An Update on Taiwan’s Swine Production

Taiwan, with a population of about 23.4 million, is a relatively small island nation located close to China's east coast. While Taiwan has been successful economically, its agriculture represents only 1.5% of its GDP. That doesn’t prevent the country from having one of the highest rankings in terms of meat consumption: 43kg of poultry meat per person and per year (50% of the total) and about 35kg of pork.

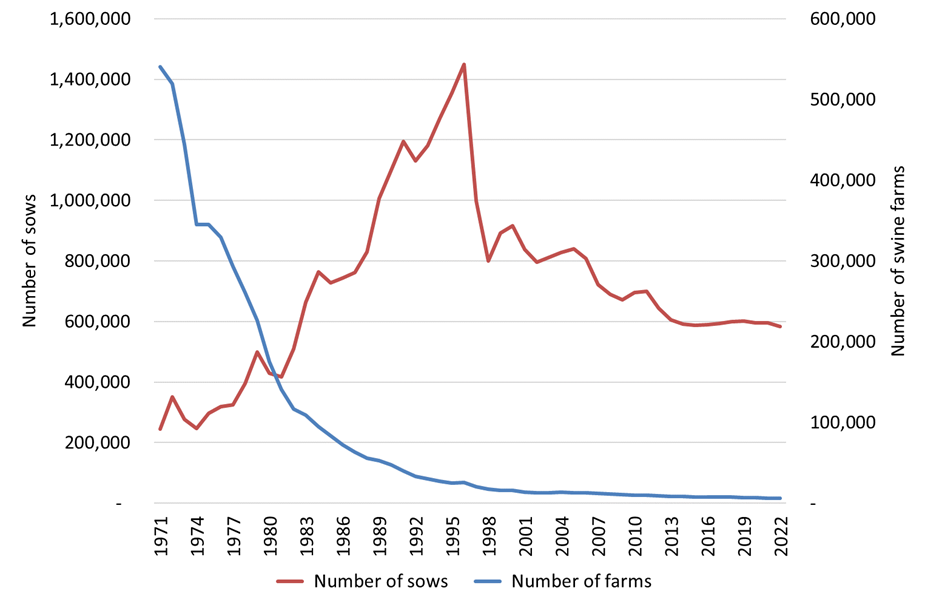

Data on swine production supplied by the Council of Agriculture shows that the number of swine farms dropped by 99% in the last 40 years, while the sow population multiplied by 2.4 times during the same period. However, the number of sows present in Taiwan’s swine farms today is only 40% of what it was in 1996. Since then, it has been dropping year after year and has more or less stabilized since 2013 (see Figure 1).

Figure 1: Number of swine farms and sow population in Taiwan since 1971

The turning point was 1997, when Taiwan experienced a significant setback in its pig industry due to outbreaks of foot-and-mouth disease (FMD) caused by live piglets smuggled from mainland China. Before that, Taiwan used to be the second-largest exporter of pork products in the world, exporting meat to Japan and other neighbouring countries. At the same time FMD happened in Taiwan, Classical Swine Fever (CSF) also hit the Netherlands, and the two important players’ inability to export led to a historical jump in pig prices. But soon, as other countries increased their production, the surplus of pigs in the market resulted in a global price collapse. And since then, because it lost the ability to export (it was only in 2020 that Taiwan was officially recognised as free from FMD without vaccination), Taiwan's pig industry has faced challenges and uncertainties. Today, Taiwan is 90% self-sufficient and has to import pork meat, mainly from Europe and Canada.

