Between 2021 and 2022, due to the raw material price crisis, feed prices increased by 34% on average. The increase was especially significant in northern European countries, about 55% in Finland and Sweden. Given that feed costs accounted for between 56% of production costs in Finland and up to 80% in southern Brazil, the impact of higher feed prices on production costs was considerable. On average across all countries, the cost of production increased by 27%. In France, the average cost of feed increased less than in other countries thanks to its self-sufficiency in cereals and the role of feed manufacturers. The energy crisis aggravated by the war in Ukraine had not yet affected French livestock farms which were protected until the end of 2022 by their three-year contracts.

Figure 1. Cost structure of pig production in 2022 (€/kg hot carcass). Source: IFIP based on InterPIG data.

In addition to feed and energy costs, depreciation was another rising expense. Construction prices rose sharply in 2022 (by an average of 47%) as a result of the rebound in demand for materials following COVID and the end of trade relations with Russia, a producer of raw materials used in construction. Rising interest rates further increased construction costs.

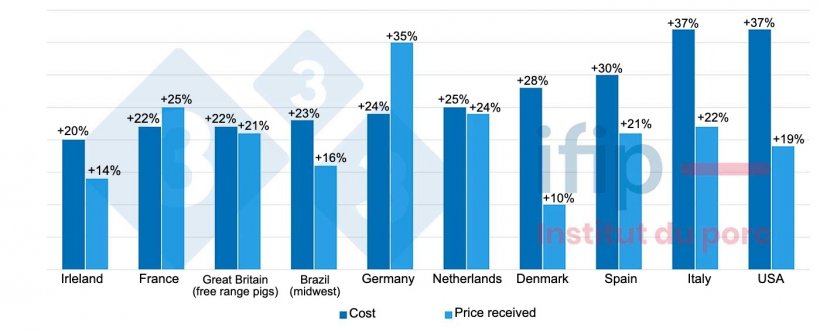

Figure 2. Evolution of cost price and price received (2022/2021): average increase of 27%. Source: IFIP based on InterPIG.

The countries on the other side of the Atlantic produced the least expensive pigs. A gradient then emerged between the countries of Europe. Italy develops differentiated products: its heavy pigs are better valued but much more expensive to produce. In 2022, the cost difference became more pronounced: Italian pigs cost more than twice as much to produce as pigs from midwestern Brazil. In addition to feed costs, the variation in production costs is explained by the price of production factors and the technical performance of the farms.

Labor costs depend on both the hourly cost of labor and productivity. While the Netherlands had the highest labor cost (€27.9/hour), their labor was also the most productive (213 kg carcass/hour). They have optimized buildings and organization to reduce labor time per sow. In contrast, labor costs in southern Brazil while low (€2.8/hour), were also much less productive (64 kg carcass/hour). Brazil, the United States, and Spain showed the most competitive costs in this regard.

Danish sow productivity remained the highest: Danish farmers, specialists in farrowing, weaned an average of 34.1 piglets per sow in production per year. The Netherlands and Germany weaned 32.5 and 31.2 piglets per sow per year, respectively. France reached 30.4 piglets weaned per sow per year (+0.9% compared to 2021). Spain, affected by PRRS, weaned 27.2 piglets per sow per year, a decrease of 2% from the previous year.

Table 1. Technical performance and prices of production factors in 2022.

| Country | Total cost (€/kg hot carcass) | Average feed cost (€/T) | Labor cost (€/h) | Price of farrow-to-finish facilities (€/sow) | Piglets weaned/ sow | FC | Kg carcass produced/hour (farrow-to-finish) |

|---|---|---|---|---|---|---|---|

| Brazil (South) | 1.61 | 406 | 2.8 | 2 911 | 29.7 | 2.38 | 64 |

| USA | 1.81 | 336 | 16.8 | 5 430 | 27.8 | 2.91 | 165 |

| Denmark | 1.86 | 349 | 25.8 | 9 508 | 34.1 | 2.63 | 155 |

| France | 1.92 | 360 | 21.7 | 10 105 | 30.4 | 2.79 | 165 |

| Spain | 2.06 | 416 | 15.5 | 5 955 | 27.2 | 2.69 | 148 |

| Netherlands | 2.08 | 401 | 27.9 | 10 591 | 32.5 | 2.64 | 213 |

| Germany | 2.22 | 399 | 20.5 | 12 863 | 31.2 | 2.83 | 134 |

| Italy | 2.89 | 411 | 15.3 | - | 29.7 | 3.64 | 99 |

Green: particularly favorable factor / Red: particularly unfavorable factor / Black: factor close to the average of the eight countries. Source: IFIP according to InterPIG.

The results, i.e., the difference between the price received and the cost price, were negative in the countries of the InterPIG* network (-0.28 €/kg carcass on average). Only the United States showed a positive result in 2022 (+0.21 €/kg hot carcass). The increases in pork prices observed worldwide were insufficient to cover cost changes. In France (**), the results improved slightly but remained negative (-0.09 €/kg hot carcass), as in Germany, which benefited from a strong increase in incoming prices due to the collapse of pork supply.

In 2023, production costs will remain high for farmers: feed prices will not ease until the second half of the year and will remain high. French farmers will face an increase in energy costs in 2023.

* InterPIG is a network of international experts in pig production.

** Prices received do not take into account the exceptional COVID-related aid received by French farmers.