To start, if we had to give the year 2025 a headline, it would read, "Market driven by tweets." As we saw during Trump’s previous administration, market fluctuations went hand in hand with his prolific tweeting on the social network X, and we believe this trend will continue, especially now that the owner of X, Elon Musk, is part of his team.

We will list the points that we consider fundamental one by one:

- Importance of geopolitics: This is not a new determining factor this year, but it will continue to play a major role. Geopolitical conflicts move the market. Entrenched conflicts such as the Armenia-Azerbaijan conflict over Nagorno-Karabakh, Syria and the fall of the Al Asad regime and the new regime, the proxy conflict in Yemen between Saudi Arabia and Iran (which put at risk one of the most important oil export routes - the Strait of Hormuz). Israel and the fragile ceasefire in Gaza; Israel is a strong ally of the United States, but especially of the Republicans, which will further strengthen its position in the region. Conflicts increase the possibility of breaking supply chains. Conflicts that have been simmering for years and others generated for political gain will set the pace for market fluctuations in the coming months.

- The Russia/Ukraine war: Although it doesn't make headlines, the war continues and with it all the risks it entails for the grain trade. Although for all parties (Russia, Ukraine, and the European Union) it has been vitally important to maintain the grain trade, which is why exports have continued despite the war since 2022, the risks implicit in a conflict zone continue to exist, such as the breakage of the export agreement, price increases, or freight price increases due to the risk of cargoes in the conflict zone. On the other hand, it also remains to be seen how the war will evolve, and the role that the United States (the major financier so far of Ukraine) will play in it since the Republican government does not seem to be in favor of financing the war. It is conceivable that a cease-fire could be forced. In a situation where both sides are showing great wear and tear (both economically and in casualties), Trump's appearance may favor a truce or ceasefire. If this agreement were to include the reduction of sanctions against Russia by the EU, this could favor a drop in grain prices.

- China and Trump's tariff policies: He has not tired of repeating that he considers the current productive distribution with China unfair and detrimental to the interests of the United States, so a trade war is imminent. Placing tariffs on Chinese products (he has even spoken of imposing 100% tariffs) will provoke China to act accordingly by placing tariffs on American products. The Chinese economy continues to slow down and, although the government has so far been able to maintain the markets via stimuli, it is not clear whether they will be enough to influence the markets in 2025, especially given the belligerence shown by the U.S. government towards China. Although it has broken raw material import records, preparing for Trump's arrival in government, if China stops buying raw materials in general, it will drive raw material prices downwards.

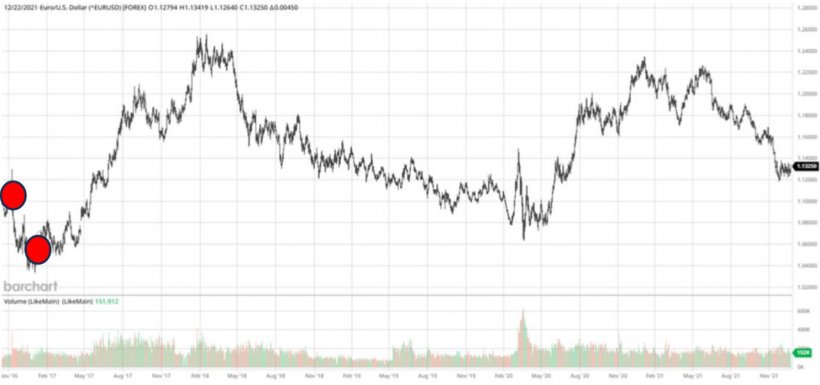

- Euro/Dollar: The currency plays an important role. Trump and his government are in favor of a weakened currency that allows the export of goods, which in turn favors reindustrialization and domestic consumption, in short, they support protectionist policies. Let's look at a graph of his previous government: the first point corresponds to election day on November 8, 2016, and the second to when he was sworn in as president on January 21, 2017. As seen in the graph, the policies they encouraged favored the devaluation of the dollar down to 1.257 €/$. The devaluation of the dollar will favor the competitiveness of U.S. grain and soybean prices in all markets.

Source: barchart.com

- Extreme weather phenomena: In recent years, the proliferation of extreme weather events affecting crops, either in terms of yields, which in turn reduce production, or their quality, has also become a regular occurrence. This factor remains a high risk for 2025.

- EUDR implementation: The implementation of the European regulation against deforestation has been delayed until December 30, 2025, for large companies, pushing back a regulation that is difficult to implement and that adds a significant administrative burden to companies. But it has not been canceled, simply in a few months, we can relive the groundhog year for 2026 purchases.

- Lack of leadership in the European Union: The EU lacks strong and clear leadership, which it needs if it wants to play a predominant role in the world. We believe that, out of necessity, in the face of a government in the United States where the relationship with Europe is not a determining political factor, a leadership that favors greater union may finally appear. Excessive bureaucracy is one of the EU's weaknesses in the short term, in the face of the change in the rules of the game posed by 2025. Less regulation would favor trade in grains and oilseeds, and even benefit the emergence of competition.