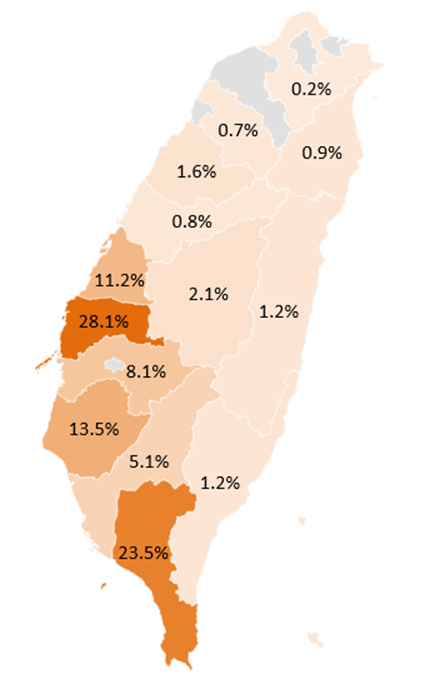

As shown in Figure 2, there are six major counties producing pork in Taiwan. Yunlin (the centre west of the island) and Pingtung (the south west) hold more than 50% of the total sow population. The remaining four areas are Tainan (13.5%), Changhua (11.2%), Chiayi (8.1%), and Kaohsiung (5.1%). In terms of pig population, the largest farms (5,000 heads or more) represent only 2% of the total number, but they raise 22% of the pigs. It should also be noted that there are still a lot of small players: farms with fewer than 100 heads account for 24% of the total, but they produce less than 1% of the pork meat in the country. However, a survey made at the beginning of 2023 indicates that 15% of the owners of those small farms plan to decrease or stop their production.

Figure 2: Geographic distribution of the number of sows in Taiwan

Most swine farms in Taiwan are privately owned and based on the farrow-to-finish model. In terms of genetics, they usually raise Landrace x Yorkshire x Duroc pigs, but some farmers produce the indigenous "Taiwan black pig", a branded and premium product, tastier but also more expensive to produce. The demand for the meat of black pigs cannot be met by the current supply of about 650,000 heads per year, or 8% of the total number of pigs slaughtered in Taiwan.

After a difficult 2022, Taiwan's hog prices are higher in 2023, and profit is back. At the time of writing this article, the average weight at slaughter was 128kg, and the price per kg was NT$ 90 (€2.73), compared with a cost of production of around NT$ 71 (€2.15) in 2021. A drop in production, caused by high input costs and productivity challenges, explains this increase in prices.

Unlike most of its neighbours, Taiwan is still free from African Swine Fever (ASF), but its hot and humid climate makes it harder to prevent illnesses, especially because biosecurity needs to be improved on many of the farms. Pork producers have to deal with infectious diseases such as porcine reproductive and respiratory syndrome (PRRS) and porcine epidemic diarrhoea (PED), which have a tremendous impact on productivity. We can estimate that, on average, 35% of the pigs born are lost before slaughter. As a consequence, the number of pigs sold per sow and per year is just above 16.

Another challenge is the fact that Taiwan imports about 90% of the raw materials used in animal feed and depends on global prices. Last but not least, manpower remains in short supply.

Recently, the industry has been encouraged to improve its competitiveness through strategic business alliances and better marketing, and the government has launched programs to counter the aging and retirement of pig-raising farmers. In 2021, Taiwan’s government announced an investment plan (the "Comprehensive Transformation and Upgrade Plan of the Pig Industry in Response to Trade Opening") of NT$ 13 billion (€400 million) to increase the competitiveness of the pig industry, enhance the quality of domestic pork, mitigate environmental impacts, and expand pork exports. These efforts include measures such as regulating the domestic pig market to maintain reasonable prices, implementing compulsory pig insurance to reduce business risks for farmers, and providing subsidies for pig farm renovations and investment in pollution prevention.

The plan also focuses on improving hygiene standards and raising high-quality pigs, establishing slaughter and freezing plants, supporting the adoption of temperature control equipment for transportation vehicles, and promoting the upgrade of traditional temperature control equipment in meat stalls. Additionally, the Taiwan authorities have engaged in negotiations regarding export conditions and procedures while focusing on expanding overseas markets and offering incentives and subsidies to boost export growth by more than 20 percent.

A practical example of the implementation of this modernisation plan is the case of Taiwan Sugar Corporation (TSC), a state-owned company founded in 1946. Originally a sugar producer, TSC has diversified its business into various fields, including agriculture, tourism, and biotechnology. With about 20,000 sows, it is one of the main players in swine production.

In the last few years, TSC has started to transform its 13 traditional pig farms into "modern circular piggeries". This means moving from the farrow-to-finish model to a multi-site one, using buildings equipped with negative pressure ventilation, water curtains for cooling and odour control, temperature climate control, and automated feeding systems. Specific investments are also made to save water, convert pig manure into biogas and produce electricity with rooftop solar panels, aiming towards a “sustainable operating model for zero-waste and zero-pollution”.

In conclusion, Taiwan, once a major exporter of pork meat, has to deal with multiple challenges if it wants to become competitive again in the global market. The recent investments and incentives might finally mean a brighter future for Taiwan’s swine producers.

Welcome to 333

Connect, share, and interact with the largest community of professionals in the swine industry.

Celebrating 154653Users on 333!

Sign upAlready a member?