All the usual seasonal patterns are presenting themselves this fall both increasing weights and broadly declining prices. However, this year we have seen a little different move up take place in pig prices over the last month, most likely related to a behind the scenes quickening of net export sales which will not be finally verified from the published data until the first week of December (USDA reporting on actual/final pork imports and exports by month is two months behind). While not unheard of, this upward tick in prices from September to October of about 2% (so far) can be contrasted with an average 4% decline for this two month transition into the fall pattern when examining the historical data between the period 2002 and the current period. The only exceptions were substantial rises in 2011 and 2012 which were largely induced by the drought and pork prices rising to meet the big spike in feed costs.

This leaves us in an unusual but happy situation in the US in that profitability may very well inch across the dreaded fourth quarter of the year and into January. This is made possible by very low feed costs from the more than adequate carryover of both corn and soybeans from last crop year and a big crop of both corn and bean being harvested right now.

Some longer term trouble appears on the horizon as well as some unexpected good news. China has just announced the reopening of export trade between 14 US pork plants and distributors which have been banned for most of the previous year. This is great news for US producers given the looming trouble on the horizon which has been the multi-year sluggishness of US pork net exports.

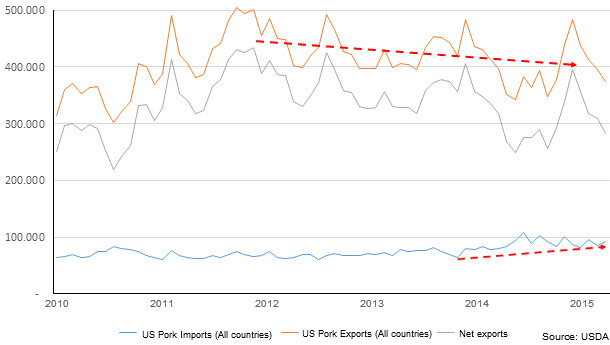

Many market commentators believed that China would be a big buyer this fall coming off of its large sow slaughter over the last year or more. That has not materialized for the US but the EU has hit the jackpot capturing now about 65% share of Chinese pork imports. The news of the 14 plants opening for trade will not necessarily have an immediate impact but could be the beginning of the halt in US pork net export declines which have become somewhat entrenched.

It’s a complicated matter involving several components. First there is the Chinese rejection of ractopomine which was reported to be found in trace amounts among the shipments declared to be ractopomine-free several months ago. Next, the strength of the US dollar has made US pork appear expensive compared to Canada and the EU. The US FED has been signaling an interest rate increase all year but has failed to execute even a miniscule “signaling” increase (usually a fraction of 1 percent). This mere promise of an increase has led to expectations that the dollar would strengthen further against world currencies and just the threat of that has kept foreign buyers dealing with weaker currency partners like Canada and the EU.

The worldwide stagnation in economic growth coupled with the massive stock market selloff on the Shanghai markets heralded the beginning of the Chinese repricing of assets (call it a balloon that burst). When you add this to the US-Saudi oil price war which has sent crude oil plummeting, Canada, a natural resource exporter has seen its currency tale a dive from near par with the US dollar a couple of years ago to 75 cents on the US dollar today. It’s great to travel to Canada once again and charge a $75 meal only to come home and open my American Express bill and find out it really only cost $56.

Canada produces very high quality pork and when its relative price falls against US pork, it begins to flow out to willing export buyers displacing US purchases. It is no secret that there has been some tension between Beijing and Washington over alleged cyber-attacks, some disputed areas off the coast of China and China being omitted from the recent Transpacific Trade Partnership (TTP). The omission of China from the TTP was seen as a move to counter its growing and already tremendous economic power in Asia and the Pacific. All that can’t really help the pork export situation there when there are so many other well priced offerings around the world.

When you examine net pork exports (which is what really matters, export sales minus import sales), you can make the case that the US has been in a downward path since 2011. There is a lot of exuberant talk about meat export sales from various quarters in the US but the data and the reality is that for US pork, the picture is troubled and the future is not automatically rosy even though the fundamentals are strong. Commentators often point only to export sales which have had a steady downward trend for the last few years. What they often fail to mention is that the increased strength of the US dollar has resulted in imports of pork, especially from Canada, to be on the rise and they have increased their upward trajectory over the last year. This increase in imports is gutting the effect of export sales.

The only prospect for long-term growth in both the EU and the US is the steady increase of net export sales. We are at interesting cross-roads trying to determine which pork producing nation or group of nations will capture the future opportunity.

I’m not bold enough to predict that the summer could be a trouble spot for US prices yet, especially with the futures markets for the summer months looking pretty profitable. But you wonder if they have built in a lot of sales that may not materialize. Production is roaring back as the September quarterly hogs and pigs report showed inventories up almost 4% and breeding animals up 1% over the year reaching a total breeding herd size just under 6 million sows. The last time US total breeding inventory reached this level was in 2008.

In addition, USDA revealed that sow productivity reached a new record high of 10.39 pigs per litter up from just over 9 pigs per litter 10 years ago, although farrowing intentions were pretty flat. Relief from the two new packing plants will have to wait as while the one in Michigan has broken ground, it is not expected to be operational until 2017. For the first time in about 75 years, total pork production will exceed beef production in the US and US total meat production will be at an all-time high. “Sell it or smell it” remains the cautionary slogan at this stage.