Groundhog day? (Four months of the same)

The Spanish pig price can only go down. The million-dollar question is when.

The pig sector events all around the world

Weekly newsletter with all the pig333.com updates

Swine industry news in your email

Pig health: news and articles on PRRS, PCV2, biosecurity, etc, Pig disease guide, atlas of pathology, clinical cases…

Biocheck.UGent is an independent, risk-based, scientific scoring system for assessing the quality of your on-farm biosecurity.

A visual and practical step-by-step guide on how to perform a necropsy on a pig.

All the information about ASF: how to recognize the disease, how it is transmitted, pictures of lesions, latest news, guides, etc.

All the information on Foot and Mouth Disease in pigs: how to recognize the disease, how it is transmitted, images of lesions, latest news, guides,...

Description of the most important diseases and conditions in pigs

Images of major swine diseases

Pig disease diagnostic tool

Definition for the most commonly used pig terms

Simulator that calculates the amount of drug to add to the water when using a flow dispenser.

Weekly newsletter with all the pig333.com updates

Pig Prices by countries. Pork production and trade. News of the pig market and the raw materials

The latest slaughter pig prices in the most important pig markets. Check the evolution of the historical prices in charts and in several currencies.

Latest quotations for the main commodities used in pig feed. Historical graphs with the pig price and estimated feed price.

Figures & trends in pig numbers, pork production and pork trade.

Global production and trade data for the most important raw materials

Weekly newsletter with all the pig333.com updates

Articles on nutrition and pig feeding, characteristics of raw materials and additives for pig feed. Prices of raw materials

Latest quotations for the main commodities used in pig feed. Historical graphs with the pig price and estimated feed price.

Technical sheets of the main raw materials and additives used in swine feed. They include a comparison of nutritional values from various sources, product

Global production and trade data for the most important raw materials

Definition for the most commonly used pig terms

Use this tool to diagnose problems with the feed conversion ratio. Click on the flowchart or on the buttons within the text to navigate through the different parts of the tool.

A biweekly newsletter with the latest developments in swine nutrition

Articles on genetics and pig reproduction: genetic improvement, genomics, artificial insemination, use of hormones

Compare production data, calculate the number of sow, nursery, and finishing spaces, and visualize your tasks on the work schedule by type of BMS.

Tool that allows you to calculate the replacement rate in your farm

Definition for the most commonly used pig terms

Use this tool to find out why your farrowing rate is less than ideal. Click on the flowchart or on the buttons found within the text to navigate through the different parts of the tool.

Weekly newsletter with all the pig333.com updates

Management, pig farm management, work planning in each production stage: management in gestation, grow finish, batch farrowing

Compare production data, calculate the number of sow, nursery, and finishing spaces, and visualize your tasks on the work schedule by type of BMS.

Tool that allows you to calculate the replacement rate in your farm

Definition for the most commonly used pig terms

Weekly newsletter with all the pig333.com updates

Design of facilities and equipment for pig farms: building design, climate control, feeding systems, etc.

Biocheck.UGent is an independent, risk-based, scientific scoring system for assessing the quality of your on-farm biosecurity.

Environmental Footprint Calculator along the pork value chain.

Definition for the most commonly used pig terms

Simulator that calculates the amount of drug to add to the water when using a flow dispenser.

Use this tool to explore which slurry management strategy best fits your situation. Click on the flow chart or on the buttons within the text to navigate through the different parts of the tool.

Weekly newsletter with all the pig333.com updates

What makes us stand out is the quality and independence of our contents. Find out about the authors who make it possible. Our goal is to generate a virtual community of advanced users in the sector.

He was born in Cassà de la Selva (Girona) on July 7th, 1953

He is Agricultural Technical Engineer (he obtained his technical certificate from the School of Barcelona in 1973), although he has never worked as such.

Guillem Burset started his professional path as manager at the company Jaume Abras, S.A. (a pig meat butchering room) where he remained from 1977 to 1989. In those days he was elected President of the FECIC (Meat Industries Catalan Federation), holding this position from 1986 to 1989.

In 1990 he worked as manager at the Spanish delegation of the multinational Danish company ESS-FOOD which, at that time, was the first pig meat trading company at a worldwide level. He remained at ESS-FOOD Spain until December 1993.

In 1994 he was founding partner of the company Grup Unexporc, S.A., which was born with the aim of exporting Spanish pig meat. Grup Unexporc, S.A. is one of the leaders in this activity, based on the production of its major shareholders: Cárnica Batallé and Matadero Frigorífico Avinyó.

