The U.S. pork production industry is in a kind of “in between” time with a huge amount of the profit prospects ahead depending on the 2016 crop year and the global economy (recession or emerging growth?). If commodity prices in general were not so low, the industry would be spilling a lot of red ink. Market weights for live hogs have made a kind of quasi-permanent adjustment to the mid 280’s (127kg) as the mean, which is not to say it couldn’t be driven significantly lower if large losses loomed, but we have added about 8-10 lb to the average live weight at marketing in the last couple of years. Largely due to the tremendous profitability induced by the herd thinning related to PEDv and the ability of packers and processors to manage the volume through retail and export markets.

At the same time, net exports (which is the key number you should look for, rather than the much touted total exports each month) have been falling since 2012. As we mentioned last time, this is very likely to continue for several reasons, but the main one is the strength of the dollar and the retreat of China economically which has placed a big dent in global demand.

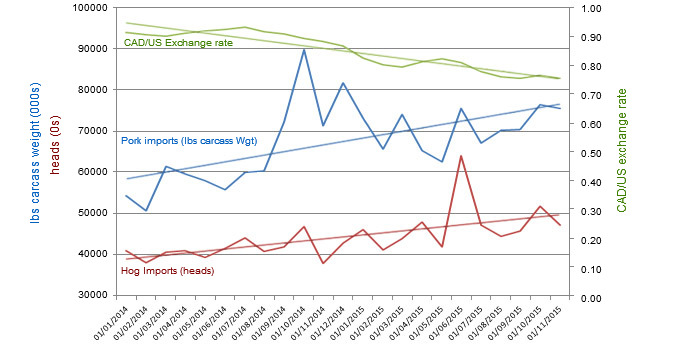

At the present time, the lifting of the MCOOL (Mandatory country of origin labeling) restrictions, which prevented Canadian weaner pigs from being shipped into and grown out in the US, means that not only is the importation of cheaper Canadian pork products rising but so is ( and will continue) the live animal imports. It will be interesting to see if the cross border partnerships with US finishers redevelop and flourish again. It is this very natural comparative advantage between the countries that was ripped up by MCOOL without any benefits to anyone, due to the political vs economic decision to implement it. See Chart 1.

Chart 1. Pork and live hogs imported from Canada to the United States along with the exchange rate in 2014 and 2015. Source: USDA ERS, Pork, Monthly US Trade; USDA ERS, Hogs, Monthly US Trade

Now of course, the long run economics have prevailed but will Canadian weaner pig producers consider the US an undependable long-term partner? Or will they re-establish the flow of piglets to the south and sell them in the more lucrative U.S. markets? I can recall a well-known Canadian speaker criticizing the MCOOL at implementation with tears in his eyes, describing the coming losses for both sides of the border and vowing to only build finishers in Canada for the future. The possibility of coming profits probably heals a lot of past wounds.

Not only does the US packer support much higher market weights and net prices than Canadian slaughter plants (counting the exchange rate) but the availability of low cost corn (vs wheat and other small grains) is a factor. We will know the answer to that question in about a year and it will be told around the relative proportion of new finishers cropping up in Canada with sales coming to the US vs imports of piglets to the US. Lenders love to have packing contracts before providing financing so that will determine much of where the pigs wind up.

At the present time, there is relatively uninterrupted belief being expressed in the futures markets since November of 2015 that the normal seasonal pattern will be established throughout the year, projecting about a 25-30% rise into the summer from current prices (basis adjusted). That seems optimistic at this stage but most of the things which could derail this progression are not sure at this point but most likely have higher than average probabilities.

The headwinds to a 30% rise in carcass prices into the summer include a relative abundance of pork and all other meats coupled with much lower retail prices emerging in the meat case. While lower prices clear excess inventory, they also reveal the extent of overproduction and can create a kind of meat saturation point for consumers.

With all the dangers of relying on anecdotal examples acknowledged, in my little Mid-USA town last week you could buy 10lbs of chicken leg quarters for $3.80, whole, boneless pork loin at under $1.60/lb and the whole pork tenderloin under $2.00/lb. One cut of Select grade beef roast was selling in unlimited quantities for under $3.00/lb for the first time in a long time. This makes ranging between meats very easy for consumers and dilutes the advantage of pork. While retail outlets often push out “loss leaders” to induce shopping at their location, (the goal is for you to fill the basket with higher margin items along with the cheaper meat), we did not see these levels of loss leaders in the meat case over the last 12 months. Add to that the rising sow inventory, the constant incremental rise in sow productivity, marginally declining net exports of pork and low cost feed and you have a prescription for stagnation on the price front.