News broke the week of October 12 that private operators in the Chinese market were buying large quantities of pork cuts at very interesting prices.

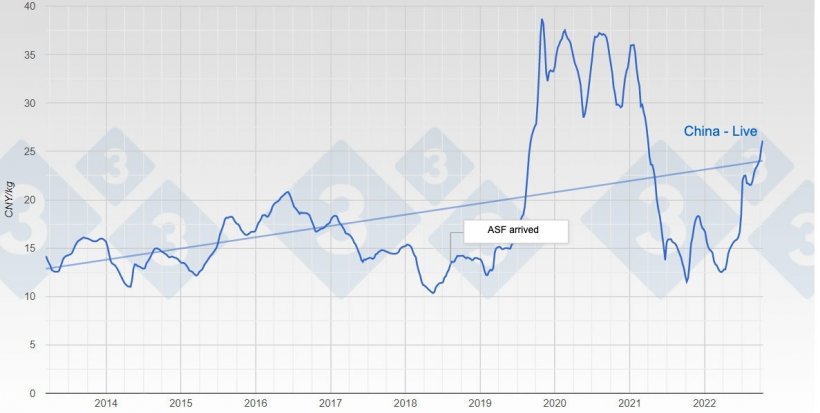

Evolution of pig price in China

We had been pining for news like this for months. The truth is that for weeks now the Chinese government has been making strategic purchases with the aim of slowing down the price escalation that is taking place there. In China, live pigs are worth much more now than they ever were before ASF arrived in the country.

In the Spanish market, what was foreseen is now taking place: the heat is gone, and pigs are fattening up well and making up for growth delays very quickly. The supply of pigs for slaughter is recovering very quickly, although week by week it is far from last year's supply. It is not anecdotal that in the week that is ending (at the end of October!) quite a few foreign pigs (mainly Belgian and Dutch) were still slaughtered.

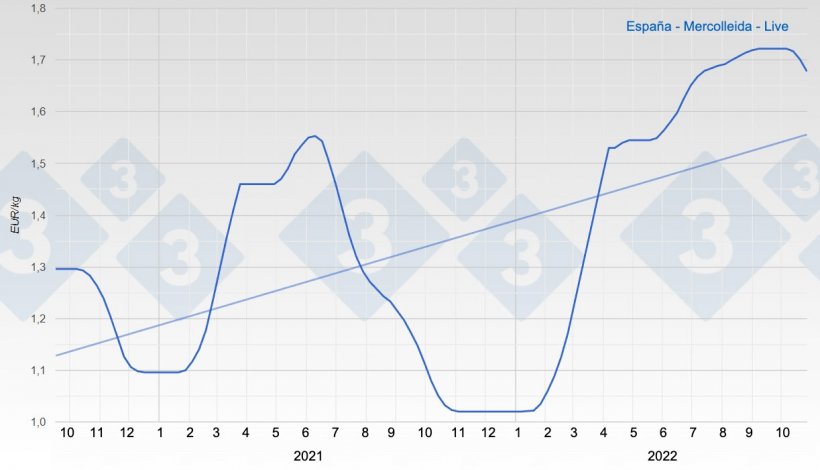

Evolution of pig price in Spain

The Spanish price has started its descent from the historical maximum. The price decreases are being restrained because of the large slaughter capacity installed in Spain and the imperative need expressed by some large slaughterhouses -especially the largest- to kill all the pigs they can find.

In the rest of Europe, things are still far from clear ("everything is very confusing"). Germany has lowered its carcass price by 20 cents in one month (the impossibility of exporting to third countries is a very heavy burden), dragging down its satellite markets: the Netherlands, Belgium, and Poland. Currently, according to Mercolleida, the theoretical price of a pig in Germany is 19 cents / live kg lower than the Spanish price. A huge difference for one pig. This unprecedented difference at this time of the year is what justifies the still existing flow of "European" pigs arriving in Spain for slaughter. France is now slackening its pace after a few months of leading the European price and Italy is still immersed in a situation of distressing and suffocating lack of animals (and its price is still stratospherically high: 2.07 euros/kg live for finishing pigs from 160 to 176 kilos live!)

It has been an atypical year if ever there was one; in spite of this, we are in autumn and the weather and the pig's metabolism will be how they have always been: more pigs arrive and will arrive for slaughter and the price will fall accordingly.

The "China Factor" will play a determining role. At the moment it is reducing and slowing down the declines. No one knows for sure how permanent this interesting demand situation will be.

Let's try to find out more by turning to some numbers since you know that "numbers are neutral, have no feelings, and tell the truth." The current live price in China is 20% higher than it was during the price peaks (June 2016) before the emergence of ASF. From March to today, the Chinese price has more than doubled (pay attention to this fact!). Everything seems to indicate that there has been a recurring miscount in the sow inventory in the statistics published in recent months (perhaps finishing pigs have been counted as sows...) and that, obviously the pigs that theoretically should be there... well, they are not. If this shortage of animals continues - and everything seems to indicate that it will - Chinese imports should continue.

In Spain, we have just come out of the difficult summer. Slaughtering 20% or even 25% less than normal week after week almost automatically leads to reduced frozen stocks. Frozen stocks below the minimum are psychologically very important when it comes to defending prices: it instills value to those who sell the meat. This absence of stocks brings strength to the market, delaying and slowing down price declines.

The grip that this year's long, hot summer has had is widespread and influential: the average carcass weight of slaughtered pigs is still one and a half kilograms below last year's. Everything seems to be happening in slow motion compared to previous years.

So, in the Spanish market:

- The supply of live pigs is recovering but is still far from last year's level.

- The average carcass weight is recovering, but still far from last year.

- Frozen stocks of pork are at very low levels.

- The flow of foreign animals for slaughter continues.

- China is buying decisively: significant quantities at interesting prices.

All of these factors (excluding the fourth) strengthen the market, contributing to a moderate and unhurried decline.

We expect the decreases to continue, although without shocks. Pig price in Spain will go down little by little, prudently. The price is still well above the current costs and in such a turbulent year this circumstance, in November, is already a remarkable achievement.

We still think that from now until Christmas there are not enough weeks left for the price to reach its bottom (we will continue to go down in January); now it seems to us, however, that the bottom will remain higher than the 1.35 that we forecast in our previous commentary.

We will end with a solemn phrase from Henry David Thoreau (American writer): "Success usually comes to those who are too busy to be looking for it."

Guillem Burset