Since January 2022, France has banned the surgical castration of male piglets without pain management, i.e. without anesthesia. The production of entire male pigs or immunocastration (chemical castration) are alternatives to castration under anesthesia. Among European producing countries, the choice alternative differs according to the farming context and the payment methods for the pigs.

Without being imposed by the European Commission, the new French legislation follows in line with other European countries in the context of strong social pressure. The objective is to improve animal welfare. Castration of one-week-old piglets is carried out to avoid the development of an unpleasant odor in pork and pork products. When male pigs reach sexual maturity, at around 180 days, the production of the hormones skatole and androsterone develops, which are responsible for the unpleasant odor (boar taint) when eating pork and pork products.

One answer to this problem is to raise entire males, which have higher efficiency, meaning lower costs but require certain adjustments in regards to management. Carcasses with boar taint must be detected at the slaughterhouse. In the specific case of France, the human nose is used. However, meat companies are reluctant to accept pork from entire male pigs due, on the one hand, to the risk of boar taint and, on the other hand, to the production of leaner meat, which has consequences for the quality of products requiring fat.

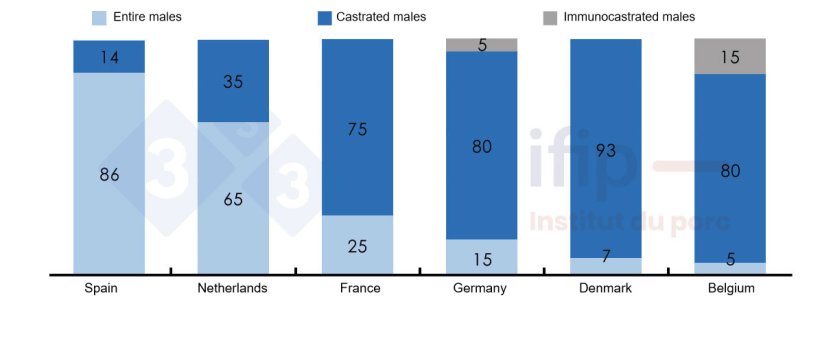

In the European Union, castration remains dominant, representing approximately 31.5% of the 258 million pigs slaughtered in 2020. The production of entire male pigs is estimated at 45 million pigs, i.e. 17 % of the slaughter. Immunocastration represents approximately 1% of EU slaughter. Organizations or companies have defined their rules according to the value of castrated or uncastrated pigs, which influences the payment to producers. Here are some examples in the EU:

- Since 2021, castration in Germany is only allowed under general anesthesia, usually with the use of isoflurane gas, which can be performed by the farmers themselves. This requires 12 hours of theoretical training and a practical phase under the direction of a veterinarian. The German government provided 13.5 million euros to finance the purchase of the necessary equipment. The cost of this method is €2/piglet. The production of entire male pigs represents 15% of the German market, i.e. a supply of 4 million pigs/year. Depending on the slaughterhouse, a reduction of 3 to 5 euros per entire male pig is applied. Immunocastration accounts for about 5% of slaughterings; although many farmers have not adopted this solution, some slaughterhouses have encouraged it.

- The Netherlands produces 5.4 million entire male pigs, closely associated with the animal welfare-related quality seal "Beter Leven." Castration with general anesthesia using CO2 is performed on 3 million piglets. Immunocastration is poorly developed. In terms of payment, the average discount is 3 to 4 €/entire male.

- The production of entire male pigs in Denmark makes up 7% and is mainly destined for the domestic market. The producer pays a fee of €3.50/pig to cover the costs of analysis and classification. The remaining male pigs are castrated under local anesthesia (93%). Export-dependent companies do not accept meat from entire male pigs.

- In Spain, the production of entire male pigs was already a common practice prior to animal welfare concerns. Spanish slaughterhouses do not detect boar taint, the slaughter weight of these animals is lower and therefore the age of the pigs is younger to minimize the potential risk of pork having boar taint. Only the heaviest Iberian pigs are castrated and they represent 7% of the national supply. Export sales by Spanish companies would not be affected. Not castrating has no impact on payment per animal.

- In Belgium, the production of entire males remains low. Immunocastration represents 7% of the supply, supported by a few large distributors.

Over the last ten years, the number of entire males has been gradually increasing in Europe. In most countries, this development has been met with a saturation of the domestic market and companies have difficulties in exporting this pork. Social pressure suggests that the production of entire male pigs will continue to develop. Contracts between producers and slaughterhouses will be essential.

Breakdown of pig slaughter according to entire, castrated, or immunocastrated male pigs.

Jan-Peter van Ferneij, economist at IFIP.