About the situation in China

“ASF is creating significant uncertainty in key areas, such as China’s herd numbers and the outlook for 2021, especially for the sow population, but also on China’s pork production and pork prices,” explains Justin Sherrard, Global Strategist – Animal Protein for Rabobank.

While Rabobank believes pig supply will generally increase in 2021, prices are expected to fluctuate due to the uncertainties of disease development, restocking interests, feed costs, and import policies. “Our view is that average hog prices in 2021 will be lower than in 2020 and subject to strong ups and downs during the year,” says Sherrard.

As China’s economy is expected to recover further from Covid-19 impacts in 2021, this will support foodservice demand and institutional consumption, as well as household consumption. As pork prices will soften from the high levels of 2020, they will get support from improved demand.

About the situation in Germany

The ongoing pressure from ASF’s spread in Germany is also significant, and while progress has been made in containing the disease, more work is needed. The situation in Germany has implications for other parts of Europe as well.

“After the ASF outbreak in Germany was confirmed in September 2020, ten countries imposed import bans on German pork, including China, Japan, and Vietnam, leaving about an extra 70,000 metric tons of pork on the EU market each month,” according to Sherrard. Although a number of countries recently relaxed import bans on German pork, the import ban by China will likely remain in place for 1H 2021 at a minimum, as the situation is still evolving.

The outbreak has already had a significant impact on piglet and live pig imports to Germany, and lower live animal imports will likely continue in 2021. From September to November 2020, piglet imports from Denmark and the Netherlands, the two major suppliers of piglets to Germany, dropped by 25% and 31% respectively compared to the same period in 2019. This represents a total of 0.7m less head imported to Germany, approximately 1% of total slaughtered animals in 2020.

About the impact on world pork trade

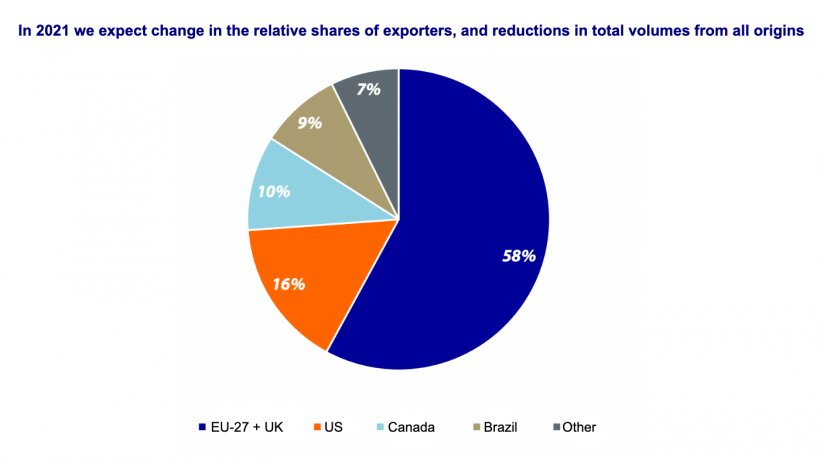

The implications of ASF for world pork trade are a major swing factor in global pork markets. China’s booming import demand for pork and other species was a major demand driver in global animal protein markets in 2020, but Rabobank anticipates China’s pork imports will decline in 2021. “At the same time, we see all exporting countries looking to maintain trade with China. Price will be one major factor that determines which countries will maintain high pork trade flows to China in 2021, along with availability and geopolitical considerations,” concludes Sherrard.

From the Rabobank report: African Swine Fever: A Global Update – Ongoing Change in Global Pork Markets in 2021

March 16, 2021/ Rabobank.

https://research.rabobank.com/