The weather in May has definitely not aided pork prices in Europe. In Central Europe, the sun has been conspicuous by its absence and the anticipated barbecue season is proving to be weak and has not boosted pork. At the beginning of June, the barbecue season is ending and consumption has fallen very short.

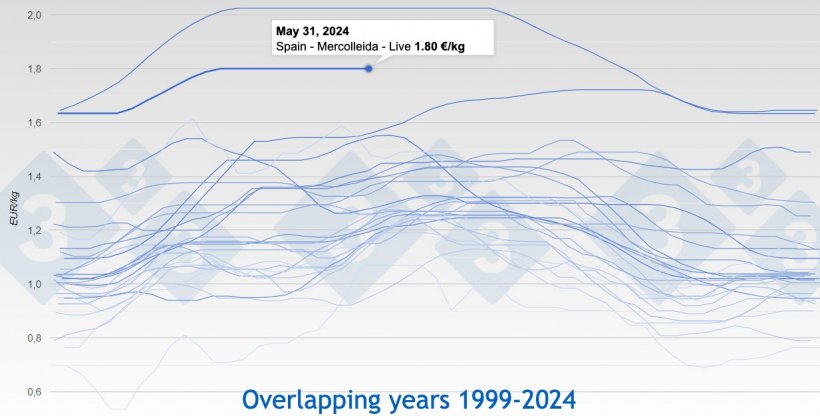

Spain's reference market price has stayed the same week after week throughout the month, unable to find sufficient reasons for a change of scenario. Producers' insistence on raising the pig price has met a wall of resistance in slaughterhouses due to the impossibility of raising pork prices. We must remember that the Spanish price in May was at the top of the European podium: it would be difficult to go up (either gently or vigorously) when our closest competitors are cheaper... Let's not forget, moreover, that the average carcass weight is still at record levels, which is not conducive to increasing prices. Not even yesterday, in the market session that set the price of the once mythical week 22, was it possible to change the price. In any case, it seems clear to us that the price will rise, as we comment below.

Summer is approaching and with it comes a change in consumption habits (grilled meats are preferred to stews). In addition, inflation is unforgiving and consumers' purchasing power has declined. In Germany, pork consumption is estimated to be 4% lower than last year... The war conflicts around us (Gaza and Ukraine) generate insecurity and do not favor consumption.

Asian markets are still very apathetic... except for pork bellies, an item in which Japan and Korea have been very interested lately (contracts have been closed at record prices for a few months). For the slaughterhouse, the rise in bellies balances the falls in ham, whose price on the continent is falling, influenced by the arrival of the ASF to the ham nucleus of Parma (Italy), as mentioned in this section a month ago.

On May 21, the Spanish Council of Ministers approved an important Royal Decree: 496/2024. This Royal Decree allows processed animal proteins derived from poultry to be used in pig feed. We are pleased that this possibility is finally a reality. Being able to access an alternative source of proteins will be positive for our livestock, there is no doubt about that. This is very good news. Great news. Clearly the news of the month.

The relative position of our prices among our world competitors has hardly changed: prices in both the United States and Brazil remain where they were, and pork from those origins continues to enjoy an undoubted comparative advantage in world markets. We have to continue to deal with this.

Where there have been significant changes is in the price of some feed raw materials: global instability and doubts about Ukraine's future export capacity have pushed wheat prices higher (up 30% from April to today). Everything seems to indicate that the new prices are here to stay.

Thus, we face the summer with some mysteries to solve, namely:

- Are the 140,000 “new” sows in Spain (November 23 vs. November 22 census) already in full production? If so, about 70,000 more pigs per week would be expected to be available for slaughter.

- Will slaughterhouses continue to “slaughter at all costs,” or will they slow down if their margin vanishes? We are inclined to the latter hypothesis.

- Will China continue to be apathetic in its purchases or will we start to notice that their huge sow liquidation is translating into less local supply? That would be the million-dollar question. Maybe by the end of the year, things will happen.

- Will PRRS continue to scourge our piglet population, or are defense protocols working and the virus has lost virulence? In any case, PRRS has been at large in Spain since 2022 (its effects began in the second half of the year when weekly slaughterings were suddenly reduced) and it is already part of the picture, it is in the landscape.

Our reference market price will very likely rise in the short term. Tradition dictates it. Summer and its torrid temperatures delay growth. We believe the upward trend will be shortlived (or very shortlived, depending on who you ask).

2024 is confirming a change of scenario that was easy to predict: our exports to Third Countries are decreasing while they are increasing to other EU members. Spanish pork is replacing that of other EU countries whose pork production is or has been in decline. Right now more than 50% of Spanish exports go to European countries.

This year has been a very good one for Spanish pig farming. No storm clouds can be seen that could disturb this good progress. Pigs are worth much more than the cost of producing them, slaughter flows continue at a good pace, and nothing seems to threaten the current bonanza.

Processors (sausage manufacturers) remain unable to pass the totality of the increased raw material prices onto the prices of their final products. This situation has continued for over two years (since the upward spike in February and March 2022). In any case, many manufacturers manage to stay afloat by cutting costs, negotiating cent by cent with their customers (overcoming, when possible, the resistance of large retailers), gritting their teeth, and balancing.

We will end with a quote from the great Magnus Carlsen, former world chess champion (he relinquished the title voluntarily last year): “You need to have that edge, you need to have that confidence, you need to have that absolute belief that you're the best and that you'll win every time."

Guillem Burset