According to USDA's Agricultural Projections to 2029, slowly increasing corn prices and mostly flat hog prices during the projection period lowers the hog feed price ratio (hog price/corn price), causing the initial growth in farrowings to reverse in the second half of the projections period. However, continued gains in pigs per litter and growth in hog carcass weights continue the upward trend in pork production.

While pork and beef production has been roughly equivalent in recent years, pork production is expected to exceed beef production for most of the projection period, peaking at just over 32.1 billion pounds in 2029, compared to 29.5 billion pounds for beef.

Pork production is expected to continue to grow, but at a slowing pace, and exports are expected to represent about one-third of production by 2029, contributing to a decline in per capita consumption in the U.S. during the latter half of the projection period. The overall decline is 2.2 pounds per capita between 2021 and 2029, ending at 49.4 pounds.

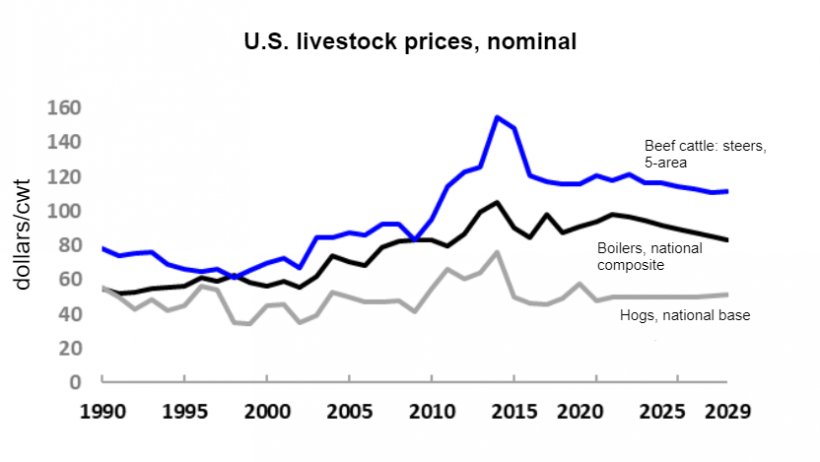

Large supplies of pork reflecting the rapid increase in pork production in 2019 and 2020 are expected to pressure prices down in 2021, with prices falling to about $48 per hundredweight (cwt) before a combination of slowing production growth and gains in exports lifts them. Prices are expected to hold steady at close to $50 per cwt most of the projection period.

The United States is expected to maintain its position as the second-largest exporter of pork behind the European Union (EU) between 2020 and 2025, and then become the leading exporter during the remainder of the projection period. Production efficiency gains in the hog sector continue to enhance the sector’s international competitiveness, and the presence of African Swine Fever (ASF) in China and other markets is expected to fuel increased global import demand for U.S. pork.

February 2020/ USDA/ USA.

https://www.ers.usda.gov/