The Spanish pig industry is a successful one, which has meant a continuous increase in production in recent years at a rate of more than 1,000,000 head per year. In 2019 more than 53,000,000 head were slaughtered.

This growth is supported by an increase in exports; Spain now exports more than 55% of the pork it produces. Exports have traditionally gone to countries within the European Union, which until a few years ago represented 75% of Spain's exports. But this situation is changing rapidly and according to the latest data available from 2020, extra-EU exports of carcasses and cuts now represent 52.8% of the total.

| Destinations | 2019 | 2020 | 20%19 | %Total |

| France | 129,590 | 115,402 | -10.9% | 9.9% |

| Italy | 94,039 | 111,601 | +18.7% | 9.6% |

| Portugal | 55,521 | 46,794 | -15.7% | 4.0% |

| Czech Republic | 37,614 | 37,189 | -1.1% | 3.2% |

| Hungary | 19,412 | 19,880 | +2.4% | 1.7% |

| United Kingdom | 25,930 | 21,218 | -18.2% | 1.8% |

| Germany | 19,736 | 19,339 | -2.0% | 1.7% |

| Bulgaria | 22,288 | 18,704 | -16.1% | 1.6% |

| Denmark | 13,716 | 12,785 | -6.8% | 1.1% |

| Romania | 33,679 | 32,444 | -3.7% | 2.8% |

| Total EU | 564,965 | 548,932 | -2.8% | 47.2% |

| China | 182,297 | 457,239 | +150.8% | 39.3% |

| Japan | 81,424 | 69,501 | -14.6% | 6.0% |

| South Korea | 41,806 | 26,040 | -37.7% | 2.2% |

| Philippines | 24,633 | 11,462 | -53.5% | 1.0% |

| Hong Kong | 5,171 | 8,225 | +59.1% | 0.7% |

| United States | 5,439 | 747 | -86.3% | 0.1% |

| Total extra-EU | 395,892 | 614,563 | +55.2% | 52.8% |

| Total | 960,858 | 1,163,495 | +21.1% | 100% |

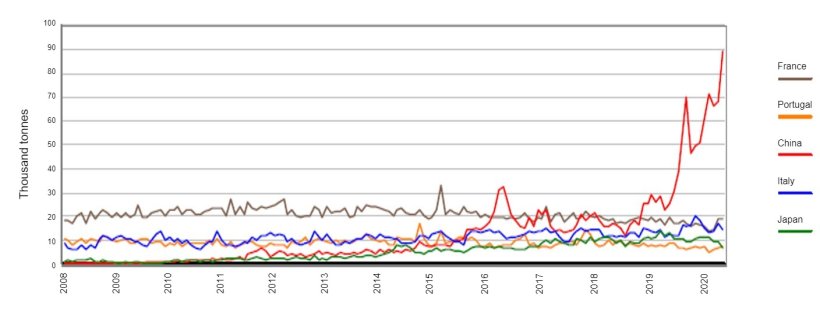

Among third countries, Spain's main customer is China. Spain was the main supplier to the country in 2019 and 40% of Spain's exports of carcasses and cuts have been directed there so far this year (Graph 1).

Graph 1. Monthly evolution of exports of carcasses and cuts from Spain to France, Italy, Portugal, China and Japan. Source: AEAT.

In 2018, when the outbreaks of African swine fever (ASF) began, China experienced an unprecedented health crisis that led to a major decline in its census and pig production. As a result, it has had to turn to international markets for its pork supply.

ASF is a disease without a treatment or an effective vaccine and, in order to control it the only possible strategy is to eliminate the disease by culling and emptying the affected farms, which are then restocked with animals free of the disease once the quarantine period is over. This is the only effective measure, at present, to prevent recurrences and the spread of the disease by animals that are asymptomatic, but carriers.

The emergence of an ASF outbreak in Germany in the beginning of September 2020 is causing significant tensions in the European and world pork markets and in the pig trade, especially for Dutch and Danish piglets, which were largely exported to Germany.

