The year ends with a commercial situation that is difficult to manage. We will come back from the Christmas holidays with an important excess of delayed livestock but, one way or the other it will have to be managed. In January we will confirm that the average carcass weights will beat all the records, but we will have to live with that.

The private stocking operation decided by the EU Commission will start on January 4th. It is expected that many operators (mainly Danish and Spanish) accept to freeze cuts from the first day. This market supporting tool should show its effectiveness and help to secure the price of pig at the market floor price where it is now, and maybe to favour a slight rebound.

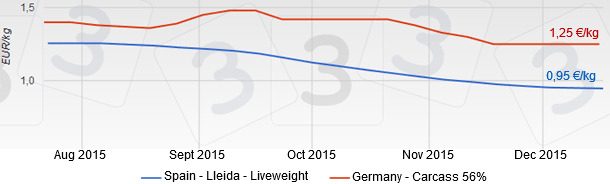

In the last weeks, the Christmas consumption has been faithful to its appointment, especially in the north of the EU. It is nothing to write home about, but it is better than nothing. Germany, the European bandmaster, has repeated price for five weeks and provides a great dose of stability. In order to dream of better prices we must find a bottom from where to rebound. We are very probably there, although Spanish market is, right now, heavier than the German one.

In 2014 the slaughterings increased by 5% in Spain with respect to 2013, and in 2015 +7% with respect to 2014... The processing industry (abattoirs and cutting plants) have made an enormous and almost superhuman effort to export and avoid stagnation. We are exporting almost 50% of what we slaughter (we will end 2015 above 45%), and the more we export the more we depend on what happens overseas. This is the consequence of globalisation, that has already been discussed in this section.

The decision of the US Federal Reserve of raising the interest rates will translate as a higher strength of the US dollar. We are probably heading a euro/USD parity. This circumstance favours us. In the real world of the third countries we are competing against countries whose economy is pegged to the USD (US, Canada, Brazil, etc.). Export, export and export: this is the slogan (and the only solution).

We think that the price will stabilise at the current level, but we do not rule out a slight rise in January. It will not be until several weeks from now that it will be able to raise to more decent levels. Spring will alleviate (partially) the current hardships.

It is Christmas, and it is time for love and peace. Let us make the effort to disengage from the harsh reality and let us enjoy ourselves with our families: we really need it.

I wish you a Merry Christmas and a Happy New Year

Guillem Burset