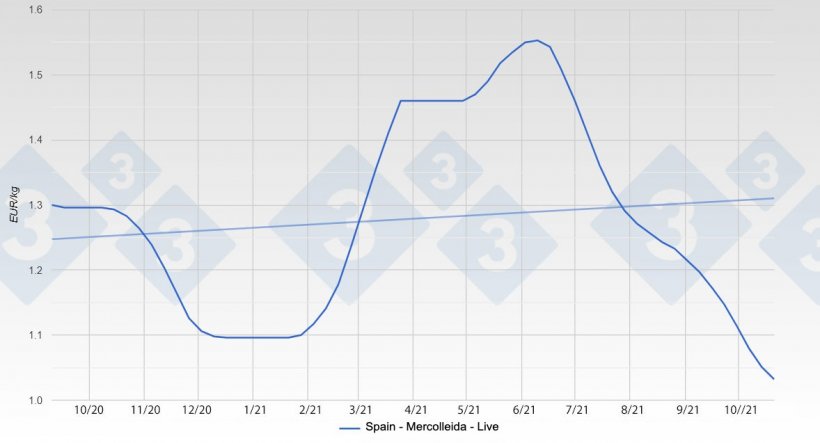

Since the heights of Spain's record prices in early June (let's remember, 1.55 euros / kg live) to the edge of the current abyss (just over one euro) three and a half months have passed in which the price has slid steadily and incessantly downward. A real journey from heaven to hell. Since June, the price has dropped 34%. We can look at it another way and say the June price was 50% higher than it is now. No one knows how low the price will get; no one can know. Although right now the bottom seems very, very near (unless Germany says differently). A few weeks ago we dared to forecast that 1.02 euros / kg live could be the bottom; reality won't be far from it.

Evolution of the pig price in Spain.

The virtual absence of China as a destination is weighing down all European prices. Countries without ASF (Spain and France, also Denmark) export as much as they can to alternative destinations (Taiwan, Vietnam, Philippines, Latin America...) and thus manage to keep the price of their pigs one or two small steps above Germany and its satellite markets.

The worst thing about the current situation is that we do not know when nor how it will end. During this time it is very clear that there is a problem of oversupply within the confines of the EU and that the only solution is reducing the herd. It is not sustainable over time to have the pig price in the vicinity of one euro per kilogram with a cost of production in the vicinity of 1.30. What cannot be is impossible. Let us add that so far, while the pig price has fallen, so has the price of pork and in most Spanish slaughterhouses the balance sheets are either neutral (read: zero) or still negative. And let us indicate here that without profits the slaughterhouse lacks the incentive to slaughter more pigs. And with the current situation, it is essential that the slaughterhouses work at full speed.

Spanish production has experienced some "happy years" which, for the time being, have come to an end. It is unlikely that what we have known (uninterrupted growth, sustained profits, and continued happiness) will be repeated. When the current storm has passed (it will clear up, it will certainly clear up), it will be time to take stock, put things back together, see the reality with the necessary perspective, and keep going.

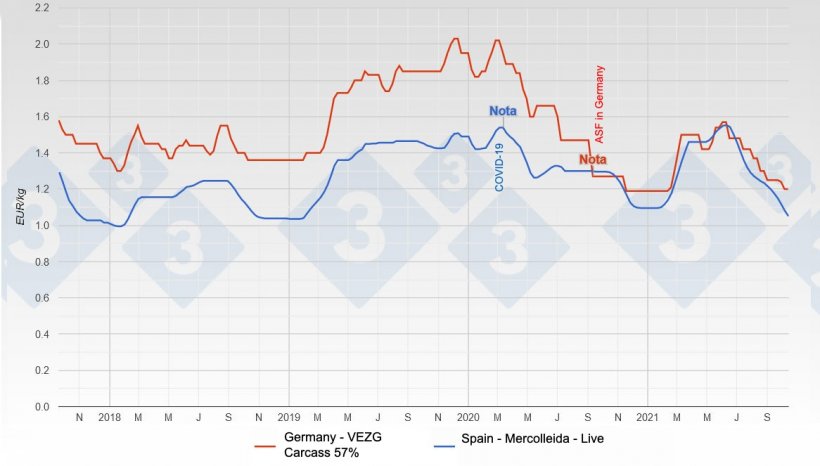

Three, four, or five years ago now, the differences between the Spanish and German prices (conveniently converted to euros / kg live) were trivial; two or three cents up or down depending on the time of the year. Since the arrival of ASF in Germany, this parallelism has disappeared.

Comparison of the pig price in Germany (carcass) and Spain (live).

