Firstly, we would like to express our deep appreciation to our readers for their loyalty and consistency: two of our articles appeared in the Top 10 most-read articles in 2023 of the English edition of 333. Thank you so, so much!

The Spanish pig price began the year at practically the same level as it was at the beginning of last year. This is a good situation for Spanish pig farming: the price isn't expected to go down (unless an exceptional event were to occur, which can never be ruled out) and the current price is clearly above the cost price.

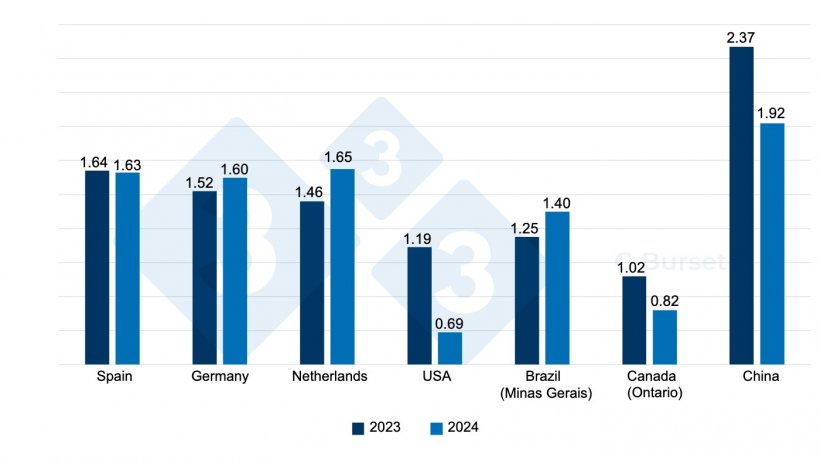

In Figure 1, we compare the initial prices from last year and this year of our main global competitors (we include China because of its importance as the world's leading producer and as Spain's former leading customer).

As we can see, the situations are different and diverse. In Europe, prices remain well above those of America; Germany and the Netherlands remain at very low slaughter levels. In January, it went public that Vion Germany (the second-largest pig slaughterhouse group in Germany) sold a large part of its industrial assets and closed some plants: the restructuring of the German slaughterhouse sector was inevitable. So far, 2024 has already brought us this partial and surprising restructuring of the slaughterhouse sector in Germany.

In the United States, the price has collapsed due to overproduction (the current price is less than 73 cents per kg live: incredible!). Canada behaves as a sort of captive market with respect to its southern neighbor. Brazil keeps its price teetering slightly above its production costs (the price is around 1.20 euros/kg live on average right now). In both the United States and Canada, swine production is in crisis: farmers have been losing consistently for many months (almost a year). As this situation is unsustainable, we believe that there will be a significant herd reduction in both countries in the near future.

In China, the price is weighed down by overproduction. The reduction in the number of sows is underway and seems inevitable. It does not seem that Spain will be able to export large quantities in 2024 to what was our leading customer until recently...

It is clear that the trend that emerged in 2023 will be consolidated in 2024: our most significant destinations will be European destinations to the detriment of Asian destinations. It will be impossible to compete with the United States, Brazil, and Canada in Asia. The European Union will continue in its role as a "Privileged Island in World Pig Prices".

The reduction of herds in Central Europe has favored Spanish production, which has found alternative destinations to Asia there (just in time!). We think that this substitution of pork from other European origins for Spanish pork will be maintained or accentuated in 2024, as we have said.

In Spain, we started the year with record-breaking average carcass weights. According to Mercolleida, the average carcass weight for the first three weeks of January exceeded 95 kg. Despite this, the January slaughter has been very significant, and the excess of pigs that had been delayed after the holidays has been absorbed little by little.

The Spanish swine census from last May provided a revealing fact: in 2023 there were 50,000 more sows in production than in 2022; this figure alone would indicate that in 2024 there will be 1,400,000 more pigs for slaughter than in 2023. If we add to this fact that PRRS has lost virulence and farmers have learned to reduce the density of the barns as an effective prophylaxis, we can assume that barring a catastrophe, some 2,000,000 extra pigs will be available for slaughter. Be that as it may, and no matter how many sanitary problems arise, it seems to us that the overall swine sanitary situation in Spain will be better in 2024 than in the two previous years: if only because it has been so bad (Rosalia) that it can only get better. Everything points to the fact that in 2024 the total Spanish slaughter will be very close (although still below) the 58,600,000 animals (current record) seen in 2021.

Both domestic and imported piglets are now being paid over 100 euros per head. The only possible interpretation of this relevant and overwhelming data is that there is a lack of piglets in Spain and the rest of the Union. By summer there will be a lack of pigs for slaughter in all EU countries. The truth is that we are living in a dizzying situation. Tensions in the market seem to be assured.

With the Christmas season behind us, the dreaded January slump has arrived. Pork is weakening and the slaughterhouse margin is suffering. The future of the Spanish pig prices appears to be linked to the evolution of pork prices. If we rule out massive exports to Asia, we are left with the markets of Central and Eastern Europe: we will see if consumption there maintains a good level. For the time being, pork prices are moving downwards. And spring is still quite a few weeks away.

Let us remember that last year from April to July the slaughterhouses suffered considerable losses; we do not believe that something similar can be repeated. It has probably been learned that with the operating account being resoundingly negative it is better to wait and see rather than strive to slaughter and slaughter.

We will end with a quote from Lewis Carroll (British mathematician and writer): "You can get anywhere if you only walk long enough."

Guillem Burset