ASF drives Chinese pigmeat import demand up

African Swine Fever (ASF) continues to spread in China and other countries in south eastern Asia. In August it reached Myanmar and in September the Philippines and South Korea South Korea is the 3 rd main EU trade partner for pork products (9% share in 2018 ) while the Philippines is the 4 th (7% share). The disease also continues to spread in Vietnam whose imports of EU pork have risen by 36% (2% share) in Jan-July 2019.

Chinese figures report a reduction of the pig herd by one third by July 2019. However, experts estimate it could reach 50%, creating a supply gap that doubles current world trade levels. Live pig prices in China only rose significantly from August, as meat was still available thanks to the slaughterings earlier in the year. Thus, even if Chinese pigmeat imports have already risen significantly in 2019 , an additional surge is expected until the end of 2019 and in 2020 . In 2019, China is demanding more pigmeat from all its main trade partners. The US and Canada have surpassed the high 2016 exports levels, despite the trade restrictions in place. By contrast, offal imports remain at similar levels than previous years.

EU pigmeat exports rising but limited by supply

ASF is still contained in the EU. In July Slovakia became the 10 th MS currently affected by the disease . The other nine MS are: Belgium, Bulgaria, Estonia, Hungary, Italy (Sardinia), Latvia, Lithuania, Poland and Romania. Serbia also declared outbreaks in July.

In Jan July 2019, EU pork ( pigmeat+offal ) exports to China have grown by 45% year on year (44% share), driven by rising pigmeat shipments (+73%). Pigmeat exports also increased towards Japan (2 nd EU trade partner, +8%), while they fell towards other main trade partners: South Korea 11%), the Philippines ( 5%) and the US 17 %). Total EU pigmeat exports in the period grew by 19% (+9% for offal). By the end of 2019, EU pigmeat exports are expected to be 20% above last year constrained by a limited supply. Export growth should continue in 2020 while supply grows.

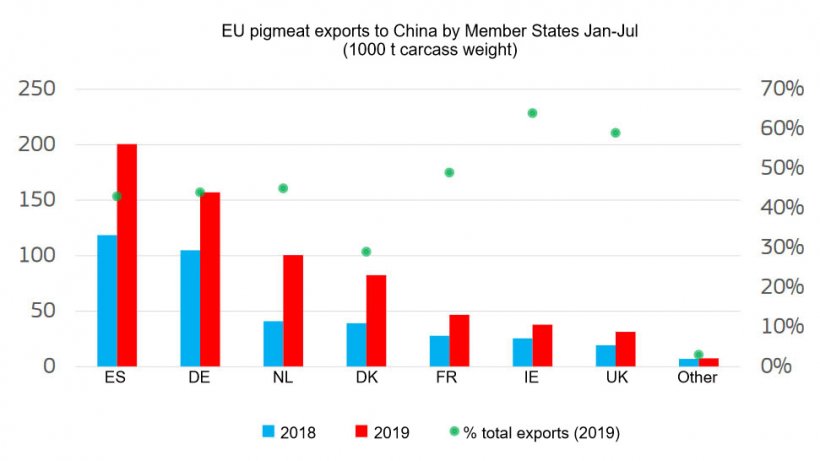

Practically all EU pigmeat exports to China are shipped by seven MS (see Graph). The share of exports to China for those countries varies between 30% and 65% of their total exports.

Production growth in 2020 driven by high prices

The December 2018 livestock survey showed a significant reduction of the EU breeding herd ( 3% year on year). The latest survey (May June 2019) still shows a moderate falling trend in the countries covered ( 0.6%). Nevertheless, pigmeat production should grow slightly in 2019 (+0.4%), thanks to continuing efficiency gains. In 2020, additional growth is expected (+1.5%); however, its magnitude will depend on how MS react to the high prices. Some countries will still reduce production due to social concerns, the enforcement of environmental restrictions and ASF risk. Others (e.g. Spain) are already increasing supply to take advantage of the opportunity in Asia.

EU pigmeat prices at record levels

Pigmeat prices are increasing since mid March and are currently the highest since September 2013, driven by the surge of Chinese exports. Prices should still rise as demand from Asia continues growing. The EU piglet price showed unseasonal increases in August and started to decline only in September. Apparent consumption per capita is expected to fall to 31.8 kg in 2019 (0.5 kg less than the average of the previous two years) as high prices favour other meats, particularly poultry.

Friday October 5, 2019/ DG Agri/ European Union.

https://ec.europa.eu