To illustrate the current reality, let us compare the Spanish and German prices (the latter duly converted to live prices) using the first price of each month since October of last year, when Germany had already lost its ability to export to almost all countries due to ASF:

| First price of: | Spanish price (€/kg) |

German price (€/kg) |

Difference |

|---|---|---|---|

| October 2020 | 1.30 | 0.96 | + 0.34 |

| November 2020 | 1.24 | 0.96 | + 0.30 |

| December 2020 | 1.11 | 0.90 | + 0.21 |

| January 2021 | 1.10 | 0.90 | + 0.20 |

| February 2021 | 1.12 | 0.90 | + 0.22 |

| March 2021 | 1.30 | 1.06 | + 0.24 |

| April 2021 | 1.46 | 1.14 | + 0.32 |

| May 2021 | 1.47 | 1.08 | + 0.39 |

| June 2021 | 1.55 | 1.19 | + 0.36 |

| July 2021 | 1.46 | 1.12 | + 0.34 |

| August 2021 | 1.27 | 1.04 | + 0.23 |

| Septiembre 2021 | 1.22 | 0.95 | + 0.27 |

| October 2021 | 1.08 | 0.91 | + 0.17 |

From this list we can make the following observations:

- The difference between the maximum German and Spanish prices was an impressive 41 cents per kg live! (1.55 - 1.14)

- The monthly differentials have always been above 20 cents per kilo live (with a maximum of 39 cents), with the exception of October.

- Until September the Spanish price had been above the cost price.

- Since October of last year the German price (and satellites) has been below the cost price.

- There must be a reason that explains and justifies the drop in Germany's price (see below).

Let us recall that Germany "drags" its neighboring markets, Belgium and the Netherlands; and also Denmark to a lesser extent.

Until recently, Germany has been the leader of the European swine market. What happens in Germany has repercussions all over Europe, right down to the last corner. For various reasons it is experiencing one difficulty after another. First there was a major change in labor regulations, restricting flexibility in the hiring of foreign labor (→ increase in labor costs); later the pandemic crippled the food service market (→ loss of an essential market); then in the middle of last year African swine fever appeared in the country (→ loss of access to foreign markets) and to top it off, right now there is a suffocating lack of workers that prevents the necessary amount from being slaughtered, and the carcasses cut up and pieces deboned. With this in mind, it isn't strange to hear of German slaughterhouses losing money despite paying producers very low prices. A medium-term solution does not seem feasible: it is a concatenation of intertwined difficulties that cannot be resolved simultaneously. As this is an unprecedented, widespread, and indiscriminate crisis, the German federal government will probably have to intervene (once things are in place [after the election], though for now it seems it will be a while).

What is happening in Germany (and satellites) is much more serious than what is happening in Spain. To say these farmers have been losing for a year is an understatement. As losses have now skyrocketed, alarm bells are ringing everywhere. As we mentioned in the previous article, a protectionist network is being built of the consumption of German pork only, which will hinder sales of non-German pork in this market. As we said, the European competition authorities should, if not intervene, at least closely observe what is happening. If everything is legal and lawful, then go ahead, but if it is not, whoever has that responsibility in the EU (to facilitate the free circulation of goods, as the founding principles state) cannot remain with their arms crossed. Someone, from among the affected countries, should do something.

We are sure that there will be massive culling of sows; there will probably also be cases of euthanasia with the prospect of huge losses. At present, the balance between live animal supply and demand is broken; there is too much pork and too many pigs. And without China in the distance, the only way forward is through drastic herd reduction in the European Union.

The good news we will state here that the USDA (United States Department of Agriculture) believes that slaughterings in China will decrease by 14% in the year 2022. Let's hope they are right.

A glimmer of hope and faith in the future appears far away on the horizon: the Government of the People's Republic of China recognizes (as do the facts) that live pig prices of around 2.00 euros/kg live are lower than the cost prices of many farmers. Many small farmers are going out of business (that partly justifies the USDA forecast). Let's stay here and look at the fact that if 2.00 euros / kg is a price lower than the cost of small farmers... we can imagine that the best and most efficient farms would have costs of about 1.50 or 1.60 perhaps. As the average costs in Spain are much lower, it is reasonable to infer that at one time or another, this competitive advantage will be asserted.

Sometimes a light is lit in the darkness.

We will remain attentive to the multifaceted reality in order to try to dissect it.

As Bertrand Regader (a psychologist specializing in psychology divulgation) said: “Hope helps us to see beyond the storm of going through hard times.”. Let's hold tight —again— to hope.

Guillem Burset