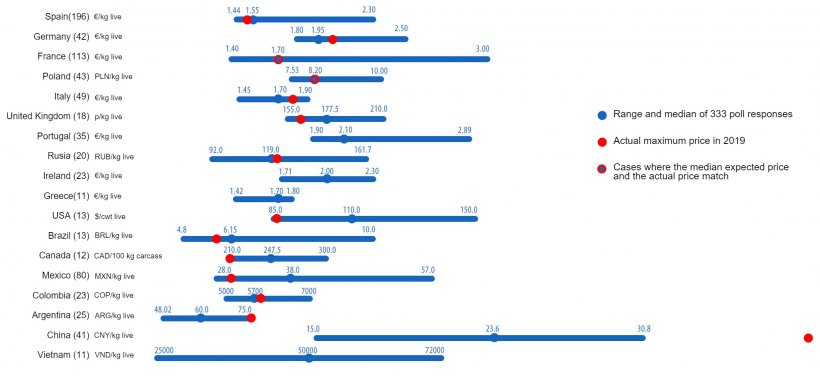

In May 2019, we asked our users what they thought the maximum pig price would be in their respective countries. The responses collected showed clearly optimistic expectations. In most countries, maximum prices were expected to be much higher than those of previous years.

Now that the 2019 year has come to a close, we will see whose prediction came closest to the actual price. The results are presented in Graph 1.

Graph 1. Maximum pig prices in 2019: comparison between 333 users' predictions (May 2019) and the actual maximum price reached during the year. For each country, the range of responses is shown by the blue bar, with the maximum, minimum and median values represented. The actual maximum price in 2019 is indicated by a red dot. The number of analyzed responses is shown in parentheses.

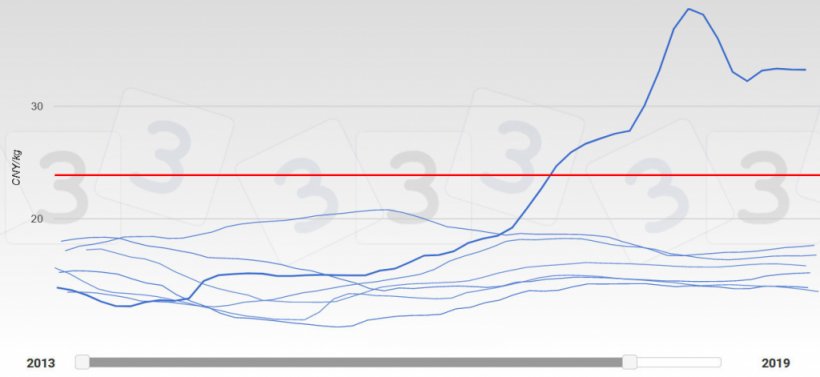

The most striking results were seen in China. It was really very difficult to predict the level that prices would reach in China. The red dot indicates the actual maximum price, CNY 38.71/kg live, which is literally almost off the chart. In May, Chinese users predicted a maximum price of CNY 23.6/kg live (60% less than the actual max price). The country's pig population plummeted due to African swine fever which caused prices to more than double from those of previous years (Graph 2).

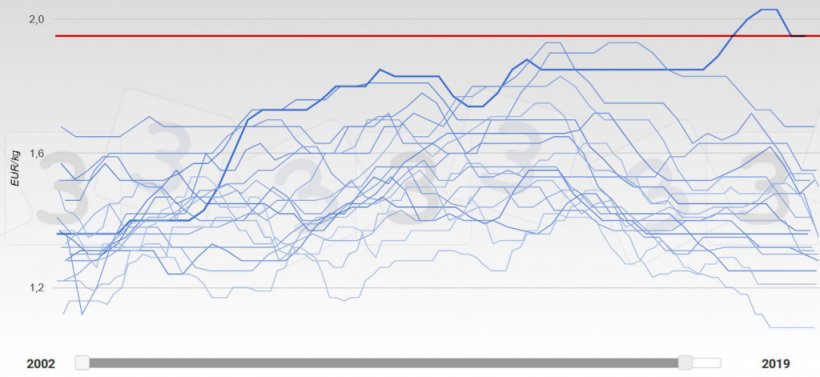

In general, European users' predictions were quite accurate with most countries reporting extraordinarily high prices throughout 2019, prices peaking at different times of the year, and in some cases even reaching historic levels. Visit the 333 markets and prices page for details.

Polish and French users' predictions were spot on, with Spanish and Russian users not far off, while German and Italian users expected prices slightly below the actual price. Predictions from the United Kingdom were furthest off, with user expectations above the actual price reached.

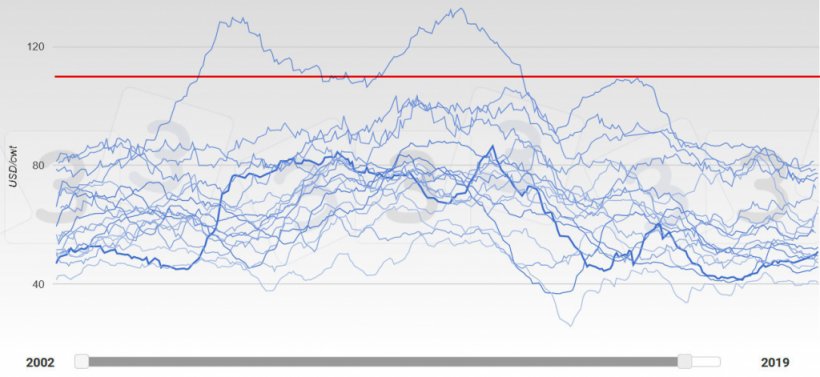

Our North American users were perhaps too optimistic with their 2019 predictions as the actual maximum prices in Canada, the US, and Mexico fell far below their expectations. In Canada and the US, only those users whose predictions were on the lower side of the response range were correct. Despite the differences between market expectations and reality, both Canada and Mexico saw high price levels at various times throughout 2019. The price evolution in the US was radically different, however. There, the volume of pork exports to China increased in 2019 despite trade conflicts, but an excess supply caused by increased production brought prices to extraordinarily low levels at the end of the year (Graph 5).

Brazilian and Colombian users came very close to the actual maximum prices with their predictions as well. The volatility of the Argentinean economy led to prices well above that expected by users of 333. Prices rose throughout the year, reaching 75 ARG/kg live (which is 50% higher than the maximum price in 2018).

This year, we want to do a more realistic poll. Instead of asking about the maximum price, we will ask you what you think the average pig price in 2020 will be in your country. Will it be higher than that of 2019? How much longer will ASF take its toll on the markets? Will markets feel the effects of the COVID-19/coronavirus epidemic?

We'd value your opinion and encourage you to participate in the economic question of the year: What will be the average slaughter pig price in your country in 2020?

333 Staff