China is the world’s largest producer and consumer of pork. China produced 57.06 million metric tons of pork in 2024, accounting for approximately 48% of the world total. By the end of 2024, the national pig inventory stood at 427.4 million head, of this the sow inventory reached 40.78 million, a decrease of 640,000 head year-on-year.

The number of swine operations slaughtering more than 500 head of hogs a year exceeded 70% of China’s total swine operations in 2024. The top 26 swine operations with more than 2 million head of swine each accounted for around 30% of the country's slaughter. It is predicted that the trend of intensification and scaled operations in swine farming will continue to increase.

The African swine fever (ASF) outbreak in 2018 significantly impacted China's swine industry, leading to notable changes in the geographical distribution and operational modes. These changes reflect the industry's adaptation to the challenges posed by ASF, aiming to enhance biosecurity, improve efficiency, and stabilize the country’s pork supply

Trends in Chinese swine production

Southern sow shift: There is a noticeable movement of sow operations towards southern

regions including the provinces of Fujian and Hubei. The mountainous terrain of these regions

lends themselves to more isolation and are considered more biosecure. Additionally, the south has less arable land and raising sows does not require much land, and favorable local policies have spurred investment.

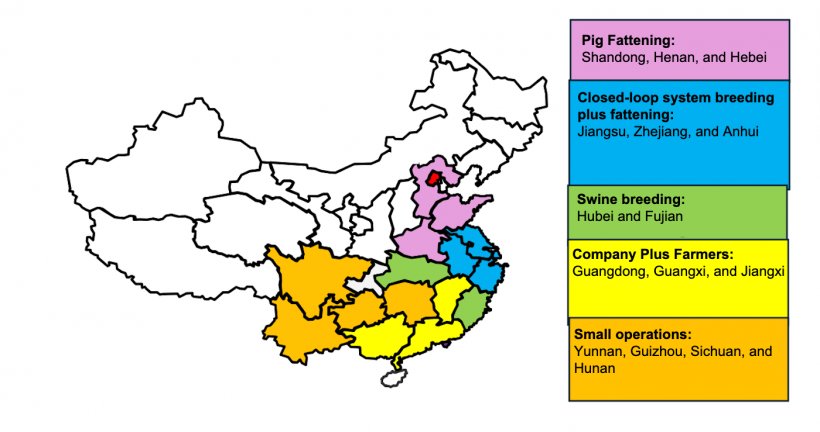

Specialization: Different regions have specialized in various aspects of pig production. The provinces of Hubei and Fujian have become a key area for swine breeding. The northern region of Henan and Shandong have become specialized in the fattening of pigs, focusing on raising pigs to market weight.

Operational modes: The modes of operation vary by region. Southwestern areas of Yunnan, Guizhou, Sichuan, and Hunan are characterized by smaller-scale, retail-oriented pig farming operations. Farms in Jiangsu and Zhejiang provinces typically engage in both breeding and raising pigs within the same operations, maintaining a closed-loop system. Southern areas (Guangdong, Guangxi, Jiangxi) feature a mix of company-operated farms and independent farmers, often working in partnership or under contract farming arrangements.

Challenges in China’s swine industry

Overproduction led to financial losses for farmers in 2023, with modest profits in 2024. The government continues to control the sow inventory in an effort to stabilize swine and pork production.

Rising feed costs push large operations to integrate the industry chain for efficiency.

Pork consumption dropped 7.8% in 2024 to 28.1 kg per capita due in part to ASF which increased prices. Additionally, the continued reduced demand following the COVID-19 pandemic has further impacted overall pork consumption.

March 14, 2025/ USDA/ United States.

https://apps.fas.usda.gov/