Swine production

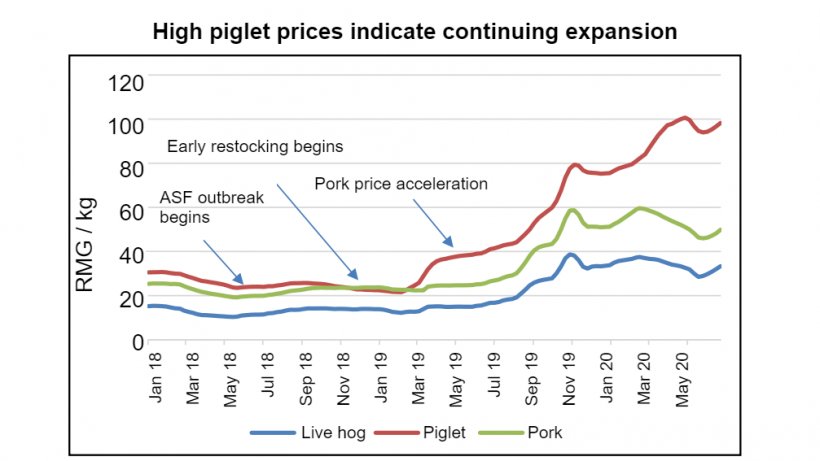

The number of official ASF cases reported by China declined significantly since the second quarter of 2020. Investments in biosecurity and supply chain measures, taken primarily by larger swine companies, have been largely effective in controlling the spread ASF. Additionally, the government’s policy support has positively stimulated swine recovery, resulting in continuing growth of sow and live pig inventories in the first half of 2020. This expansion is forecast to continue in 2021.

Beginning sow inventory for 2021 is forecast at 31 million head and 2021 ending hog inventory is expected to be up at 370 million head, equivalent to over 80% of pre-ASF levels.

Pork production

While pork production in 2020 will remain low at 38 million metric tons due to weak domestic demand, it will increase by 9 percent in 2021 to 41.5 million tons as the swine inventory recovers.

Pork imports

Record pork imports in 2020 (4.3 MMT) will retreat by 14% in 2021 to 3.7 MMT due to increasing domestic supplies. COVID-19 continues to directly and indirectly constrain pork imports, including the Chinese government taking regulatory action against foreign facilities. China’s opaque policies towards imported meats will create a significant amount of business uncertainty among the meat industry.

August 7, 2020/ USDA/ United States.

https://apps.fas.usda.gov/