For the Chinese government, the pork supply is essential since pork is considered a basic necessity and is a highly appreciated product there. However, according to most experts census recovery will still take another 2-3 years, despite the measures established by the government to control ASF and recover the census. However, given that pork production is strategic for China, there is no doubt that it will recover, and the country will not need as many imports, so the world market for pork will be strained. China needs to supply itself with pork, but it is doing so under ever-improving economic conditions.

However, geopolitical conditions are constantly changing. For example, a possible change in the presidency of the United States in the next legislative elections in November could cause a change in U.S. trade relations with China and, consequently, a modification in international markets. Although, the dispute for world hegemony will continue to create tensions between the two superpowers.

China will try to source pork from other countries. In the last few months, news has emerged that a strategic agreement is being finalized with the Government of Argentina to produce pork there. One must not forget that Argentina is a major producer of raw materials for the manufacture of animal feed. It is probable that China will not be self-sufficient in the next 5-10 years, but its purchasing power may lead to distortions in the market.

China is learning to play, and it is playing with its purchasing power and geopolitics, using pork as one of its commercial assets in its international relations. It could be that Spanish exports to China will not be so significant in the future.

What will happen then in the Spanish pig industry? Will it be prepared to act in an even more mature market where those with surplus pork (mainly European countries), will have to look for other markets?

Spain must prepare for cyclical crises in the sector, which have been delayed in recent years due to the aforementioned health reasons and the strength of the Spanish sector's exports in search of new markets, allowing the country to enjoy an extraordinarily long period of prosperity.

At this juncture, Spain continues to grow in census and productivity, but Spanish producers should make it a priority to be more efficient and should realize that growth cannot continue indefinitely.

It is true that Denmark, a country where the pig industry represents more than 5% of its GDP, has been exporting around 80% of its production in the last 20 years, but it has very strong structural pillars and R&D plans in genetics, health, sustainability, management, nutrition, etc. Currently, it is specializing in producing and exporting piglets to its European neighbors and many of its farmers, faced with the impossibility of continuing to grow in their country, mainly due to environmental issues, are leading business projects tied to pig production in Eastern European countries, where wages are much lower than in Denmark and where they can continue to grow.

Spain must establish a Strategic Plan for Swine that will make the country more efficient and less vulnerable in the future. A plan based, among other things, on:

- Strategic health plan. Animal health is a competitive advantage that must be strengthened. Preventing the entry of ASF must remain a priority, but within the strategic health plan, controlling and eradicating PRRS would be very good for Spain, as it costs the Spanish industry hundreds of millions of euros annually.

- Improved productivity on sow farms and the number of piglets produced, improving genetics, health, facilities, and management.

- Improved feed efficiency (feed conversion ratio) on finishing farms, and using new products and byproducts in feeding, which result from R&D programs.

- National Biosecurity Plan. This is vitally important to maintaining the health status which allows Spain to export to all countries. It should include measures such as increasing the distance of newly built sow farms to two kilometers, which will allow a high health status to be maintained on sow farms and allow for more sustainable growth.

- Limiting the large-scale projects of various sow farm nuclei or finishing farms in the large estates due to the negative social impact these projects have and because they represent a health risk and unsustainable growth for the industry in all aspects.

- Prioritizing the use of slurry as agricultural fertilizer, reducing the use of chemical fertilizers in industrial agriculture. Control the management of slurry in the slurry management plants that do not have enough land for the use of slurry as agricultural fertilizer.

- Developing new slurry management systems to reduce pollutant emisiones and promote more sustainable production.

- Promoting self-sufficient energy on farms through the use of photovoltaic, geothermic, and energy coming from slurry along with all other economically viable energy alternatives.

- Continuing to be firmly committed to promoting the Spanish pig sector in foreign markets through the industry organizations that are doing such good work.

- Encouraging the growth of Spanish meat and pork production companies in other countries, so that they can continue to be world leaders in globalized markets that require large volumes to be able to work with the large food distribution groups worldwide.

Ultimately, the Spanish pig industry must prioritize efficiency, profitability, and sustainability, within a framework of solid biosecurity and health, without limiting growth and doing so in the wisest and most sustainable way.