Inflation of pork products remained high in Europe compared to beef. Since pork is more accessible, pork consumption decreased more moderately (-6.1%) compared to beef (-8%), reaching 39.9 kg carcass equivalent per capita per year. Most countries, except for Germany and Italy, saw consumption decline. Increasing food insecurity and the adoption of convenient, healthy, and fresh products, which require little effort explain in part this drop in consumption.

Marked pork inflation across Europe

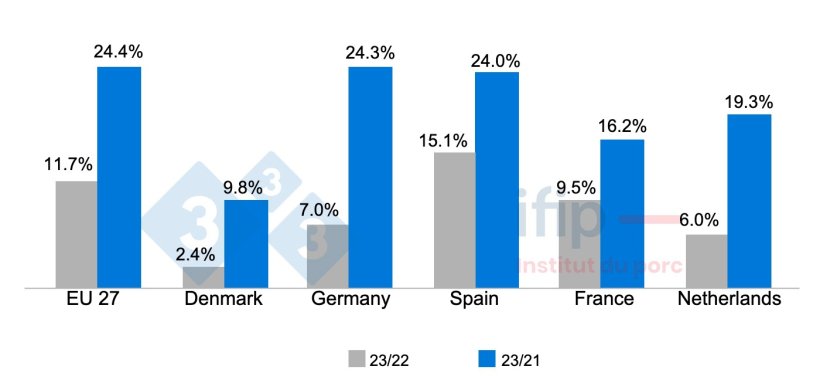

Food inflation remained high in the EU-27 despite the decrease in total inflation: on average, it reached 12.7% in 2023. Meat prices were 10.7% higher than in 2022. Pork saw the highest increase (+11.7%), ahead of poultry (+8%) and beef (+7.4%), which rose more moderately.

The increase in retail pork prices was most significant in Spain (+15.1%). In France it was 9.5%, in Germany 7%, and in the Netherlands 6%. On the other hand, the increase was more moderate in Denmark (+2.4%), with a cumulative rise of 9.8% over 2 years. Since the end of 2023, the inflation rate of pork products in Europe has stabilized, even falling in some countries such as France, Germany, and Denmark.

Evolution of the consumer price index in Europe from 2022 to 2023 and from 2021 to 2023. Source: Ifip with Eurostat data.

Slow decline in pork consumption, sharp drop in beef, and rise in poultry

This upward price trend has put pressure on low-income consumers and has contributed to a decline in meat consumption, the most significant item in household food budgets. The amount of meat (excluding poultry) consumed in the EU-27 has decreased by 3.9 kg over the past 4 years to 55.3 kg/inhabitant, or a total of 36.5 million carcass equivalent tonnes (CET). Including poultry, which increased by 4.2% and accounts for a third of consumption (27.6 kg/inhabitant), total consumption reached 82.9 kg/inhabitant.

Beef experienced the largest drop, with per capita consumption falling 8% from 2019 to 2023, to 13.9 kg. Pork also fell albeit to a lesser extent (-6.1%; -2.6 kg) to 39.9 kg/capita.

Contrasting trends in pork consumption by country

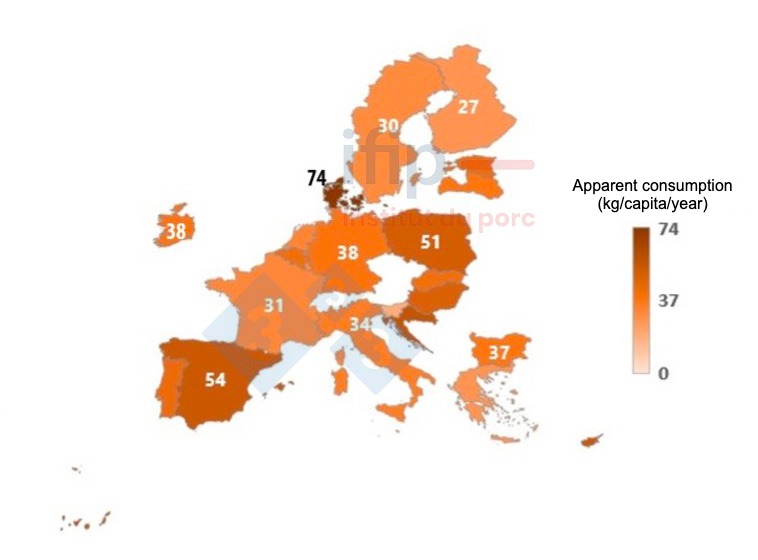

Denmark and Spain remain the largest consumers in Europe, with 73.6 and 53.8 kg/inhabitant respectively, ahead of Poland with 50.7 kg/inhabitant.

In 2023, most countries saw consumption fall. Germany and Italy were the exceptions, where consumption remained practically stable (-0.5% and -0.2% over 2022). Pork consumption fell most sharply in the Netherlands, from 43.9 kg/inhabitant in 2022 to 32.1 kg/inhabitant per year in 2023 due to social pressure. In the other countries, the decline was not as marked: -11.5% in Denmark, -3.1% in France, -1.7% in Spain, and -1.1% in Poland.

Consumption penalized by insecurity and new consumer behaviors

Compared to beef, pork consumption resisted inflation by remaining affordable. However, increasing food insecurity across Europe led a growing number of consumers to give up meat due to its cost, including pork. In Europe, 10.5% of the population lives below their country's poverty line, and 9.5% of consumers cannot afford a meal containing a meat protein (meat, poultry, or fish) every other day. This proportion ranged from 3.8% in Denmark to 13.3% in Germany. France stood at 12.2% in 2023 (compared with 7.5% in 2019), an increase of nearly 5 percent over 4 years.

Apparent pork consumption in 2023 in the EU-27 Source: Ifip with JRC data.

As for consumers with fewer economic constraints, they are looking for solutions that allow them to balance their budget with their environmental and "healthy eating" ideals. In recent years, there has been an increase in planning purchases and the adoption of ready-to-eat, healthy and fresh products that make it possible to eat well with little effort, delegating responsibility to manufacturers. The shift from mealtimes to continuous snacking in response to individual stress is growing among young peoople in Western Europe. Percent of the population that cannot afford a meal containing meat protein (meat, poultry, or fish) every 2 days. Source: Ifip with Eurostat data.

The proportion of flexitarians seems to be stabilizing. In 2021, they represented barely a third of consumers, according to the Smart Protein study conducted in 10 European countries.