In 2005, Guillem Burset left Grup Unexporc, S.A. in order to create his own international pig meat trade company.

During the course of his professional career he has participated in several congresses as a speaker, always talking about the pig meat world trade (Pfizer Forum, UAB, Europorc…)

Guillem Burset is a chess enthusiast.

Updated CV 03-Oct-2013

The Spanish pig price can only go down. The million-dollar question is when.

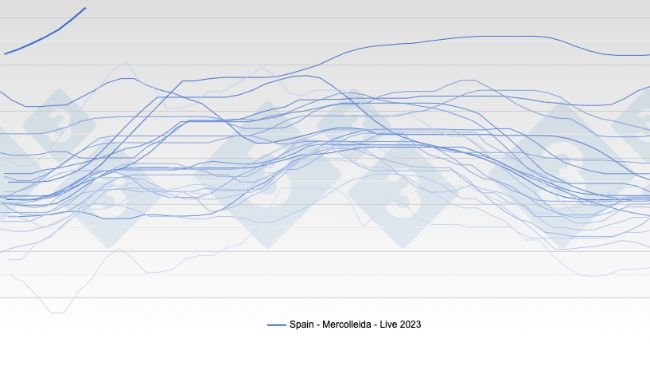

Mercolleida has had the same price for the 13th time in a row. Spain continues to have the most expensive pig price in the world in what is now known as the "Spanish Miracle".

What implications do current hog prices in Spain have for exports and slaughterhouses? How will we manage the typical reduced supply in the summer, exacerbated this year by PRRS?

Slaughterhouses will suffer a very complicated summer; in addition to the normal lack of pigs, there will be the absence of hundreds of thousands of piglets, victims of PRRS. Sooner rather than later, we will only be able to slaughter just four days a week.

The self-sufficiency rate of pig production in the EU will tend to decrease, approaching 110% instead of 125% as it has been until recently. Burset reviews the situation in the leading countries.

We are witnessing a reconversion of the industry. We have seen a string of all-time record hog prices and now pork prices for processors are also rising, but large-scale distributors are only willing to raise prices in dribs and drabs.

What is happening with Spanish pig prices? Guillem Burset explains this anomaly in the international market.

Guillem Burset analyzes the swine market in 2022 and shares his forecasts for the coming year.

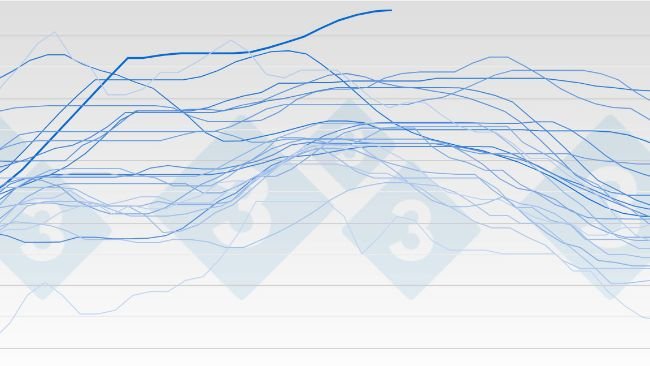

While pig prices and inventories are falling in most of Europe, we see the center of gravity of European pig production shifting relentlessly to the southwest of the continent.

Again with China? Didn't they already recover their inventory after ASF? Burset clarifies the situation and analyzes how it will affect us.

After assessing the international situation, Burset forecasts the beginning of the price drop for Spanish pigs, which will continue until the beginning of 2023.

Summer has been hellish with skyrocketing costs, slow rising pig prices and "anchored" pork prices. Guillem Burset analyzes the current situation in the swine market and predicts what the coming months will bring.

Never before had the Spanish pig price reached 1.689 €/kg live... What will happen in autumn?

Guillem Burset analyzes the current situation of the Spanish swine industry in the European and world market and gives us clues about what may happen in 2023.

After several weeks of stable prices in Spain due to the fight between slaughterers and producers, the Spanish pig price finally went up. Guillem Burset forecasts what will happen now.

Guillem Burset analyzes the current situation in the European swine market, which is entering uncharted territory: skyrocketing prices, exports threatened, prices of raw materials and energy going through the roof, a lack of pigs...

Welcome to 333

Connect, share, and interact with the largest community of professionals in the swine industry.

Celebrating 195452Users on 333!

Sign upAlready a member?