Wheat: Satisfactory 2023 harvest for the three main producers and exporters: European Union, Russia, and the United States

With 791 Mt, world wheat production increased slightly compared to 2022 (+0.3%). In the southern hemisphere, results were mixed. Although Argentine production increased by 3.3 Mt compared to 2022 (15.9 Mt), it is still below the levels recorded since 2018. After its bumper 2022 crop, Australia suffered a setback with only 26 Mt harvested due to unfavorable weather conditions. Although lower than the previous two seasons, the European crop was satisfactory, with 132.5 Mt produced. In France, production increased thanks to a slight increase in area and yield. International trade was marked by Russia, which exported considerable volumes: with 55 Mt exported, it dominated the wheat market. Thanks to its competitive export prices, Russia has imposed strong competition on other exporters, especially in Europe, which have been forced to lower their prices to capture the sluggish demand. This race for competitiveness has weighed on prices. American and European market prices fell to levels not seen since 2020, dragging down the physical markets. In 2023-2024, feed wheat delivered to Ille et Vilaine was traded at an average of 215.4 €/t, 27% lower than in 2022-2023.

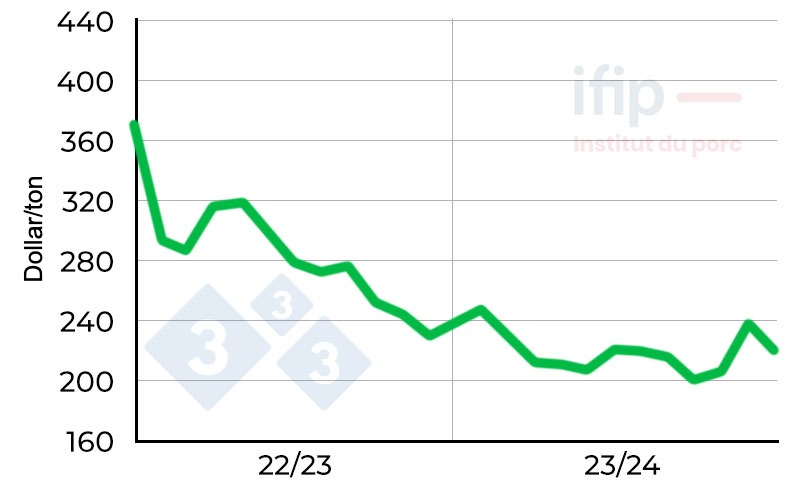

Wheat prices in Chicago. Source: CBOT, nearest term.

Corn: Record global production (1,224 Mt, +6%/2022) and U.S. production (389.7 Mt)

Production was excellent in the Americas. Only Brazil saw a decline. With 122 Mt harvested, the South American producer remained above its five-year average (+8%). After a disappointing year last year, Argentina regained its place among the major producers, with 50 Mt produced. In Europe, corn production recovered after an average harvest in 2022. With 62.7 million tons harvested, it is now above the five-year average. The American market suffered from competition from South America, whose export prices are competitive. Brazil is strengthening its market share with China. American producers struggled to sell their stocks, which led to prices falling on the Chicago market (-74.8 $/t /2022-2023). These factors weighed on the European Euronext market, where corn lost almost €50/t on average in 2023-2024 / 2022-2023.

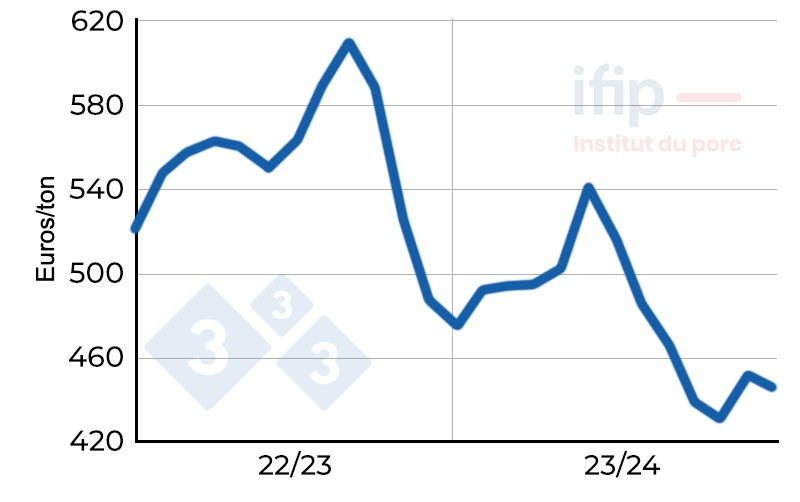

Corn prices in Chicago. Source: CBOT, nearest term.

Rapeseed: World production stable (89.4 Mt / 88.9 Mt in 2022)

Volumes produced in Canada (canola) and the European Union increased slightly (+1.8% and +1.9%). The price of rapeseed meal is influenced by the soybean markets, the price of Canadian rapeseed, the price of oil, and the price of vegetable oils, making it volatile. On the French market, the price of rapeseed meal fell by 13% / 2022-2023, with an average annual price of €317/t (€365/t in 2022-2023).

Sunflower: Increased yields thanks to the Black Sea basin

Russia and Ukraine accounted for almost 60% of world sunflower production. In Europe, the three main oilseed crops grew slightly. In France, soybean, rapeseed, and sunflower crops decreased by 9.6%, 0.7%, and 0.9% respectively compared to 2022-2023. On the French market, the price of sunflower closely followed that of rapeseed.

Soybean: Exceptional harvest (391.1 Mt, +9%/five-year average)

Although South America experienced difficulties at the beginning of the season, the results were ultimately good. Brazilian production was above average (+12%). This was due to strong local demand linked to growing domestic swine production. Brazil's export activity also drove its soybean production, with 105 Mt of soybeans exported (+10 Mt/2023) and 22.4 Mt of soybean meal (21.3 Mt/2023). Argentina returned to its usual production levels with 49.5 Mt harvested (+18%/five-year average). The United States also had a good harvest with 113.3 Mt, which drove dynamic crushing promoted by the demand for soybean oil destined for biofuels. International demand remained calm. Import activity from China, the world's largest soybean importer, was sluggish, limited by a difficult economic context. This slight imbalance between supply and demand led to increased stocks (+8.3% /2022-2023). At the end of 2023, soybean prices showed an upward trend, supported by the climatic and political context. Planting in Brazil was hampered by unfavorable weather conditions that worried stakeholders. In Argentina, the election of Javier Milei and his desire to abolish export taxes encouraged soybean producers to curb sales, which supported local prices. In 2024, prices began to decline, returning, in the case of grains, to pre-crisis levels. Improved growing conditions in Brazil, good crop prospects, and a slowdown in Chinese demand weighed on prices. U.S. producers struggled to sell their production in the face of stiff South American competition. U.S. soybean stocks reached a four-year high (+28% / 2023), which affected world prices. European soybean production increased by 2.3%/2022-2023 but remains anecdotal at 2.8Mt produced. The issue of European protein autonomy remains a problem and imported volumes are not weakening. European soybean meal imports stabilized at around 16.5Mt and were almost exclusively destined for animal feed. European markets were therefore directly linked to the evolution of American prices. The price of soybean meal on the French market thus recorded a sharp fall after soybean meal in Chicago. It fell €70/t compared to 2022-2023 with an annual average of €481/t.