This year we wanted to test 333 users' forecasting abilities by asking them what the average pig price would be in 2020. To do this, we conducted a poll that was open from February 4 to April 24, 2020 in which 811 users participated, providing data from 58 countries. It was precisely during this time that COVID-19 broke in many of the countries participating, causing an exceptional, unprecedented situation worldwide, whose affects continue today, and how long they will last is unknown.

Some of the data from the poll was collected before COVID-19 entered the countries surveyed or before its effects could be felt, and some of the data was collected at the height of the disease spread. For the countries with the most data, we have tried to distinguish the possible COVID-19 effect from the predictions.

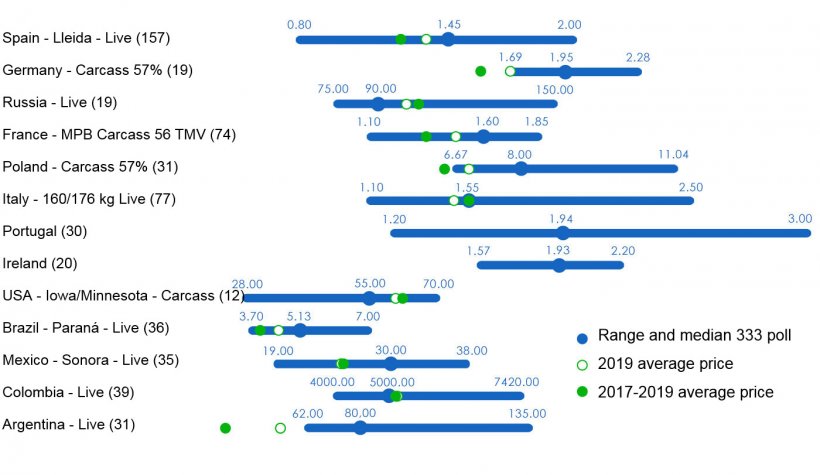

For comparison purposes, the average price for 2019 and the average price for the last 3 years (2017-2019) have been used, as shown in the markets and prices section of 333. At the time of the poll, as seen in Figure 1, most of the countries surveyed expected a price higher than last year's and higher than the 3-year average, which is the case for Spain, Germany, France, Poland, Mexico, Brazil, and Argentina. The expected price in Italy was very similar to the 2017-2019 average, which is slightly higher than the average price in 2019. Only in 3 countries, Russia, the United States, and Colombia, were the expectations for the 2020 price lower than the 2019 price and the average 2017 - 2019 price.

Figure 1. 333 poll on the average pig price in 2020. Range and median of all the responses recorded by country, average price in 2019 and for the last three years. The number of responses recorded is in parenthesis.

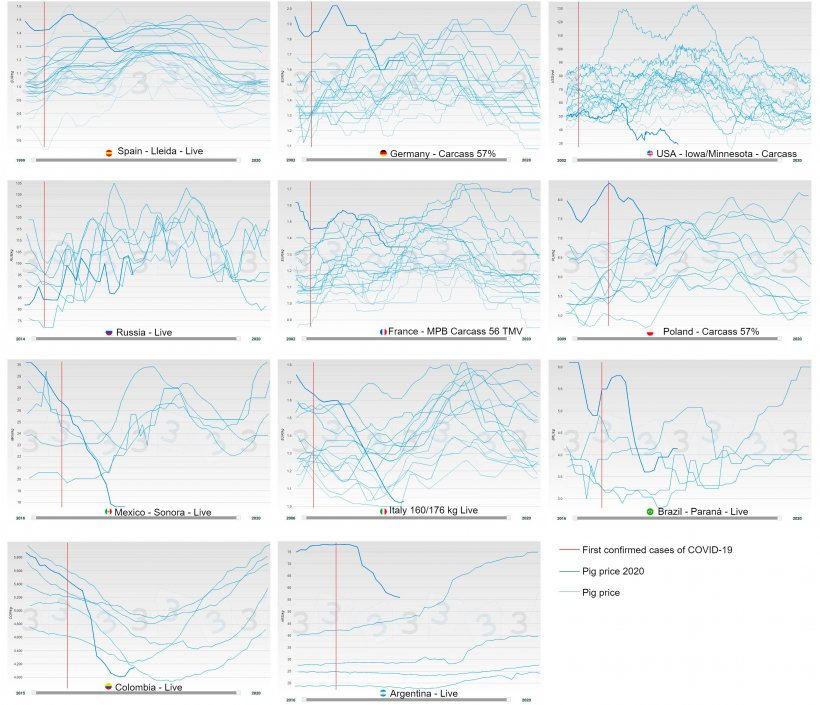

Countries expecting better prices saw extraordinarily high prices in 2019, especially in the latter part of the year, and also in the early part of 2020. All of them saw historical seasonal highs during this period and in some cases the price even reached all-time historical highs (Figure 2). In all these countries, except Italy, the average price in 2019 was among the highest on record, and in fact it was the all-time highest in Germany and France (Figure 3).

On the other hand, the price trajectory of recent months in the countries with expectations below the references was in the low price range (United States and Russia) or intermediate in the case of Colombia (Figure 2), which is reflected in the fact that this country expected values very similar to the reference prices (Figure 1).

Figure 2. Annual evolution of pig price by country (blue), the thick line represents the price in 2020. The red indicates the date on which the first COVID-19 case was confirmed.

Figure 3. Average price evolution and standard deviation by year and country (blue). In pink is the median price for 2020 according to 333 poll responses.

Price references taken for comparison purposes fall within the range of user responses except with the results obtained for Germany and Argentina. These exceptions could be attributed to very good expectations of the survey participants, a low sample size, or a strong currency depreciation effect in the case of Argentina.

As mentioned above, several countries were affected by COVID-19 outbreaks during the data collection period. For example, let's consider Spain, where the median price initially expected was 1.50 euros/kg live and, after the state of emergency was declared, fell to 1.41 euros/kg live.

At the time of writing, despite dramatic price declines since mid-March due to the effects of COVID-19, the average pig price so far in 2020 is quite close to 333 users' predictions in some of the countries (Figure 3). Now that some countries are beginning to show signs of their prices recovering, we will see what the rest of the year holds and how prices are influenced by the pace of China's recovering pig production, the slaughter capacity in the USA recovering and the changes in its pig census, the political tensions between the USA and China, the spread of ASF in Europe, as well as the probable but uncertain effects of COVID-19.

We will be back again in December to evaluate the results. Thank you very much to all poll participants for your contributions!

333 Staff