Most people cannot wait to see 2020 go into the record books across a range of factors and then disappear behind us as fast as possible. The hope is we will find 2021 to be a year of building toward that future everyone hopes for instead of constantly on the defense reacting to the next gut punch offered up in 2020. The truth is, we will be dealing with the cleanup of events which launched in 2020 for the next several years and best to keep nimble as there are several potential surprises lingering out there in the future mist. We will begin to unravel these in January.

It remains difficult to get a good handle on the pork supply situation in the United States, especially what is coming in the supply chain into May 2021. The December Hogs and Pigs report will provide some guidance. However, the “unknown” but substantial level of euthanasia both of finishing animals and weaned pigs in 2020, resulting from packing plant closures due to Covid-19 disease among workers, has rendered the year-over-year balancing of the various sections of the survey difficult to reconcile through no fault of the USDA or its sampling techniques.

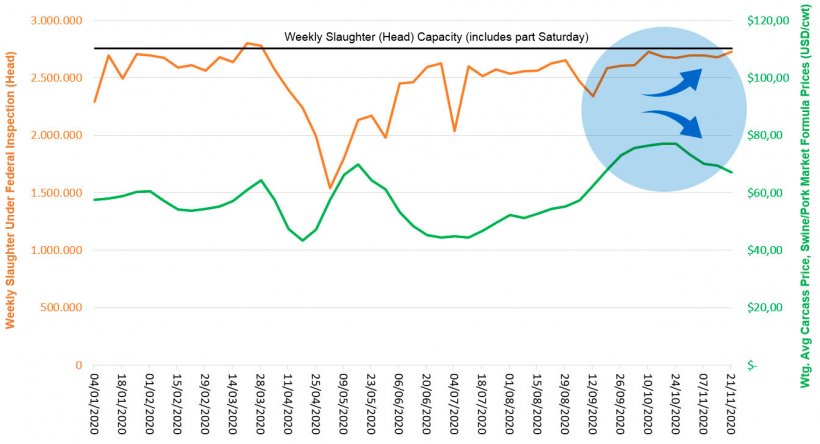

Looking at Chart 1, you will notice that weekly slaughter numbers in the United States are back to challenging total packing capacity again (look within blue circle) with the resulting fall of price advances which had provided some needed relief to producers facing higher than anticipated increases in feed costs. You can trace the magnificent job the US slaughter plants did in reestablishing a reliable slaughter capacity after the jolt provided by the first closures in March. By July, the capacity was up and handling all the summer slaughter well and restoring marginally profitable prices. That continued well into the fall producing the back-to-back counter seasonal price movements which we wrote about but the thrill is gone, just in time for Christmas. Not only are we back to slaughtering very large numbers of pigs but the national average live weights are closing in on 294 lbs. (133 kg); carcass weights at 219 lbs. (99 kg). This is admittedly anecdotal/regional and retailers price meat, especially, to draw people into the store for other purchases, but I am regularly able to buy pork now at record low prices (from the last 10 years). For instance, a whole boneless pork loin weighing 10-13lbs (4.5-6 kg) is often available for $13-$17 (€10.75-€14.00) and a whole pork shoulder weighing 7-10lbs (3.2-4.5kg) is typically $7-$10 (€5.76-€8.25).

Part of the reason the meat industry in the United States was able to respond so quickly and effectively to the major disruption of plant closures in March was the tapping of pork from frozen storage. Typically, US frozen Pork stocks rise coming out of January and reach seasonal peaks in April and September after which a draw down takes place before the cycle begins again early in the next year. It is extremely rare for US frozen Pork stocks to fall below 500 million lbs. (226 million kg). Chart 2 reveals the rapid drawdown of frozen stocks as plants began to close, reducing the total supply in cold storage by over 30% in just a handful of months. If cold storage does not begin building again in the next few weeks, we can assume it is being exported at discounted prices.

Exports have been a saving grace this year for almost every major pork producing country that had capacity to export. And it was not just pork. Beef, pork and poultry were all substantially cushioned from the Covid-19 plant impacts by record exports. However, it looks like the thrill is gone for the EU as well, as prices descend from the rarified air to that of mere mortals. It remains a big problem to resist responding to transient profitability with expansion that overshoots the mean long-run increase in demand. Producers take the hit on overproduction and due to the limits of a biological production function, the hits can keep on coming for months and months before changes made today are realized.

Staying 3-5% below packer capacity is the sweet spot which keeps returns reasonable without tempting packers too strongly to reduce capacity but achieving that result is not possible due to the significant gain from individual producer expansion cheating. Coordination and/or integration helps here substantially, and it is why that trend is increasing every year. Prices are drifting down to close out the year and if you look to the futures as a guide for next year, it is boringly normal. This happens when people have no real idea what to expect so they simply go back to the expected patterns which are traced out in “normal” years until something breaks.

In this season of the year, at least in the northern hemisphere, we feel the closing of the old order of things in the winter weather and that gray look outside the window. Everything is seemingly asleep. That sleep belies that fact that beneath the outward appearance, something new is already building and will soon announce itself in an affirmation of new life in greening wheat fields and opening buds. As we wait for that new thing to arrive, I am wishing everyone, especially those hit most hard during this last year, a time of rest and reflection followed by action in the new year that embraces and makes real the hopes we all hold for the coming new year.