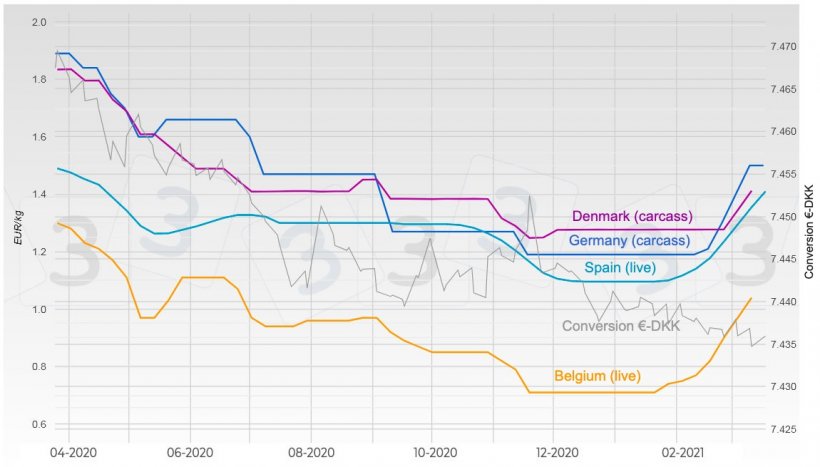

On January 28, before the market session in Lleida, pigs were worth €1.096/kg live farm gate in Spain. As of last Thursday, when the session ended, they were already worth 1.410 €/kg live. An increase of 28% in only seven weeks.

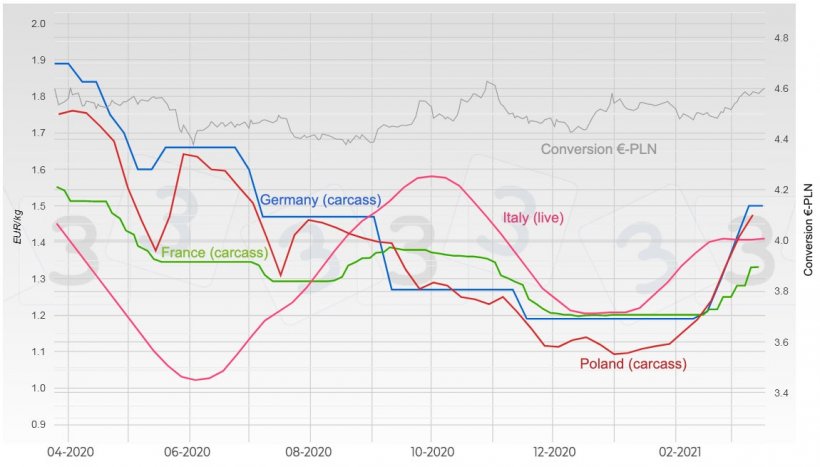

And this situation is practically identical for the rest of Spain's community partners. Two maximum increases chained in Spain (and the third at 5.50, only half a cent less than the maximum). Never seen before. In Germany, we have seen +9, +10, +10 and "prices staying the same". The prices stayed the same this last Wednesday due to significant outbreaks of COVID-19 in slaughterhouses: slaughtering capacity has been lost and, circumstantially, there is a surplus of pigs. But it is certainly a false truce, an Easter Truce.

In February, Spain replicated the exports to China that it achieved in January: once again over 165,000 tonnes of pork (equivalent to more than 450,000 carcasses per week!). Germany has resumed exports to the Philippines and Singapore. And China is considering accepting the regionalization concept that Germany advocates and defends. EU export flows remain at record levels. And they will stay there. This brutal drain of pork from the EU space is what first vacuums and then propels prices upwards.

In Germany as well as in the Netherlands and Belgium, pork has spent months and months at a price well below its cost price. As a result, many farmers have opted to abandon the business, and we notice the lesser number of pigs on the market.

The combination of EU exports at peak volumes with the reduction of pig herds in Germany, the Netherlands, and Belgium have caused a kind of perfect storm in the market; the upward curves are steeper than ever and no country is left out of the picture.

Graph 2. Evolution of pig prices in Germany, Spain, Denmark, and Belgium.

Graph 3. Evolution of pig prices in Germany, France, Italy, and Poland.

Everything points to the fact that we are far from the ceiling. Rises will slow down only when exporting to China is no longer a profitable venture. And it seems clear that there is still a long way to go, that there is still a lot of bullish ground to cover. It is not unreasonable today to think that in June the Spanish price will reach 1.55 or 1.58.

Everything is going well for pig producers and everything seems to be going well - still, and for now - for slaughterhouses. On the other hand, things are looking bleak for the processing industry: sausage, salted pork, and ham manufacturers.

The pig price rises are brutal and radical. And if the carcasses go up, the pork cuts and meat go up even more (the price of the bones does not vary). We are talking about rises of 30% to date; we know that we are not finished and we know that in producing cured products the weight of the product is reduced, so the final price of said product should rise by a higher percentage.

More or less, the general situation throughout the EU is of open blockage, but there is total resistance and reluctance from the large distributors towards the increases that should be applied. And in the event that some increases are passed on, it will be done late and poorly. The situation is very serious, to the point of jeopardizing the survival of many companies.

From our own trunk of memories, we retrieve the following highly topical statements from the end of the April 2019 commentary. (In this case, we are self-plagiarizing):

"Right now, for the processing industry, the only plausible motto is: “RISE OR DIE”."

"The survival of many Spanish pork processing companies will depend on their ability to transmit the required rises to their finished products. Yes, you have read it well: we have used the word 'survival'."

We believe that the time has come for the (Spanish? European?) authorities responsible for the market to act. We couldn't understand why that in the face of this real catastrophe situation due to a force majeure, that whoever could do something wouldn't do it. Where is the borderline between "respect for the given word" (contracts) and "serious and insurmountable circumstances at odds" (abrupt and radical rises) that allow or do not allow what? It seems to us that arbitration by the authorities is essential.

We lived through a similar situation in 2019; the differences between then and now are several, namely:

- In 2019 we were treading on uncharted territory; we have learned that important shreds of companies' solvency have fallen by the wayside. The sector has become fragile, so there is a greater risk of unsolvable problems.

- So far the rhythm and intensity of the rises surpasses those of 2019.

- All indications are that the gap between the starting price and the final price will be considerably larger than it was in 2019.

Globalization is here to stay. It is undeniable that there are fewer and fewer and larger operators... The market exacerbates its pendular movements and with that, strikes blindly. Somehow we have to establish a path sheltered from so many vicissitudes.

Before concluding, here's a thought: people learn during our lives; the transformation industry should learn to live (we, to date, do not know how) with a more and more hostile environment; it is not foreseeable that it will become kinder.

The great Albert Einstein said: "The more I learn, the more I realize how much I don't know". We subscribe to this statement.

Guillem Burset