The Commission published the Short-Term Outlook for EU arable crops, dairy and meat markets in 2016 and 2017.

Thanks to the boost in exports to China, EU pigmeat exports are expected to reach a record level in 2016 at 2.4 million tonnes (+18% on annual basis). Current negotiations for access to other markets could even further improve the export situation.

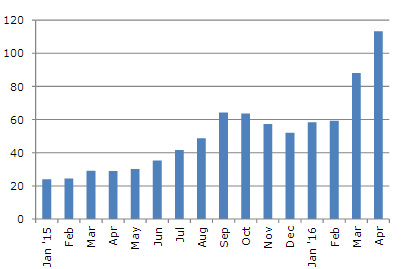

Strong import demand from China due to the restructuring of its domestic pigmeat sector explains the increasing EU pigmeat exports in the first four months of 2016 (+40%). EU pigmeat exports to China reached more than 100 000 tonnes in April and represented now almost 40% of total exports. The exports of offal to China showed a similar trend, increasing by 40% year-on-year. According to the Chinese Agricultural Outlook the import demand for pigmeat is projected to continue over the medium term (900 000 tonnes by 2025). All EU countries exporting to China saw their exports doubling or tripling since the beginning of 2015. Germany, Spain and Denmark took the biggest share of the cake, with 29%, 23% and 16% respectively, during the first four months of 2016. Only Poland cannot export to China due to African Swine Fever status (ASF). The euro/yuan exchange rate and the consequences of the economic slowdown on Chinese consumer demand and its meat sector could influence downwards EU exports in the future. Other important increases were noted in shipments destined to the Philippines, Ukraine, Hong Kong and the US.

EU pigmeat exports to China (1000 t)

The recovery of the US market share on the international scene after the 2014 PEDv 7 crisis seems to take more time than expected. US exports are lower in the first quarter of 2016 than last year, which explains why the EU exports to Japan are better off than expected. In this outlook, the Russian import ban introduced in August 2014 is expected to be maintained. Anyhow, because of the development of the Russian pork production, the sluggish economic situation and the arrival on the market of other suppliers, EU exports towards Russia would not be expected to resume completely even if the import ban were to be lifted. Although the official WTO ruling on the sanitary ban was notified to the EC in April 2016, the WTO's Dispute Settlement Body still needs to approve it before the report will be made public (probably i n September). In the meantime, the assumption that the sanitary ban will remain in place for 2016 and 2017 is retained, blocking almost all exports to Russia.

Friday July 8, 2016/ EC/ European Union.

http://ec.europa.eu/agriculture