Demand growth is slowing, and the industry is changing in response—and it needs to. Growth in production and consumption offers opportunities for China’s producers and for global traders.

As China's economy slows, animal protein demand growth is following suit, but additional demand each year is still big in absolute terms. According to Chenjun Pan, Senior Analyst Animal Protein: “On the supply side, pork production will be reshaped, while poultry production faces uncertainty, and beef production will likely drop. As a consequence, meat imports are expected to increase steadily, further cementing China's role as the world's most significant meat importer.”

In the coming years, additional production will mainly occur in the north and north-east, while in the south—where rivers and lakes are located—further development of pork production will be restricted.

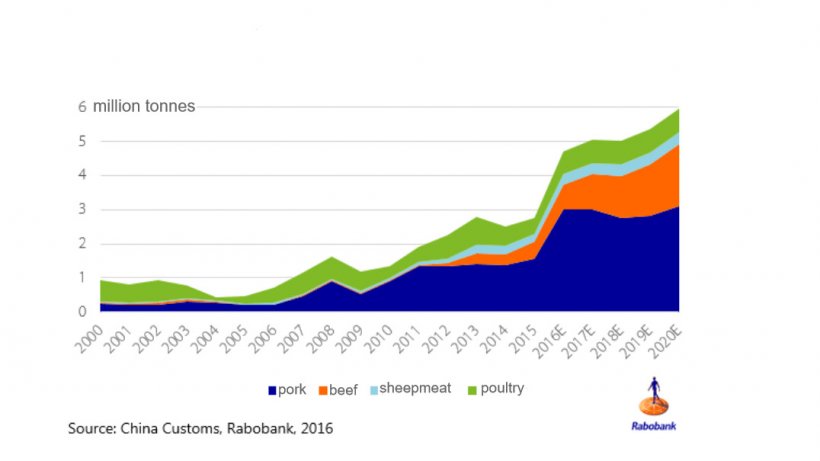

China will cement its role as the number one global meat importer

Meat imports are expected to increase steadily in the coming years—across beef, pork, and poultry—reinforcing China’s position as the world’s most important meat trader. As total meat imports to mainland China reach over 6m tonnes in 2020, China will become—if it is not already—the main focus for meat exporters everywhere.

Two important questions arise from this increasing focus. The first is how China will look to influence global meat trade, given its dominant role. The second is how animal protein companies will look to establish a sustainable supply chain to meet China’s evolving market needs.

Thursday March 2, 2017/ Rabobank/ The Netherlands.

https://www.rabobank.com