In the US, we are about to begin the season of state producer meetings. This is the time of the year when virtually no cropping related activity can take place, so producers get together to hear about the latest developments and share stories. One of the hot topics this year already is bitter complaints about why the packer gross margin is at record levels while producers are taking substantial losses on each head they sell. Those of you who read my Spanish counterpart, Guillem Burset’s articles each month will realize immediately that Spain is having exactly the opposite take place. Hog prices are through the roof in Spain and packer/processors are getting squeezed bad. Why the difference in Spain vs. the US?

First, In the US, there is a mandatory reporting system through the government so that producers can see what the average price the packing industry is receiving at the wholesale level for each of the primal and sub-primal cuts of pork. These cut prices are assembled into a “wholesale carcass price” (notably absent the value of the “drop” or offal). Producers subtract the carcass price equivalent paid to them to calculate the “packer gross margin”. Almost everyone knows packers make more than this for a variety of reasons besides the omission of the drop credit and we may talk about this on a later date, but it serves as a benchmark for historical comparison.

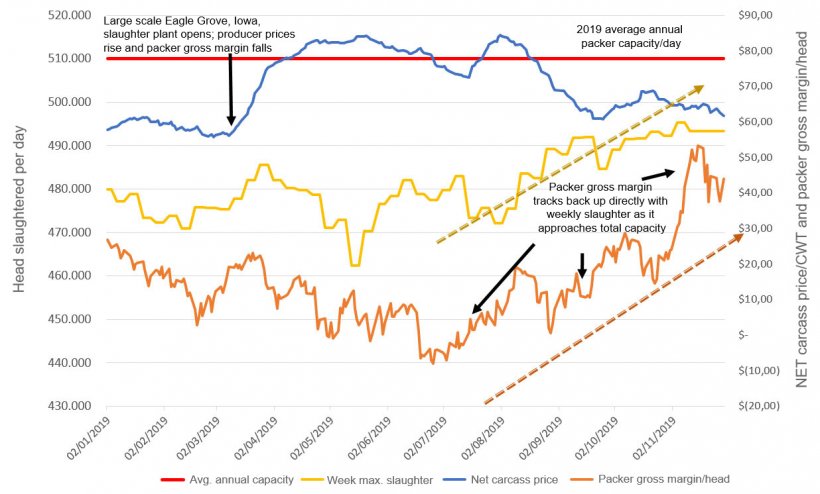

What many producers do not know or realize in the US is that pigs coming to the slaughterhouses have recently broken (once again, and again…) a record in total numbers and numbers crossed with weights, which have been extremely heavy due to relatively cheap feed. This is a brutal combination. Producers have periodically challenged the total capacity of all the packers in the country to kill pigs even with the three large scale plants which opened in the last couple of years. When this happens, even if there were no tariffs and China was begging for every carcass they could get at any price, packers would not have to pay very much at all for the pigs and their gross margin soars (see graph). When it happens in the fourth quarter (which is the most likely time to challenge packer capacity with runs of hogs), it can be especially devastating for hog prices.

Given the rather large temporary demand from China, packers can mark up the meat substantially without increasing hog prices one cent and this is the reason the gross margin for packers has recently been very high. China has not been one of the largest buyer’s of US pork historically but even with tariffs in place, 2019 will be a record year of exporting to China by the US and much more of the meat going there is frozen carcasses vs low value variety meat and offal. This will make for a record in total tonnage and total value. So even with record China sales, production overwhelms the markets.

In Spain, the pig industry is also growing in production, but the supply is not overwhelming available slaughter capacity and so packers are dramatically bidding up prices to drive more hogs toward the slaughter plant and on to China. This is causing some issues with, on the one hand, making handsome profits on exports but not being able to dramatically raise the prices for pork going into domestic retail sales. A variety of factors discourage producers from ramping up supplies too fast in Spain such as opposition to expansion by environmentalists and a very active animal rights movement as well as an economy that has not found its footing since the global recession of 2008. Stagnant income keeps demand from growing locally and clamps a lid on price increases at the local and intra-EU trade. Keeping the supply of pigs under the total domestic and export demand (and/or packer capacity) is the pathway to profits for producers. Since Spain is the number one exporter to China so far, the demand has outstripped the available pigs. They will be wise not to make permanent expansion plans into temporary Chinese demand increases. The opposite is the case in the US.

Another thing to note is that cold storage of pork in the US did not decline at the usual steep pace during the summer seasonal and then has risen dramatically and counter-seasonally in September. When there is a lot of pork going into storage, it becomes separated by time from the current kill and can reap huge profits in the current global demand environment while pig prices are underwater for the producer.

There are several US commentators who believe that the big runs of pigs are almost over (not really going out on a limb there since this happens every year, typically in early January). They are also saying that the coming year will be a big profit one for the US. I am not ready to jump on that bandwagon as USDA just lowered the price forecast for live hogs for 2020 due to oversupply. My best judgment is they were conservative. Regardless of whether you are a producer or packer, vet or any member of any of the service industries to the pork business, this season for many, reminds us that great things often have humble beginnings. All the best to you and yours as we close out another year.