![]() Pfizer’s spun out Zoetis, the most renowned name in animal healthcare industry, has set another milestone in the animal health fraternity by its acquisition of Nexvet, an Irish biological therapeutics company. The pact has further strengthened Zoetis’ position in animal healthcare market by building a strong solution pipeline for the company to sustain its leadership in chronic pain management for companion animals. This trend itself bears a testimony to the fact that the escalating pet ownership rate is indeed creating a remarkable impact on animal healthcare industry trends.

Pfizer’s spun out Zoetis, the most renowned name in animal healthcare industry, has set another milestone in the animal health fraternity by its acquisition of Nexvet, an Irish biological therapeutics company. The pact has further strengthened Zoetis’ position in animal healthcare market by building a strong solution pipeline for the company to sustain its leadership in chronic pain management for companion animals. This trend itself bears a testimony to the fact that the escalating pet ownership rate is indeed creating a remarkable impact on animal healthcare industry trends.

Increasing companion animals adoption rate ~ Animal healthcare market growth

As per the estimates, more than 65% of the U.S. households have pets, a number that is projected to increase exponentially over the coming years. U.S., on this ground, reveled the largest share in the animal healthcare industry in 2016. The region is further claimed to exhibit commendable growth prospects in the coming timeframe, driven by technology breakthroughs in pharmaceuticals and veterinary medicines sectors. China will further establish strong foothold in animal healthcare industry, driven by favorable government norms supporting pet keeping coupled with advancements in veterinary drugs. As per the estimates, China is estimated to register a CAGR of 10% over the period of 2017-2024.

Changing animal husbandry trends to dynamically influence animal healthcare market demand

The technological innovations have led to a paradigm shift in the animal husbandry pattern. The animal health companies have also embraced this change which is vividly reflected in their business approach which has traversed a long way from therapeutics, to productivity enhancement, and ultimately to the overall animal healthcare.

India, on account of intensive animal husbandry practices, is slated to witness phenomenal gains in animal healthcare market. As per the estimates, the country accounts for 10% of the overall livestock population and holds the title of the largest producer of fish, chicken, and cattle. The region on account of its rich livestock base is rapidly turning into a profound investment destination for the animal healthcare industry players.

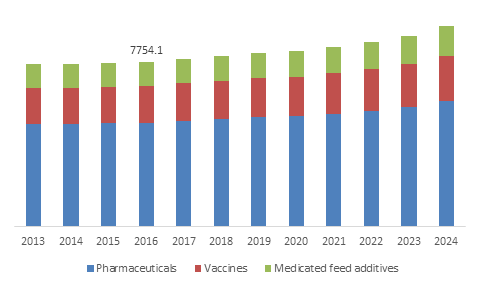

Europe Animal Healthcare Market, 2013-2024 (USD Million)

Increasing global population to chart a lucrative roadmap for animal healthcare market

With the rising population, the global meat and dairy consumption rate is set to increase parallelly. It is estimated that in order to feed the world in 2030, the overall animal protein production has to be increased by approximately 30% from what it is at the present. This scenario vividly demonstrates the importance of veterinary drugs and medicines in animal disease prevention and animal health management approach.

Europe, driven by France and U.K., is anticipated to witness a high demand for animal derived pharmaceutical proteins over the coming years, which will indeed make this region a strong ground witnessing animal healthcare market expansion. As per the estimates, the region held 25% of the overall market share in 2016.

M&As, collaborations, geographic expansion, and R&D to underline animal healthcare industry strategic landscape

Over the years, this industry has strongly been characterized by product innovations, geographical expansion, R&D, and collaborations. Pertaining to this, some of the prominent moves with regards to this fraternity are as listed under:

- In 2015, Eli Lilly and Company acquired Novartis Animal Health for a deal valuation of USD 5.4 billion which reinforced the former’s health division, Elanco’s position in the global animal healthcare market space by enhancing its global commercial presence and R&D capabilities.

- In Jan 2017, the animal healthcare industry registered one of the biggest deals with the collaboration between Sanofi and Boehringer Ingelheim (BI). The deal which was initialized in 2015 was finally closed in Jan this year when Sanofi’s animal health business, Merial was acquired by BI while Sanofi took over the latter’s consumer healthcare business. The deal made Boehringer Ingelheim the world’s second largest animal health company.

- In Jan 2017, Elanco acquired BI Vetmedica, Inc’s U.S. portfolio of feline, rabies, and canine vaccines under a deal value of USD 885 million.

- In July 2017, Zoetis acquired Nexvet, a Tullamore based animal therapeutic company, to develop a pipeline for monoclonal antibody therapies for companion animals.

- Recently, MSD Animal Health, also known as Merck Animal Health, declared its plan to purchase a new manufacturing facility in Austria so as to expand its global vaccine manufacturing capacity.

- Lately, Creso Pharma in collaboration with Virbac, a renowned pharmaceutical animal health company announced to launch hemp-based animal feed products in Switzerland.

Technological innovations to draw the future landscape of animal healthcare market

Traditional strategies might no longer serve the purpose for animal healthcare industry participants over the coming technology-driven years. With the regulatory barriers subsiding gradually, the competition is getting rather intense. In this scenario, it is a must for the animal health companies to revise their business models and approach in sync with the evolving environment. Digital technologies, in this regard, can be a potential platform to enhance the service and product portfolios of the companies. For instance, since 2016, Merial has collaborated with Georgia Institute of Technology’s Center for the Development and Application of Internet of Things Technologies to explore ways in which IoT can help in advancing animal healthcare.

Zoetis is also seeking the help of digital technologies to deliver values to its customers. The firm is participating in a U.K. based project to develop visual imaging means to aid the farmers with enhancing their production efficiency.

With these innovations, it is rather undeniable that the animal healthcare industry is all set to witness commendable gains in the ensuing years. As per the estimates, the global animal healthcare market recorded a valuation of USD 26 billion in 2016 and is slated to surpass USD 36 billion by 2024.

July 13, 2017 - Global Market Insights, Inc.