For the last several years, I have repeatedly told pork producers there is no such thing anymore as a high hog price, because profits, not prices are what really matters.

Before the middle of the last decade, a “high hog price” pretty much always meant high producer profitability. Today, even a historically high hog price doesn’t guarantee profits if feed costs are simultaneously breaking their own records. This spring in the United States, we are seeing an explosion of hog prices due to piglet losses from PEDV without the simultaneous feed cost escalation, meaning for the first time in a long time, massive profits for those who have pigs to sell. Regardless of the current situation, I hold fast to that claim for producers but I am beginning to wonder if I can make the same claim for consumers. A big question most producers have not considered is what will consumers do (both domestically and in the export markets) as pork prices sail to record levels?

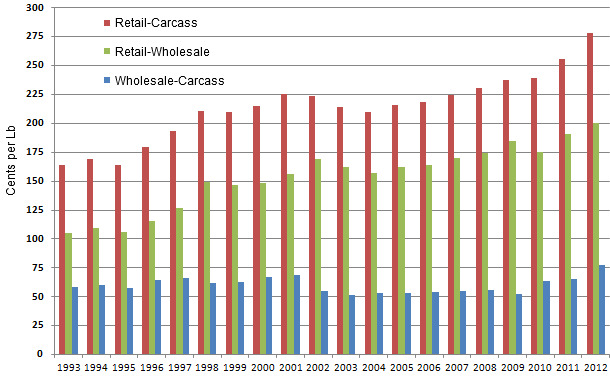

After years of relative carcass price and input cost stability, we saw the emergence of ethanol as a public policy choice, dramatically raise the cost of feed ingredients and substantially exacerbate the feed cost impacts of drought beginning in 2006. Hog prices, spurred on beginning in 2003-2004 by year over year net export growth and thrashed back to the ground by temporary overproduction from time to time have been on a similar dizzying swing. But as the volatility in input costs and carcass prices have unfolded, the very stable reality in the midst of these changes has been the farm-to-wholesale pork price spread. In most price series, the wholesale price for pork means the pork carcass broken down into the primal cuts (not retail fabrication). The value-add in harvest, chilling and the first break of the carcass is not that great, so it is largely a “cost center” activity focused on cost-plus recovery. Not so with retail pork prices.

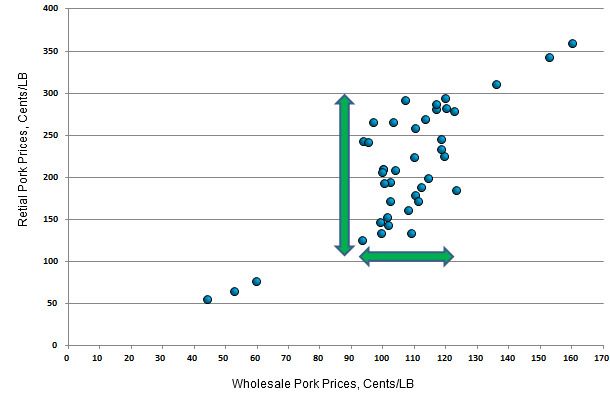

Figure 1. Retail pork/whosesale pork price relationship average annual prices, 1960-2012

The near unwavering year over year price escalation has been in the wholesale-to-retail price spread. Take a look at Figure 1 where each blue marker represents a single year’s wholesale and retail pork price combination. Even though time is not represented on either axis, the relentless increase each year makes the markers essentially progress from 1960-2012 left to right. Note especially the middle range on the horizontal axis where you can see that between wholesale prices of about 90-120 cents/lb., retail prices move from 110-300 cents per lb. as the marketing margin widens almost every year. This is a source of great consternation for many producers who want to share similar gains at the carcass level, a concept sometimes called “parity”. But the very legitimate reason for the gains is the ever increasing steps and costs between a hanging pork carcass and a ready to eat microwavable frozen dinner, the ever increasing value-added, see Figure 2.

Figure 2. Annual retail-wholesale, retail-carcass and wholesale-carcass price spreads pork in $cents/Lb

At the other end of the spectrum of value added, meat managers in retail establishments (those that sell fresh, minimally processed pork) will tell you that consumers resist increases in “price points”, which are essentially the habituated value matrix the meat shopper places on a home cooked meal and the cost of the raw meat lying there before them in the case. Such a strong resistance to price increases are in place at this point-of-sale that retailers have to get tricky in how they package fresh meat, for instance (less layers and spread out in the pack to appear larger etc.) to pass very much of a price increase on at this level. Most consumers look at the package size and price rather than the cost/weight measure so keeping the package appearing the same size for the same cost is important. Most meat consumers are “equal-opportunity carnivores” and can easily switch back and forth between beef, pork, poultry and seafood as the various price relationships change. Economists measure this rate of switching as the cross-price-elasticity of demand. However, in the current situation, for a variety of coincidental reasons, the beef herd the United States is as low as it was in the early 1950s blocking the substitution pathway from pork to beef, as retail beef prices have also reached historically high price levels.

Higher and higher pork prices will not be a big boon for wholesalers but will retail prices finally reach a point where pass-through will be severely limited as people live from week-to-week on loss-leader sale items in beef and pork as well as some additional poultry. Increased prices for pork will lead to decreases in quantity demanded by the vast majority of consumers, export and domestic. This is especially the case in the current structurally high unemployment situation which has seen inflation-adjusted per capita personal income fall steadily since the market crash of 2007.

All we need now is a poultry complex hiccup and Meatless Mondays will be an economic survival strategy rather than a social welfare statement.